👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

IPO Deep Dive

Swiggy in one minute

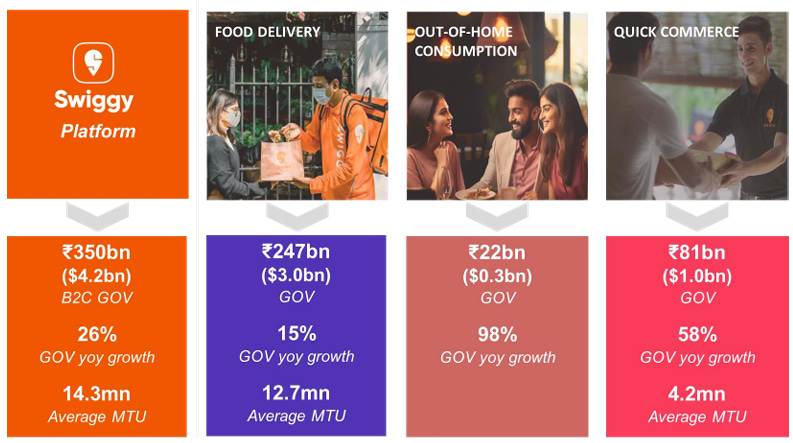

Founded in 2014, Swiggy has redefined urban convenience in India with its expansive hyperlocal logistics platform. Initially focused on food delivery, the company has since broadened its horizons to include quick commerce via Instamart, dining-out solutions, and even event ticketing. Operating across 653 cities, Swiggy connects over 14 million monthly active users to 196,000 restaurants through a delivery fleet of 390,000 partners.

In FY24, Swiggy reported ₹112,474 million in consolidated revenue, achieving a 36% year-over-year (YoY) growth. This surge was fueled by Instamart, its quick commerce segment, which has emerged as a key driver of growth. Notably, Swiggy’s core food delivery business reached EBITDA profitability, a pivotal milestone in the company’s journey. However, challenges remain: the company posted a net loss of ₹23,502 million.

Swiggy’s next big test will be convincing investors of its long-term vision. With a commanding market presence and a growing suite of services, Swiggy is positioning itself as a cornerstone of urban logistics in India.

To dive into Swiggy’s quick commerce strategies, its evolving competition with Zomato, and its IPO trajectory, keep reading.

Swiggy (SWIGGY) Stock Overview

Current Price: ₹390.00 (as of listing)

Market Cap: ₹95,234.74 crore

Free Float Market Cap: ₹8,407.80 crore

52-Week Range: ₹391.00 - ₹489.40

Swiggy’s IPO wasn’t merely a milestone for the company—it was a defining moment for India’s hyperlocal commerce sector. Over the past decade, Swiggy has cemented its position as a leader in food delivery and quick commerce, while expanding into adjacent markets such as event management and dining-out reservations.

During the IPO announcement, CEO Sriharsha Majety framed the company’s ambitions with clarity: “Swiggy isn’t just about delivering food or groceries. We’re about delivering convenience, redefining lifestyles, and building an ecosystem that meets urban India’s demands seamlessly.”

The IPO raised ₹11,327.43 crore, drawing significant attention for its scale and potential to reshape perceptions of tech-enabled hyperlocal services. Swiggy debuted on the stock market on November 13, 2024, with its shares trading robustly, reflecting strong investor confidence in its growth trajectory and transformative vision.

Recent Developments

Swiggy’s rise is tied closely to the digital transformation of India’s urban economy. Founded in 2014, Swiggy’s initial focus on food delivery expanded rapidly to encompass quick commerce through Instamart, dining-out solutions via Dineout, and lifestyle event management through SteppinOut. Today, the platform serves 14 million monthly users, partners with 196,000 restaurants, and operates in 653 cities, underpinned by a delivery fleet of 390,000+ riders.

The IPO proceeds aim to accelerate Swiggy’s quick commerce expansion, enhance AI-driven logistics systems, and support debt repayment. Its ability to maintain EBITDA profitability in the food delivery segment and scale Instamart to contribute 30% of FY24 revenue demonstrates its strategic focus on sustainable growth.

However, challenges remain. Heavy reliance on discounts and promotions, high logistics costs, and increasing regulatory scrutiny in the e-commerce space are areas to watch. Additionally, competition from players like Zomato, Blinkit, and Zepto continues to intensify.

