👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

IPO Deep Dive

Coinbase in one minute

Coinbase is a cryptocurrency exchange founded by Brian Armstrong, a former Airbnb engineer, and Fred Ehrsam, a former Goldman Sachs trader. Unlike traditional financial institutions, Coinbase is a business deeply rooted in the ethos of decentralization, financial inclusion, and digital innovation. These principles are front and center in their S-1 filing, which emphasizes the company's mission to create an open financial system for the world. For Coinbase, being a first-mover in the crypto space is seen as a core part of its competitive moat.

Coinbase's challenge lies in navigating the volatility of cryptocurrency markets while convincing investors of the long-term viability of digital assets. Yet, investors may not need much convincing. Coinbase is at the heart of a rapidly expanding market, with revenues surging +139% in 2020, reaching $1.3 billion, and profits of $322 million. Its gross margins are also impressive at 86%, underscoring its highly profitable business model. Major backers of the Coinbase story include Andreessen Horowitz, one of the most influential venture capital firms in Silicon Valley.

To explore Coinbase’s role in the evolving regulatory landscape, its competition with decentralized exchanges, and its future in the growing Web3 economy, keep reading.

Introduction

Coinbase (COIN) Stock Overview

Current Price: $220.21 (as of market close)

Market Cap: $54.717B

52-Week Range: $70.42 - $283.48

EPS (TTM): 5.62

It was not just the beginning of a new era, though it might have felt like it. In defending Coinbase's sky-high valuation, Brian Armstrong, the company's CEO, often emphasized the broader vision beyond financial metrics.

"Coinbase isn't just a cryptocurrency exchange. It's a mission to create an open financial system for the world," he argued.

Armstrong’s vision wasn’t entirely new. Since its founding in 2012, Coinbase had consistently positioned itself as more than just a facilitator of crypto transactions. It saw itself as a trailblazer, leading the charge toward a decentralized financial future. And like many tech visionaries before him, Armstrong’s bold claims were met with both excitement and skepticism. When Coinbase went public through a direct listing in April 2021, the anticipation was palpable. Set with a reference price of $250, the stock opened at a staggering $381 and briefly soared to over $429, before settling back down.

What followed was a rollercoaster—its valuation soaring and sinking, closely tied to the volatile nature of the broader cryptocurrency market. Regulatory concerns, market sentiment, and the price of Bitcoin all weighed heavily on Coinbase's stock, making it a company to watch, not just for crypto enthusiasts, but for anyone curious about the intersection of finance and technology.

But Coinbase's story, much like Armstrong’s message, is about more than the numbers. It’s about building the financial infrastructure of the future—a future where cryptocurrencies could very well be the norm.

Recent Developments

The rise of Coinbase has been closely tied to the explosive growth of cryptocurrency adoption. Co-founder and CEO Brian Armstrong has continually emphasized Coinbase's mission to create an open financial system for the world. This isn’t just about facilitating crypto trades—it’s about building a bridge between the traditional financial system and the emerging cryptoeconomy.

“We believe crypto is the next internet-sized opportunity,” Armstrong stated confidently. Coinbase’s early years focused on making Bitcoin accessible to everyday users, but as the crypto market matured, so did the company. Today, Coinbase serves as a comprehensive platform offering not only trading but staking, borrowing, lending, and custody services for both retail and institutional clients.

The company's growth has come with its share of challenges, however. Its heavy reliance on transaction fees—largely driven by volatile cryptocurrency trading—has drawn attention from analysts, particularly during periods of crypto market downturns. Like Robinhood, Coinbase faced criticism for its fee structure, though the company has begun diversifying its revenue with products like Coinbase Custody and Coinbase Prime, targeting institutional investors.

Regulatory scrutiny remains a critical issue. Coinbase has been under the microscope of U.S. regulators as they work to create clearer guidelines around crypto assets. In response, Coinbase has proactively engaged with policymakers, advocating for crypto-friendly regulations. Despite these efforts, the lack of regulatory clarity poses a significant risk to the company’s business model.

In 2021, Coinbase introduced USD Coin (USDC), a stablecoin pegged to the U.S. dollar, which has since become a cornerstone of the decentralized finance (DeFi) market. It’s one of the many products Coinbase has launched in its bid to expand beyond just crypto trading. As the company pushes into decentralized finance and other blockchain-based applications, the question remains: Can Coinbase transition from being a crypto exchange to the infrastructure provider of the cryptoeconomy?

Investor Sentiment

Investor sentiment surrounding Coinbase is divided. On one side, bullish investors see Coinbase as the leading gateway to the cryptoeconomy, benefiting from the increasing institutional adoption of cryptocurrencies. With more than 110 million verified users and over $223 billion in assets on its platform, Coinbase is well-positioned to capture a significant share of the market as crypto becomes more mainstream. Bulls point to Coinbase’s expanding suite of services—like staking, DeFi, and institutional custody—as evidence of its potential to diversify revenue streams and grow beyond just a trading platform.

Optimists also highlight Coinbase's focus on institutional clients, with products like Coinbase Prime catering to large investors looking for secure and regulated access to crypto markets. As institutional adoption of crypto continues, Coinbase’s role as a trusted custodian and exchange could see significant growth.