Investor Sentiment

Swiggy’s IPO has sparked mixed reactions. On one side, bullish investors champion its dominance in Tier-2 and Tier-3 cities, where it outpaces competitors like Zomato. Swiggy’s innovative network of 523 dark stores powers Instamart, offering over 17,000 SKUs, solidifying its leadership in the quick commerce segment.

Optimists are also buoyed by Swiggy’s diversified offerings, including premium dining experiences and lifestyle event management, which broaden its revenue base. The company’s strong institutional partnerships and AI-driven logistics, ensuring delivery precision, provide a clear technological edge.

However, bearish investors remain wary. Swiggy’s heavy reliance on discounts and annual marketing expenses of ₹10,000 million weigh on its path to profitability. While the core food delivery business has reached EBITDA positivity, overall losses persist. Regulatory uncertainties and market volatility in the quick commerce sector add to the risks. Critics contend that Swiggy’s lofty valuation hinges on accelerated progress in curbing losses and achieving sustainable growth.

History

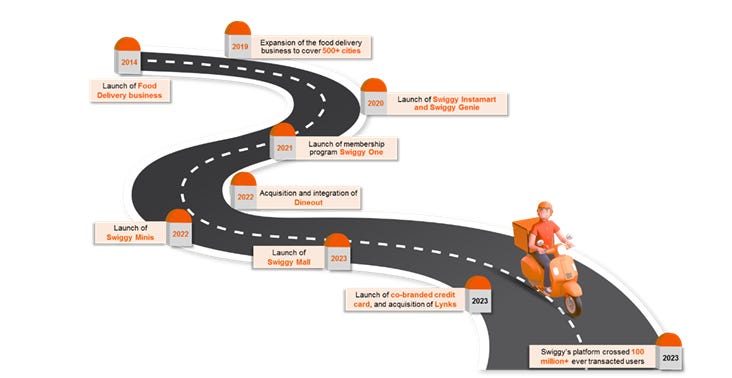

Swiggy’s journey is a masterclass in turning inefficiencies into opportunities. Founded in 2014 by Sriharsha Majety, Nandan Reddy, and Rahul Jaimini, the company set out to tackle India’s fragmented food delivery ecosystem. At the time, ordering food meant unreliable phone calls and long wait times. Swiggy revolutionized the market with a tech-first, hyperlocal logistics approach emphasizing speed and reliability.

2014: Swiggy launched in Bengaluru with a modest team of six delivery executives, focusing on food delivery from nearby restaurants. Adoption was gradual, but its unwavering commitment to reliable service soon gained traction.

2016: The company expanded to over eight metro cities and secured $15 million in Series C funding, led by Norwest Venture Partners.

2018: Swiggy introduced Swiggy Access, enabling restaurants to set up cloud kitchens in under-served areas. This innovation improved delivery times and widened menu offerings.

2020: Amid the COVID-19 pandemic, Swiggy diversified into quick commerce with Instamart, delivering groceries in under 15 minutes to meet evolving consumer needs.

2022: The acquisition of Dineout brought dining-out reservations and event ticketing into Swiggy’s ecosystem, integrating new verticals seamlessly.

2024: Swiggy rebranded from Bundl Technologies Private Limited to Swiggy Limited, signaling its IPO readiness and reinforcing its brand identity.

Swiggy’s ability to consistently innovate and adapt has solidified its position as a household name across Indian cities, proving its knack for identifying and addressing consumer needs in a dynamic market.

Market Opportunity

India’s urban consumers increasingly prioritize convenience, and Swiggy has positioned itself at the forefront of two booming sectors: food delivery and quick commerce, both poised for significant growth in the coming years.

Food Delivery

India’s food delivery market, valued at ₹40,000 crore ($5 billion) in 2023, is projected to grow at a CAGR of 15% over the next five years. While metro cities like Bengaluru, Delhi, and Mumbai drive order volumes, Swiggy’s expansion into Tier-2 and Tier-3 cities taps into a largely underserved market.

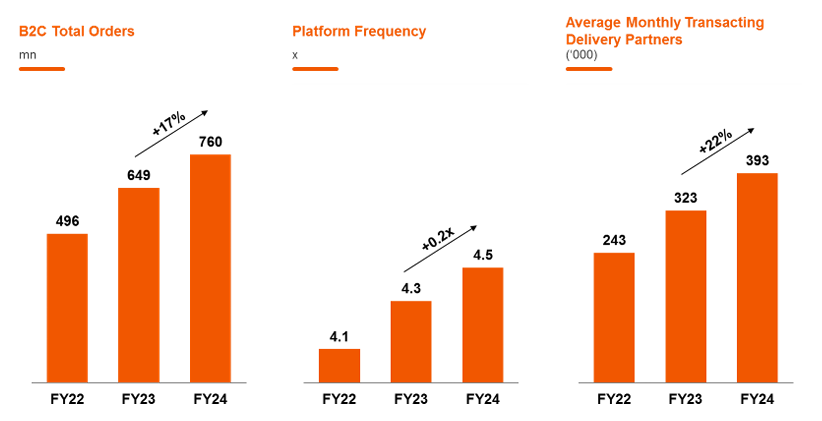

User Behavior: Indian consumers place an average of 4-5 food orders per month. Swiggy’s user base is growing at 17% YoY, with increasing order frequency signaling strong engagement.

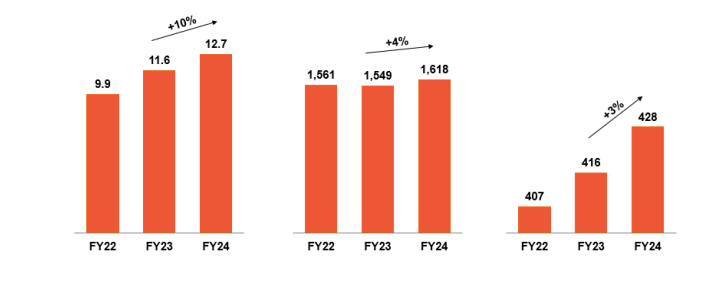

Premium Offerings: With more consumers willing to pay for quality, Swiggy’s partnerships with premium restaurants have driven a 12% YoY increase in average order value (AOV).

Quick Commerce

The quick commerce market, encompassing groceries and household essentials delivered in minutes, is growing even faster. Valued at ₹2,500 crore ($300 million) in 2023, it is projected to reach ₹41,500 crore ($5 billion) by 2026.

Instamart’s Advantage: Swiggy’s dense network of 523 dark stores powers over 500,000 daily grocery orders, offering a product catalog of 17,000 SKUs that ranges from essentials to premium items.

Consumer Preferences: Surveys indicate 70% of quick commerce users prioritize speed, while 50% value variety. Swiggy’s robust infrastructure addresses both needs seamlessly.

Together, these dual markets represent a combined opportunity worth ₹3 lakh crore by 2027, underscoring Swiggy’s strong growth potential and cementing its leadership in urban convenience.