However, the bears are concerned about Coinbase's reliance on trading fees, which are inherently tied to the volatility of cryptocurrency prices. When crypto prices dip or trading volumes slow, Coinbase’s revenue suffers, as was seen in the post-2021 market correction. Critics also point to the company’s negative EPS and ongoing losses, questioning the sustainability of its business model in a market that is still speculative and prone to regulatory risks.

The bears also worry about regulatory pressures. With the SEC and other global regulatory bodies increasing their scrutiny of crypto assets, Coinbase faces a potential future where stricter regulations could limit its operations or make certain revenue streams unviable. Additionally, the volatile nature of cryptocurrencies—a significant part of Coinbase’s business—adds another layer of uncertainty. If crypto markets cool or experience another prolonged downturn, bears believe Coinbase could struggle to maintain its valuation.

Ultimately, Coinbase's grand vision is to serve as the infrastructure provider of the cryptoeconomy, bridging the gap between traditional finance and blockchain technology. Whether the company can achieve sustainable profits while navigating regulatory challenges and volatile markets is the pressing question ahead.

History

Coinbase was founded in June 2012 by Brian Armstrong, a former Airbnb engineer, and Fred Ehrsam, an ex-Goldman Sachs trader. They shared a bold vision: to make Bitcoin accessible to everyone, at a time when cryptocurrency was still seen as obscure and highly technical. Initially, Coinbase started as a simple Bitcoin wallet, providing an easy and secure way for people to buy, sell, and store Bitcoin. This simple user interface was critical in onboarding early adopters into the cryptocurrency space.

Coinbase’s early growth was explosive. By 2014, the company was serving 1 million users and had raised over $30 million in funding from top venture capital firms like Andreessen Horowitz. As the crypto market matured, so did Coinbase. They quickly expanded to support other cryptocurrencies, including Ethereum in 2016.

The company’s decision to go public in April 2021 was a watershed moment, not just for Coinbase, but for the entire crypto industry. Instead of opting for a traditional IPO, Coinbase listed its shares directly on the Nasdaq via a direct public offering (DPO), with an initial reference price of $250 per share. On its first day of trading, shares soared, giving the company a market valuation of $86 billion, making it one of the largest public listings in history(Coinbase S1).

Market opportunity

The market opportunity for Coinbase is vast, given the increasing global adoption of cryptocurrencies and blockchain technology. Cryptocurrencies have moved from niche internet commodities to mainstream assets, with a growing number of institutional and retail investors participating in the cryptoeconomy.

According to Coinbase’s S-1 filing, as of December 31, 2020, the global market capitalization for all cryptocurrencies had grown from less than $500 million in 2012 to $782 billion(Coinbase S1)(Coinbase S1). That represents a compound annual growth rate (CAGR) of over 150%. As of October 2023, the market cap for cryptocurrencies has exceeded $1 trillion, with the potential to reach $2.2 trillion by 2028.

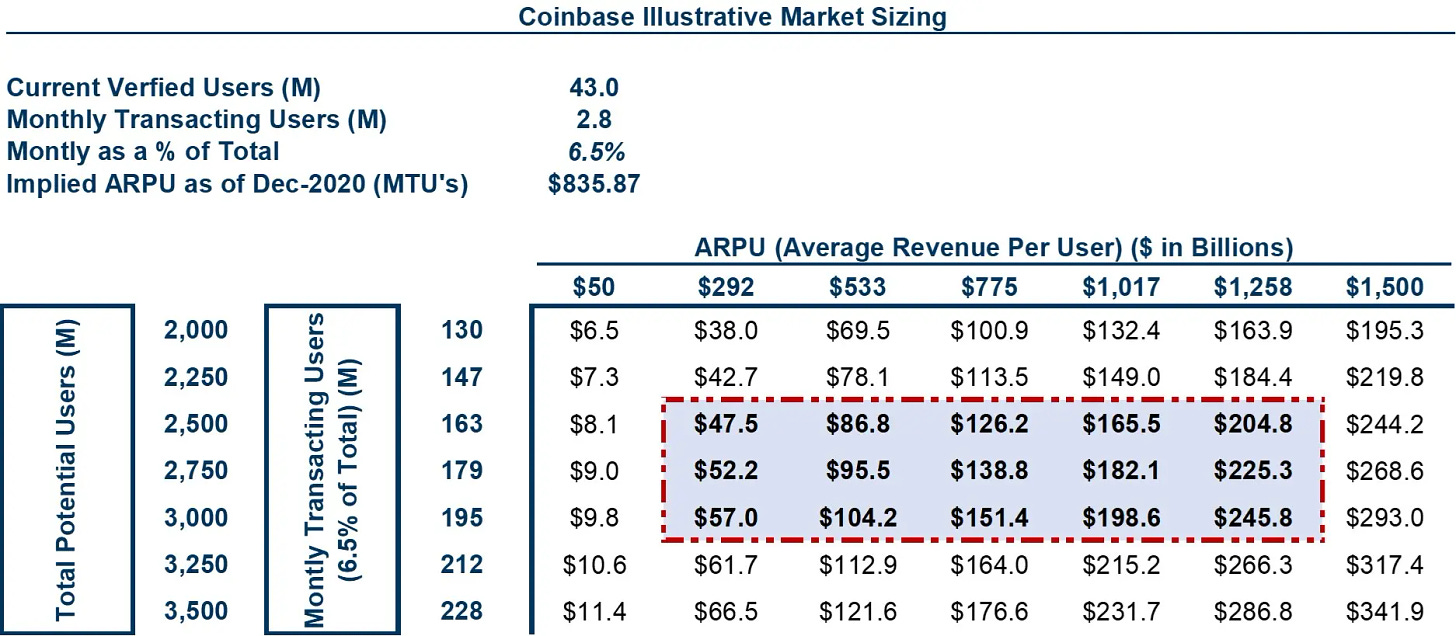

In 2020 alone, Coinbase had 43 million verified users, and it supports customers in over 100 countries. The total volume of crypto traded on its platform surpassed $456 billion by the end of 2020(Coinbase S1). This market opportunity extends to decentralized finance (DeFi), staking services, and the use of crypto for payment and other financial services. The growth of these sectors could propel the total market opportunity for Coinbase to $5 trillion by 2030 across various segments, including institutional custody, crypto exchanges, payments, and crypto-backed lending(Coinbase S1)(Coinbase S1).

Retail Opportunity: Coinbase serves over 110 million verified users as of 2023, growing from 43 million in 2020(Coinbase S1). The market for retail investors continues to expand as cryptocurrencies become more accepted, and some estimates suggest this segment alone could reach over $5 trillion by 2030.

Institutional Growth: The company has positioned itself as a trusted partner for over 10,000 institutions globally(Coinbase S1). With institutions like hedge funds and asset managers increasingly adopting digital assets, the institutional crypto market could surpass $10 trillion by 2030, according to reports from The Generalist(Coinbase S1).

Blockchain Applications: Beyond trading, blockchain’s impact in decentralized finance (DeFi), NFTs, and digital assets across various industries (from real estate to supply chain) opens additional revenue streams for Coinbase. The DeFi market alone is expected to balloon from $15 billion in 2021 to $1 trillion by 2030(Coinbase S1)

Product

Coinbase’s product ecosystem caters to both retail and institutional investors, as well as developers and businesses leveraging the blockchain.

Retail Platform: Coinbase’s primary product allows retail customers to buy, sell, and store cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The platform supports over 90 different crypto assets and provides users with real-time price tracking, secure storage options, and the ability to earn rewards through staking. As of 2021, Coinbase had 2.8 million monthly transacting users (MTUs)(Coinbase S1).

Coinbase Pro: Aimed at active traders, Coinbase Pro provides advanced charting and trading tools. It features lower fees than the standard platform and offers real-time order books, charting tools, and a powerful API that allows programmatic trading.

Coinbase Wallet: For users who want control of their private keys, Coinbase Wallet offers a non-custodial wallet. Users can store their crypto assets and connect with decentralized applications (dApps) without relying on centralized services.

Institutional Custody: Coinbase Custody offers secure storage solutions for institutions, with $90 billion worth of crypto assets stored on the platform by the end of 2020(Coinbase S1). Institutional clients include hedge funds, family offices, and high-net-worth individuals who require high levels of security and regulatory compliance.

Staking and Lending Services: Coinbase enables users to stake cryptocurrencies like Ethereum, earning returns in the form of additional tokens. In 2020, the company began offering crypto-backed loans, enabling users to borrow against their crypto holdings.

Coinbase’s product strength lies in its ease of use, robust security infrastructure, and comprehensive suite of tools, which make it the default entry point into the cryptoeconomy for millions of users.