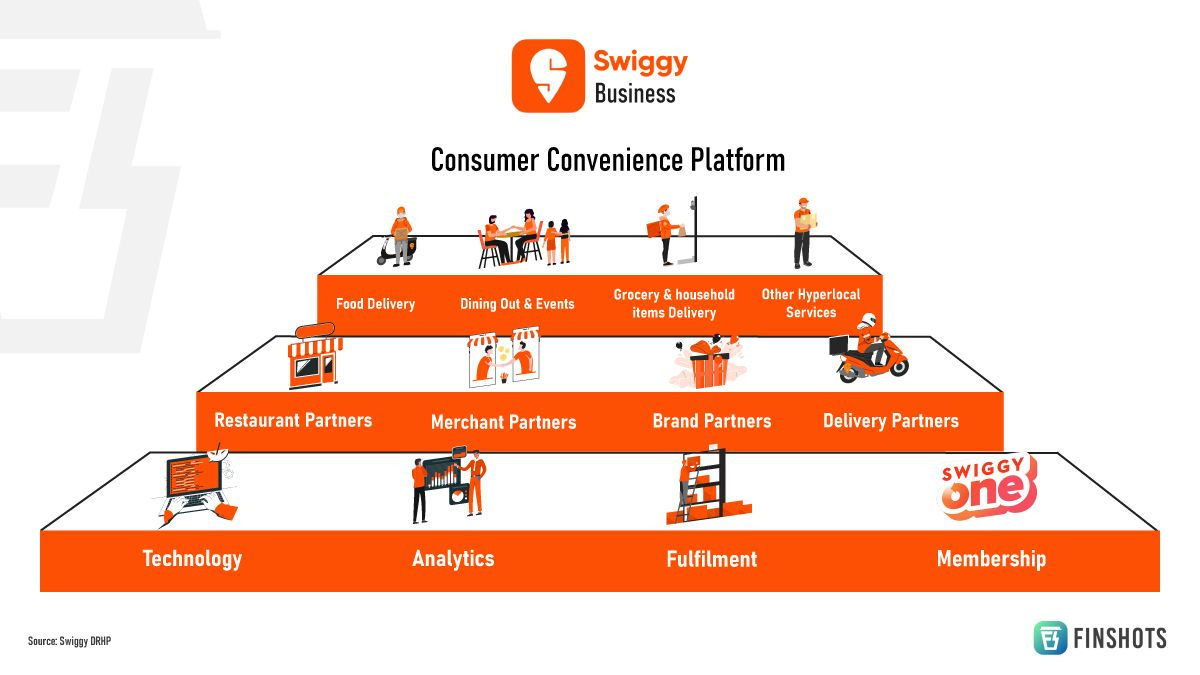

Product

Swiggy has cultivated a comprehensive ecosystem, addressing diverse consumer needs through a single platform. Its emphasis on reliability, speed, and variety has cemented its position as a leader in India’s hyperlocal commerce landscape.

Core Food Delivery

Scale of Operations: Partnering with over 196,000 restaurants across 653 cities, Swiggy caters to an array of cuisines and dietary preferences, fulfilling millions of orders monthly with consistent reliability.

User Growth: Serving 14 million monthly transacting users, Swiggy has achieved a 17% YoY increase in order frequency and a 12% YoY growth in average order value (AOV), bolstered by premium offerings and larger basket sizes.

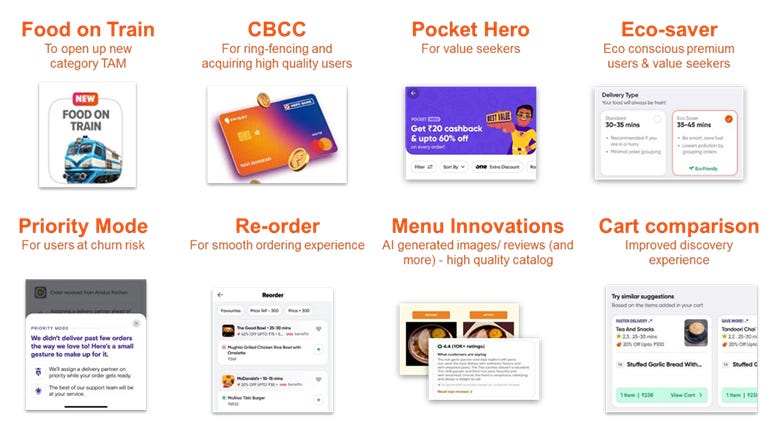

Tech Advantage: Leveraging AI for order allocation, Swiggy optimizes delivery routes and minimizes delays. Its dynamic pricing adapts to demand surges, benefiting both users and delivery partners.

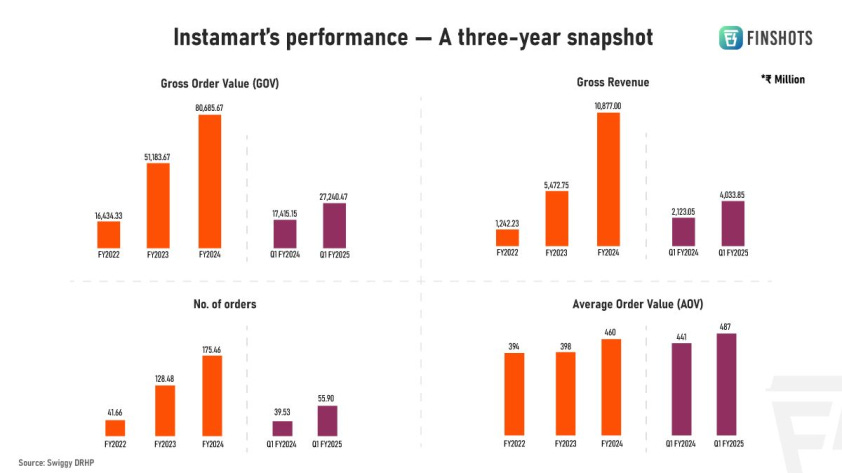

Instamart (Quick Commerce)

Launched in 2020, Instamart revolutionizes grocery delivery, fulfilling orders in under 15 minutes.