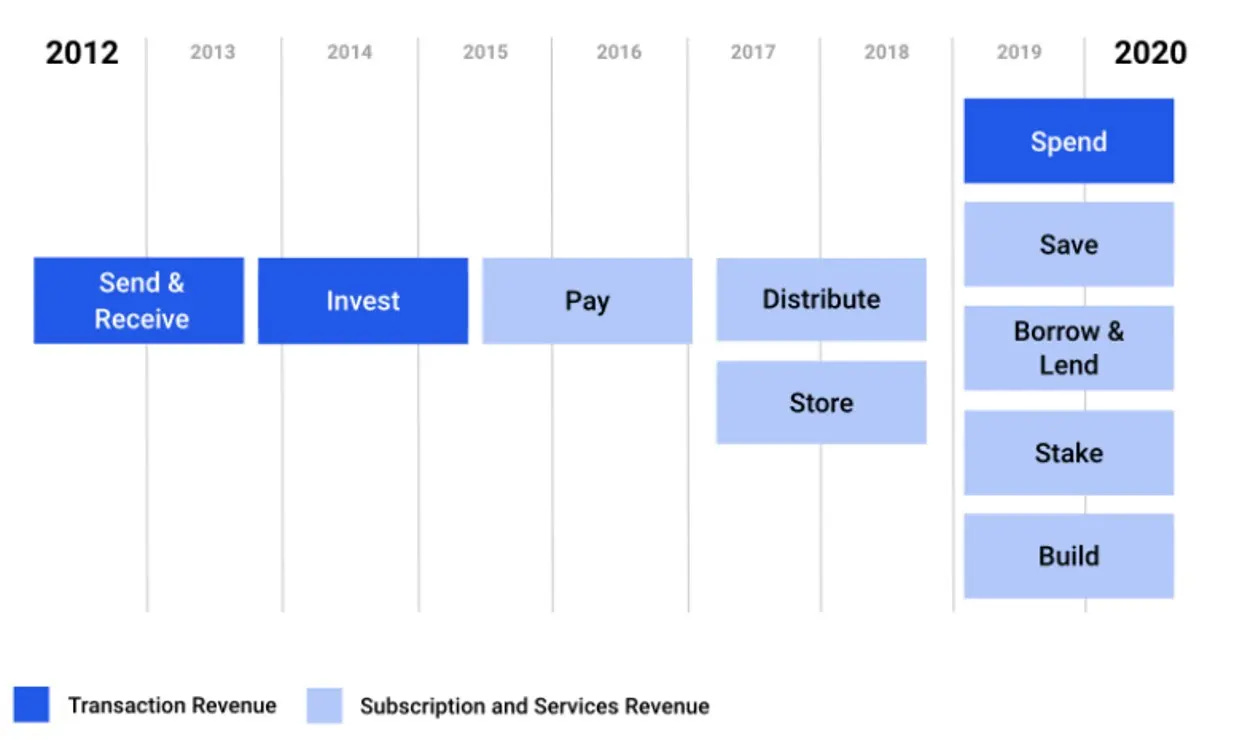

Business Model

Coinbase’s revenue model is primarily based on transaction fees that users pay when buying or selling cryptocurrencies. In 2020, 96% of the company’s $1.3 billion in net revenue came from transaction fees(Coinbase S1). Coinbase charges retail users between 0.5% to 4.5% per trade, depending on the amount and type of trade.

Coinbase has also begun diversifying its revenue streams by offering subscription-based products like Coinbase Custody, staking services, and institutional trading. These subscription products generated $136 million in revenue in 2020, a 126% growth from 2019(Coinbase S1). As the cryptoeconomy expands and more users engage with staking, borrowing, and DeFi products, Coinbase expects these recurring revenue streams to play a larger role in its financial performance.

Management Team

Brian Armstrong (CEO & Co-Founder): Armstrong is the visionary behind Coinbase’s mission to create an open financial system for the world. With a background in software engineering at Airbnb, Armstrong’s leadership has been instrumental in positioning Coinbase as the leading crypto exchange in the U.S.

Fred Ehrsam (Co-Founder & Board Member): Ehrsam co-founded Coinbase with Armstrong and played a key role in scaling the company during its early years. With his previous experience at Goldman Sachs, Ehrsam brought institutional knowledge to Coinbase’s growth strategy.

Emilie Choi (President & COO): Joining Coinbase in 2018, Choi spearheaded the company’s expansion efforts, including key acquisitions like Earn.com and the institutional crypto storage business Xapo. Her background includes leadership roles at LinkedIn, where she drove corporate development(Coinbase S1)(Coinbase S1).

Alesia Haas (CFO): With a career spanning top finance positions at companies like OneWest Bank and GE, Haas has been instrumental in overseeing Coinbase’s financial health, particularly during its transition to a publicly traded company.

Paul Grewal (Chief Legal Officer): Grewal, a former federal judge, handles Coinbase’s complex legal and regulatory issues. He joined Coinbase in 2020 from Facebook, where he managed significant legal battles concerning privacy and antitrust(Coinbase S1).

Investors and Ownership

From a small startup offering Bitcoin wallets to becoming a publicly traded giant, Coinbase’s journey has been marked by multiple rounds of investments that have fueled its rapid growth. Each funding round brought new opportunities, allowing the company to expand its product offerings, enter new markets, and scale its platform for millions of users. Below is a detailed look at the major investment rounds that have shaped Coinbase’s rise.

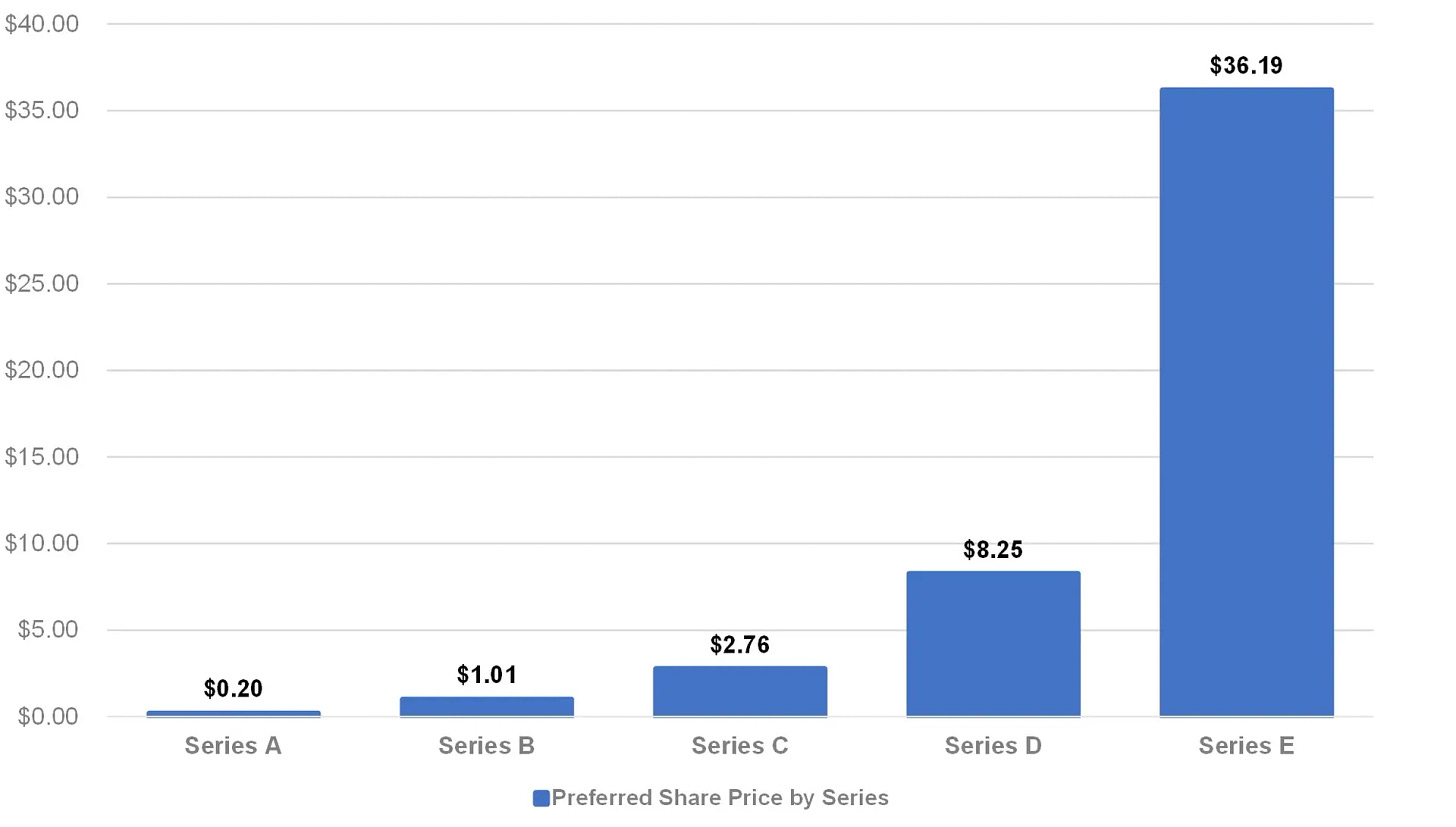

Seed Round (2012)

Amount Raised: $600,000

Summary: Coinbase started with modest backing from Y Combinator. This early seed funding helped Coinbase develop its core product—a secure and user-friendly platform for buying and storing Bitcoin. It laid the foundation for what would become one of the most prominent crypto exchanges globally.

Series A (May 2013)

Amount Raised: $6.1 million

Summary: Union Square Ventures led Coinbase’s Series A funding round. This influx of capital allowed Coinbase to solidify its position as the go-to Bitcoin exchange in the U.S., expanding its user base and gaining more market share.

Series B (December 2013)

Amount Raised: $25 million

Summary: Andreessen Horowitz took the lead in the Series B round, which was at the time the largest funding raised by any Bitcoin company. The capital was used to expand Coinbase’s product and service offerings, while also driving international growth.

Series C (January 2015)

Amount Raised: $75 million

Summary: Coinbase garnered attention from traditional financial institutions, with the New York Stock Exchange and USAA joining this round. This funding was pivotal as it bolstered Coinbase’s regulatory and institutional credibility, setting the stage for the launch of institutional products like Coinbase Custody.

Series D (August 2017)

Amount Raised: $100 million

Summary: This round marked Coinbase’s entry into the “unicorn” club, with a valuation of $1.6 billion. It was used to ramp up product innovation and improve the user experience for both retail and institutional clients, including the addition of advanced trading tools via Coinbase Pro.

Series E (October 2018)

Amount Raised: $300 million

Valuation: $8 billion

Summary: With a valuation of $8 billion, Coinbase became a leading player in the cryptoeconomy. The funds were directed toward expanding the company’s international footprint, scaling its infrastructure, and introducing new products, including its staking and DeFi services.

Series F (December 2020)

Amount Raised: $500 million

Summary: This final round came as Coinbase was preparing to go public. The massive $28 billion valuation reflected the company’s increasing dominance in the crypto space and set the stage for one of the most anticipated public listings of 2021.

Direct Listing (April 2021)

Valuation: $86 billion (at peak market cap on the first day)

Summary: Rather than opting for a traditional IPO, Coinbase made a bold move by going public through a direct listing on NASDAQ. This allowed existing shareholders to sell their shares directly to the public without underwriters. Coinbase’s initial market capitalization surged to $86 billion, making it one of the largest public listings of all time and solidifying its role as a cornerstone of the cryptoeconomy.