Dark Store Network: A robust network of 523 dark stores across 27 cities ensures rapid delivery and efficient inventory management.

SKU Portfolio: With over 17,000 products ranging from essentials to premium items, Instamart appeals to a wide customer base.

Revenue Contribution: In FY24, Instamart contributed 30% of Swiggy’s total revenue, with the segment growing over 60% YoY.

Dineout (Dining-Out Solutions)

Acquired in 2022, Dineout enhances Swiggy’s platform with dining-out reservations and experiences.

Integrated Experience: Fully embedded into the Swiggy app, Dineout enables seamless table bookings, restaurant exploration, and exclusive discounts.

Reach: Active in 43 cities, Dineout serves over 5 million diners annually.

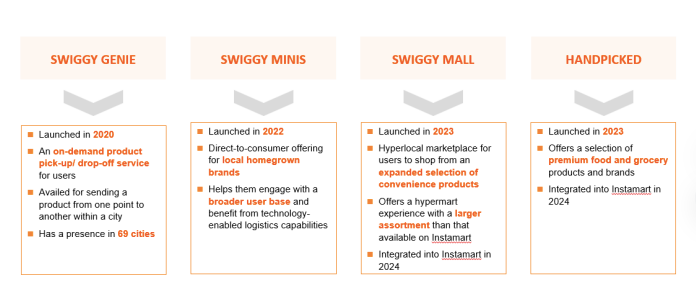

SteppinOut Events

Swiggy’s SteppinOut offers curated lifestyle experiences, from concerts to workshops, diversifying its revenue streams and adding unique value.

User Engagement: Provides access to a range of events, enhancing Swiggy’s appeal as a lifestyle brand.

Product Strengths

Reliability: Continuously tops customer satisfaction surveys with its dependable and timely deliveries.

Variety: Offers unmatched options, from local staples to gourmet selections.

Technology-Driven: AI and ML power logistics, personalized recommendations, and service efficiency, ensuring a seamless user experience.

Swiggy’s ecosystem stands as a testament to its innovation and adaptability, solidifying its leadership in hyperlocal commerce.

Business Model

Swiggy employs a multi-faceted business model that combines commissions, subscriptions, and advertising to drive revenue.

Revenue Streams

Restaurant Commissions: Swiggy charges 15-25% per order, with higher rates for exclusive partnerships and premium listings.

FY24 Revenue: ₹80,000 million (~70% of total revenue).

Delivery Charges: Users pay dynamic fees based on order size and distance, contributing ₹8,000 million annually.

Advertising Revenue: Swiggy generates over ₹4 billion annually through in-app ads, sponsored restaurant placements, and product promotions.

Subscription Services (Swiggy One): Offering unlimited free deliveries and discounts, Swiggy One has attracted over 5 million subscribers, enhancing customer loyalty and retention.

Cost Structure

Delivery Logistics: Over 50% of expenses go towards delivery partner payouts, fuel costs, and logistics infrastructure.

Discounts & Marketing: Customer acquisition and retention initiatives account for ₹10,000 million annually.

Technology Investments: Swiggy spends ₹3,000 million annually on AI-driven logistics optimization and app features to maintain its technological edge.

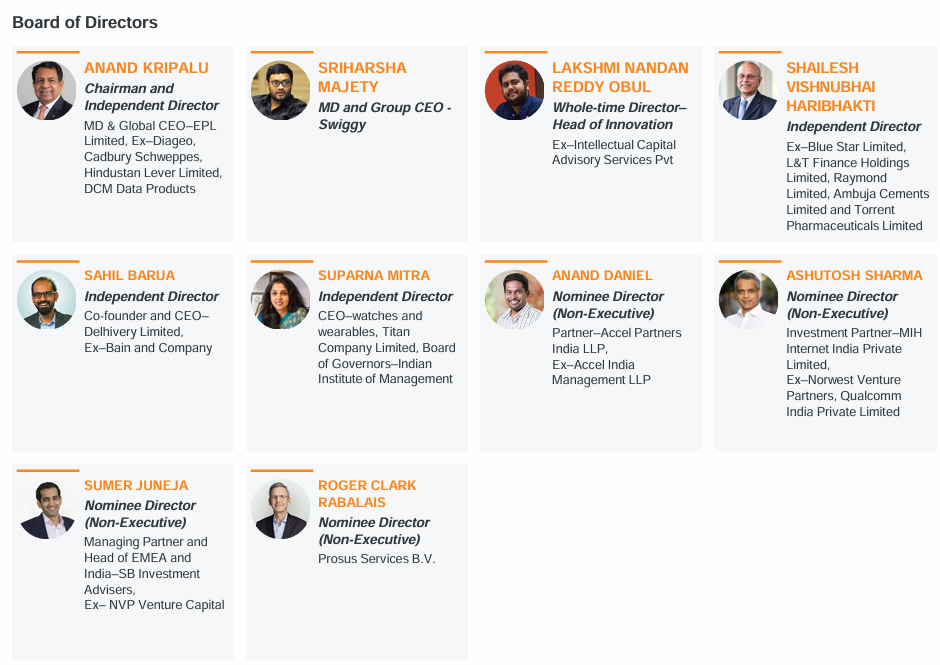

Management Team

Sriharsha Majety (Co-Founder & CEO)

Sriharsha Majety, a BITS Pilani and IIM Calcutta alumnus, is the driving force behind Swiggy. With a background in engineering and a keen interest in logistics and operations, Majety identified the potential for a hyperlocal delivery platform in India. His leadership has been pivotal in shaping Swiggy’s strategy, from its early days as a food delivery service to its current status as a multi-dimensional convenience platform. Majety’s focus on customer satisfaction and operational excellence has set Swiggy apart in an intensely competitive market.

Rahul Bothra (Chief Financial Officer)

Rahul Bothra, a seasoned finance professional, joined Swiggy with extensive experience gained at Wipro and other leading organizations. A Chartered Accountant by qualification, Bothra plays a critical role in managing Swiggy’s financial health, overseeing capital allocation, cost optimizations, and strategic investments. His expertise has been instrumental in Swiggy’s progress toward profitability and in preparing for its highly anticipated IPO.

Lakshmi Nandan Reddy (Head of Innovation)

With a master’s degree in physics from BITS Pilani and prior experience at Intellecap, Lakshmi Nandan Reddy leads Swiggy’s innovation initiatives. He spearheads projects like Instamart and Swiggy Mall, ensuring their alignment with market demands and the company’s broader vision. His focus on testing and scaling new business models has been crucial in Swiggy’s successful diversification beyond food delivery.

Investment Rounds

Swiggy’s funding journey began with a seed round in 2014, raising $2 million from Accel Partners and SAIF Partners. This initial funding was used to establish its operations in Bengaluru and build a robust logistics platform to ensure reliable and fast food delivery. The success of this model laid the foundation for rapid expansion.

In 2015, Swiggy raised $16.5 million in a Series A round, with Norwest Venture Partners joining Accel and SAIF. This funding allowed Swiggy to expand into new cities, refine its logistics, and strengthen its presence in metro areas. The focus on technology-driven logistics made Swiggy a standout player in India’s nascent food delivery market.

By 2016, Swiggy had gained significant traction, leading to a Series B round of $35 million. New investors, including Harmony Partners and Bessemer Venture Partners, joined existing backers. This capital was deployed to invest in technology and accelerate customer acquisition, helping the company scale its order volumes significantly.

The Series C round in 2017 brought in $80 million, led by Naspers (now Prosus Ventures) and DST Global. This round marked a turning point as Swiggy began scaling its operations aggressively across Tier-1 and Tier-2 cities. The company also focused on enhancing its delivery infrastructure and onboarding critical talent to support growth.

In 2018, Swiggy secured $210 million in a Series D round, with lead investors Naspers and DST Global joined by Meituan-Dianping and Coatue Management. This funding enabled Swiggy to introduce Swiggy Access, a cloud kitchen initiative, while also enhancing the user experience through app upgrades and expanded service offerings.

The Series E round in 2019 was Swiggy’s largest funding round to date, raising $1 billion from Naspers and Tencent, with participation from Hillhouse Capital and Wellington Management. This round valued the company at $3.3 billion and was instrumental in launching Instamart, its quick commerce venture. The funds were also used to strengthen its dark store network and invest in premium delivery services.