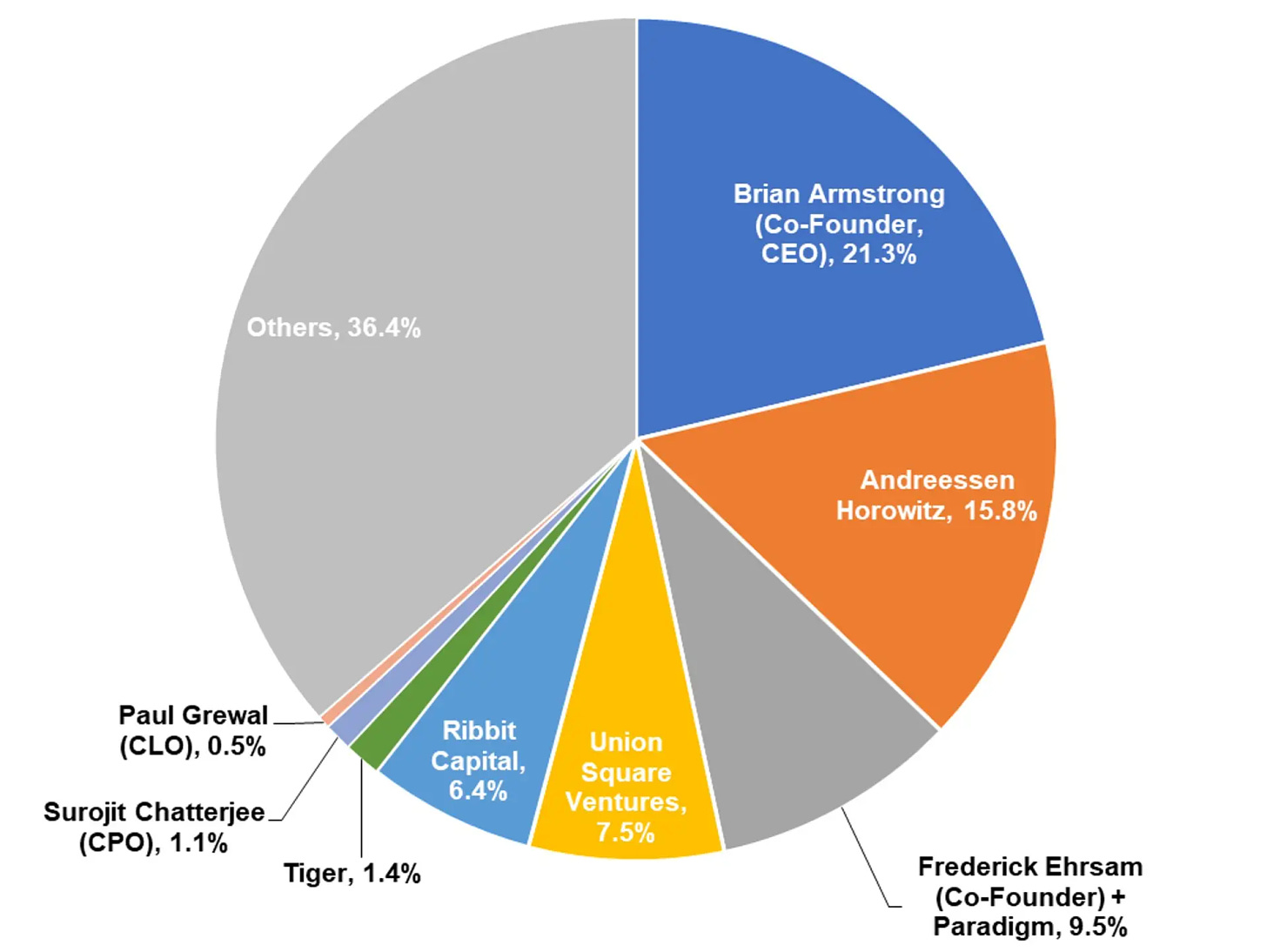

Coinbase has attracted some of the biggest names in venture capital, with Andreessen Horowitz, Union Square Ventures, and Ribbit Capital leading early funding rounds.

Ownership:

Competition

Coinbase’s closest competitors include Binance, the world’s largest crypto exchange by volume, and Kraken, which also serves U.S. customers with a strong institutional focus. While Binance and Kraken offer similar services, Coinbase’s regulatory compliance and user-friendly interface have positioned it as the preferred platform for both retail and institutional investors in the U.S. market.

Decentralized exchanges (DEXs) like Uniswap also pose a threat to Coinbase’s market share, especially in the growing DeFi sector. However, DEXs still lack the regulatory oversight and ease of use that Coinbase offers(Coinbase S1)(Coinbase S1).

Financials

Coinbase’s financial performance mirrors the growth of the cryptocurrency market. Here’s a breakdown of its key financials from 2017 to 2021:

2017: Revenue reached $923 million, primarily driven by the Bitcoin boom.

2018: A challenging year for crypto, revenue fell to $520 million, and Coinbase posted a $45 million loss.

2019: Revenue remained stable at $533 million, with institutional growth balancing the retail slowdown.

2020: A banner year for Coinbase, with revenue surging to $1.3 billion and net income reaching $322 million(Coinbase S1)(Coinbase S1)

Revenue Growth

Coinbase’s revenue model is heavily reliant on transaction fees generated from its trading platform. With the increasing adoption of cryptocurrencies, Coinbase's revenue has experienced exponential growth:

2019: Coinbase generated $533.7 million in net revenue. Despite being a pivotal year in crypto adoption, Coinbase operated at a net loss of $30.4 million, reflecting the volatility of the market at that time.

2020: The company’s fortunes changed dramatically in 2020. Coinbase saw its net revenue soar to $1.3 billion, marking an increase of 144% year-over-year (YoY). This was largely driven by increased crypto trading volume, as Bitcoin and Ethereum prices surged. Coinbase posted a net income of $322.3 million, a sharp turnaround from the previous year’s losses.

2021 (Q1): The first quarter of 2021 was a blockbuster period for Coinbase. Net revenue hit $1.8 billion, more than the entire year of 2020. The company reported an impressive net income of $771 million, with a profit margin of 43%. This surge in revenue was driven by a sharp increase in trading volume as cryptocurrency prices hit record highs.

Transaction Volume

Coinbase’s growth has been closely tied to its trading volume, which reflects the buying and selling activity on the platform:

2019: Trading volume on Coinbase reached $80 billion, which was split between retail and institutional users. Retail users, who pay higher fees, contributed to the bulk of Coinbase's transaction revenue.

2020: Trading volume surged to $193 billion, reflecting a 141% increase YoY. The rise in trading activity was largely driven by institutions, which began participating heavily in cryptocurrency markets as Bitcoin reached new highs.

2021 (Q1): Coinbase experienced a record $335 billion in trading volume during the first quarter alone, with institutional investors accounting for $215 billion of this total. This surge marked a 276% increase in trading volume compared to Q1 2020(Coinbase S1)(Coinbase S1).

Profitability and EBITDA

Coinbase has demonstrated strong profitability metrics, especially in 2020 and 2021. The company’s ability to scale efficiently while maintaining robust margins has been a key driver of its financial success:

2019: Coinbase posted a negative Adjusted EBITDA of $24 million, reflecting the challenges it faced in a volatile market.

2020: Adjusted EBITDA skyrocketed to $527 million, a 2,095% increase YoY. The company’s gross margin for 2020 was 86%, reflecting the low variable cost nature of its business.

2021 (Q1): Coinbase’s Adjusted EBITDA reached a staggering $1.1 billion, with a margin of 55%. This marked the most profitable quarter in the company’s history, showcasing its ability to leverage trading volume growth into significant profit(Coinbase S1).

Assets on Platform

Coinbase’s platform is a trusted repository for digital assets, attracting both retail and institutional clients. The value of assets held on the platform has been a key metric that reflects its market dominance:

2019: Assets on Coinbase’s platform totaled $17 billion.

2020: By the end of 2020, this number had surged to $90 billion, an increase of 432% YoY. This growth was driven by the rising value of crypto assets and the increasing trust in Coinbase’s custody services, particularly among institutional investors.

2021 (Q1): Coinbase reported over $223 billion in assets on the platform by the end of the first quarter. This included $122 billion from institutional clients, demonstrating the growing importance of institutional involvement in the cryptoeconomy(Coinbase S1).

Revenue Breakdown by Segment

Coinbase’s revenue can be broken down into two primary categories: transaction revenue and subscription/services revenue.

Transaction Revenue: In 2020, 96% of Coinbase’s total revenue came from transaction fees, driven by trading activity. Retail investors accounted for the majority of this revenue, as they pay higher fees compared to institutional clients.

Subscription and Services Revenue: In 2020, subscription and services revenue accounted for 4% of Coinbase’s total revenue, a segment that grew by 126% YoY. This category includes revenue from Coinbase Custody, staking rewards, and its Earn product, which pays users for learning about new crypto assets.