In 2021, Swiggy raised $800 million in a Series F round, led by Falcon Edge, Amansa Capital, Think Investments, Carmignac, and Goldman Sachs. Valued at $5 billion, this funding was focused on ramping up Instamart’s operations and moving towards profitability in the food delivery segment, with significant investments in technology and last-mile logistics.

The Series G round in 2022 brought in $700 million, led by Invesco and Prosus Ventures, alongside participation from Accel and Wellington. Swiggy was valued at $10.7 billion during this round. The funding supported acquisitions like Dineout, the expansion of premium services, and further development of AI-driven logistics capabilities.

Most recently, in 2023, Swiggy raised $500 million in a Series H round, led by Baron Capital and Sumeru Ventures, bringing its valuation to an estimated $12 billion. This round was critical in preparing Swiggy for its IPO while consolidating its leadership position in hyperlocal commerce across India.

With over $3.6 billion raised across nine funding rounds, Swiggy has built a strong financial foundation to support its evolution from a food delivery startup to a diversified convenience platform, poised for long-term growth.

Ownership Structure

Swiggy’s equity distribution reflects a mix of institutional and individual investors:

Prosus Ventures: 35%

Accel Partners: 10%

SoftBank Vision Fund: 15%

Sriharsha Majety (Co-Founder): 8%

Employee Stock Options (ESOPs): 12%

Competition

Swiggy operates in a highly competitive landscape alongside major players like Zomato, Blinkit, Zepto, Amazon, and Flipkart, each with unique strengths. In food delivery, Zomato is Swiggy’s closest rival, sharing a comparable market share. However, Swiggy stands out with its stronger presence in Tier-2 and Tier-3 cities, where competition is less intense, and consumer adoption is on the rise. This advantage is amplified by Swiggy’s higher customer retention rates, fueled by its reliable service and expanded offerings beyond food delivery, including quick commerce and dining-out solutions.

In quick commerce, Swiggy competes with Blinkit and Zepto but leverages its extensive infrastructure of 523 dark stores to maintain an edge. These stores enable broader product categories and faster delivery in 27 cities. Swiggy’s ultra-fast 15-minute delivery promise also differentiates it from Amazon and Flipkart, which operate on longer delivery timelines.

Swiggy’s AI-driven logistics further enhance cost efficiency and delivery precision. Its integrated platform—spanning food, groceries, dining, and lifestyle events—positions it as a one-stop solution for urban consumers. This strategic breadth, coupled with strong brand loyalty among urban millennials, firmly establishes Swiggy as a leader in India’s hyperlocal commerce ecosystem.

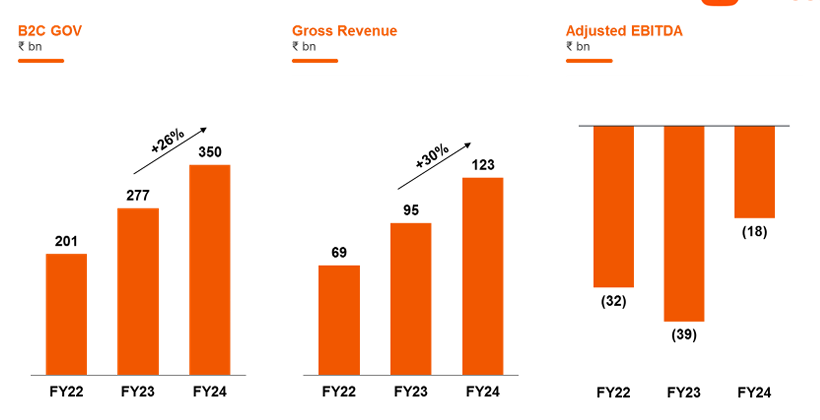

Financials

Revenue Growth and Trends

Swiggy has demonstrated robust revenue growth, driven by its diverse service portfolio and increasing consumer adoption in food delivery and quick commerce.

FY24 Revenue: ₹112,474 million

YoY Growth: 36%, up from ₹82,646 million in FY23.

Food Delivery Contribution: ₹80,000 million (~70% of total revenue).

Instamart Contribution: ₹32,000 million (~30% of total revenue).

Historical Growth:

FY20: ₹40,000 million

FY21: ₹49,000 million (pandemic surge).

FY22: ₹60,000 million (post-pandemic normalization).