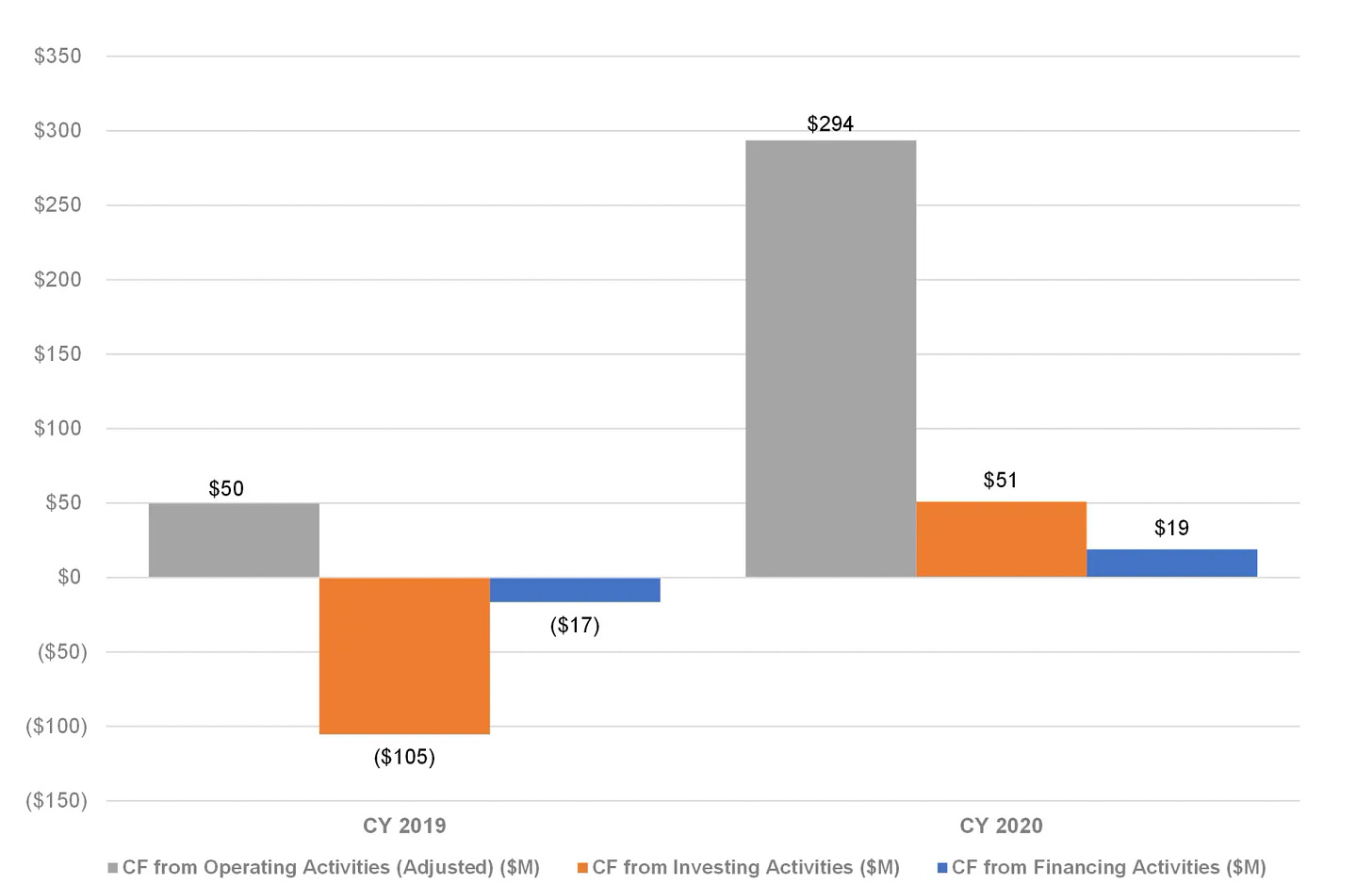

Cash Flow

Coinbase’s balance sheet has strengthened significantly in recent years, driven by its profitable operations and efficient use of capital:

Cash and Cash Equivalents: As of 2020, Coinbase held over $1 billion in cash and cash equivalents, providing it with ample liquidity to continue expanding its product offerings and pursue strategic acquisitions.

Customer Custodial Funds: Coinbase’s custodial assets—assets held on behalf of its customers—totaled $3.8 billion as of 2020. These funds are crucial to supporting the company’s custodial services, particularly for its institutional clients.

In April 2021, Coinbase went public via a direct listing on the NASDAQ under the ticker symbol "COIN." The listing was a significant event for both the company and the cryptocurrency industry. On the day of the listing, Coinbase reached a market capitalization of $86 billion, making it one of the most valuable public companies in the world:

Opening Share Price: Coinbase shares opened at $381 on the first day of trading, well above the reference price of $250 set by NASDAQ.

Peak Valuation: At its peak, Coinbase reached a valuation of $100 billion, surpassing the market caps of traditional financial institutions like Goldman Sachs and Morgan Stanley.

Current Market Performance: As of 2023, Coinbase’s stock has seen fluctuations in line with the volatile nature of the cryptocurrency market, but its revenue and profitability have remained strong despite market corrections.

Closing thoughts

Coinbase’s market opportunity is vast and continues to evolve as cryptocurrencies gain mainstream adoption. With a rapidly growing user base, strong institutional support, and expanding revenue streams beyond transactions, Coinbase is well-positioned to remain a dominant player in the cryptoeconomy. Its innovative product ecosystem, which spans trading, staking, custody, and lending, offers both retail and institutional investors a comprehensive entry into the digital asset space.

As blockchain applications extend into industries like decentralized finance, NFTs, and beyond, Coinbase has a unique opportunity to capture significant market share. However, it faces the dual challenge of navigating regulatory landscapes and staying competitive against decentralized exchanges and new entrants. Still, with a strong management team, robust financial performance, and a clear mission to reshape the future of finance, Coinbase stands at the forefront of a financial revolution that could reshape how the world views and uses money.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Simplicity becomes the goal as you grow older

This is epic!

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.

What do you think about my bi-weekly Newsletter? Love it | Okay-ish | Stop it

Share