FY23: ₹82,646 million

This consistent growth highlights Swiggy’s ability to seize emerging opportunities, particularly through the rapid expansion of Instamart, now a key revenue driver.

Profitability and Losses

While Swiggy has achieved EBITDA profitability in food delivery, overall profitability remains a challenge due to significant investments in quick commerce and infrastructure.

Net Loss FY24: ₹23,502 million, a notable improvement from ₹41,793 million in FY23.

Reflects cost optimizations and better contribution margins in food delivery.

Historical Losses:

FY20: ₹7,500 million

FY21: ₹13,000 million

FY22: ₹29,000 million

FY23: ₹41,793 million

Heavy investments in dark stores, logistics, and marketing for quick commerce impact short-term profitability but position the company for long-term growth.

Key Expense Categories

Logistics and Delivery Costs:

Largest expense category (~50% of total costs).

Includes payouts to 390,000+ delivery partners, fuel, and logistics infrastructure maintenance.

Marketing and Discounts:

₹10,000 million spent in FY24, reflecting a focused approach to customer acquisition and retention.

Technology Investments:

₹3,000 million in FY24 on AI-driven logistics, app enhancements, and user personalization, boosting efficiency and satisfaction.

Administrative Costs:

15% of total expenses, reflecting efficient overhead management.

Business Segment Performance

Food Delivery

Revenue: ₹80,000 million in FY24.

Growth Drivers:

Increased order frequency (4.5 orders/user/month).

Expansion into Tier-2 and Tier-3 cities.

Higher AOV, driven by premium offerings and larger baskets.

Profitability: EBITDA positive, supported by 15-25% commission rates and growing ad revenue.

Quick Commerce (Instamart)

Revenue: ₹32,000 million (~30% of total revenue).

Growth Drivers:

Dense network of 523 dark stores across 27 cities.

Diverse product portfolio of 17,000+ SKUs.

Challenges:

High operational costs tied to ultra-fast deliveries and inventory management.

Profitability Outlook: Moving toward breakeven with decreasing last-mile delivery costs and rising ad revenue.

Dineout and Events

Revenue growth driven by commissions, advertising fees, and event ticket sales.

Margins are improving as the unified app enhances user engagement, bringing the segment close to break-even.

Balance Sheet Highlights

Total Assets (FY24): ₹60,000 million, primarily comprising dark store infrastructure and technology investments.

Debt and Liabilities: Controlled, with manageable repayment schedules and strong investor backing.

Cash Flow Analysis

Cash flow remains negative due to high operational and capital expenditures.

Swiggy has raised over $3.6 billion to date, ensuring sufficient liquidity for continued investments.

Future Financial Outlook

Swiggy is poised for profitability in the medium term, supported by:

Mature Food Delivery Business: Incremental revenues from the profitable food delivery segment will drive net profits.

Cost Efficiencies in Quick Commerce: Increased dark store density and optimized delivery routes will reduce operational costs.

Ad Revenue Growth: Enhanced monetization through in-app ads and restaurant promotions.

Swiggy’s strategic investments and growing market presence position it as a leader in India’s hyperlocal commerce landscape.

Closing thoughts

Swiggy’s journey from a food delivery startup to a diversified hyperlocal commerce leader underscores its ability to adapt, innovate, and scale in a dynamic market. Its stronghold in Tier-2 and Tier-3 cities, coupled with a robust quick commerce segment through Instamart, highlights its strategic foresight in tapping into underserved markets and emerging consumer trends.

Despite challenges like profitability pressures, high operational costs, and intense competition, Swiggy’s focus on technology-driven logistics, diverse offerings, and customer-centric solutions positions it for long-term success. The company’s ability to maintain EBITDA profitability in food delivery, scale Instamart, and diversify revenue streams through Dineout and SteppinOut reflects a clear roadmap toward sustainable growth.

The proceeds from IPO will be crucial in strengthening its infrastructure, enhancing AI capabilities, and fueling further expansion. With a projected market opportunity of ₹3 lakh crore by 2027, Swiggy’s leadership in India’s hyperlocal commerce ecosystem is poised to solidify further, making it a company to watch in the years ahead. For investors and consumers alike, Swiggy’s story represents the potential of a platform that not only delivers convenience but redefines it.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Totally!

This holds true for any business

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.

What do you think about my bi-weekly Newsletter? Love it | Okay-ish | Stop it