👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

Partners

Money Machine Newsletter -

Market beating stocks in 5 min. Picked by elite traders. Delivered weekly to your inbox pre-market. Join 8k+ subscribers who have already placed themselves on the path to greater wealth.

S1 Deep Dive

Robinhood in one minute

Robinhood revolutionized the brokerage industry by eliminating trading fees and making investing accessible to the everyday investor. With its mission to "democratize finance for all," Robinhood focuses on commission-free trading for stocks, options, and cryptocurrencies. Its mobile-first platform and user-friendly design cater to a younger, tech-savvy demographic previously underserved by traditional brokerages.

Robinhood’s rapid growth has been driven by a changing market where retail investors have more power than ever before. The challenge for Robinhood will be navigating increased regulatory scrutiny while maintaining its user growth and engagement. With millions of users, it continues to disrupt the fintech space, pushing incumbents to adapt and shifting how people engage with markets.

To learn more about Robinhood’s commission-free model, its role in the fintech landscape, and the ongoing evolution of retail investing, keep reading.

Introduction

Robinhood (HOOD) Stock Overview

Current Price: $23.32 (as of market close)

Market Cap: $21.792B

52-Week Range: $7.91 - 25.36

EPS (TTM): 0.31

Robinhood went public in July 2021, pricing its IPO at $38 per share, raising $2.1 billion. While the stock initially debuted strong, trading as high as $85.00 in August 2021, it has since faced significant volatility. The price later declined, stabilizing within a much lower range, reflecting market concerns over profitability and regulatory scrutiny.

Recent Developments

It wasn’t the beginning of the end, but perhaps it should have been. In trying to justify Robinhood’s meteoric rise, co-founder Vlad Tenev made a bold statement: Robinhood wasn’t just a trading platform—it was a movement to democratize finance.

"We’re here to remove barriers to investing," Tenev declared, brushing off criticisms of its “gamified” interface and its role in volatile trading events like GameStop. It was a claim that echoed with the same audacity of other fintech disruptors who blur the lines between finance and a grander mission.

Robinhood, much like its counterpart WeWork, has a tendency to invoke sweeping, almost philosophical ideals. Neatly packaged behind the app's sleek user interface is a company that insists it's changing the way people think about money, not just how they invest it.

And yet, those same high ideals come with their share of controversy. The company's explosive growth, fueled by retail investors flocking to trade cryptocurrencies like Bitcoin and Dogecoin, made headlines. But the criticism never lagged far behind, with regulatory challenges casting a long shadow. Robinhood’s reliance on its "payment for order flow" model—a practice where they route trades to market makers for payments—raised questions about whose interests were really being served.

Still, Tenev pressed forward. Robinhood expanded beyond its roots, offering retirement accounts to capture more long-term investors and introducing IPO Access, giving retail investors a seat at the table traditionally reserved for the elite.

It’s a delicate balance—part fintech visionary, part broker under regulatory fire. Like Neumann’s WeWork, Robinhood thrives on bold ambition and the promise of tearing down established systems, with the ever-present challenge of proving that culture and mission can be more than just words on a pitch deck.

To understand Robinhood, you can't just look at the numbers—it's the mission to democratize finance that drives the story forward. Whether that mission will stand the test of time is the question.

Investor sentiment

Investor sentiment around Robinhood is anything but unanimous. On one side, the bulls see a company poised to redefine the financial services landscape, driven by a massive user base and a mission to bring millions of first-time investors into the fold. They talk about Robinhood not just as a brokerage, but as the architect of a new era in investing—one where retail investors have more influence, more access, and more control than ever before.

These optimists point to the platform's growing product offerings—cryptocurrencies, options, and now even retirement accounts—and to the surge in retail trading activity as signs of long-term potential. For them, Robinhood isn’t just riding a wave; it’s creating one.

But where the bulls see innovation, the bears see cracks. They worry about Robinhood’s path to profitability, citing its heavy reliance on the controversial “payment for order flow” model. For critics, this raises concerns not just about the platform's transparency, but about whether its revenue streams are built on shaky ground. Increasing regulatory scrutiny only heightens those fears.

And then there's the cryptocurrency volatility—a critical part of Robinhood’s revenue. With crypto markets notorious for their unpredictability, bears question whether Robinhood’s business model can sustain itself in the long run.

In the end, Robinhood embodies a grand vision of financial democratization. Whether it can balance that vision with sustainable profits and navigate an ever-tightening regulatory landscape is the challenge ahead.

History

Robinhood was founded in 2013 by Vladimir Tenev and Baiju Bhatt, two Stanford graduates with deep roots in finance and technology. Their idea was simple but powerful: democratize finance by offering commission-free trades. Until then, high trading fees kept many people away from investing in the stock market. With the rise of fintech and a growing demand for simpler, more accessible financial tools, Tenev and Bhatt saw a huge market gap. Robinhood’s zero-fee model was revolutionary.

In 2015, Robinhood launched its app and immediately gained traction. By 2016, it had over a million users, all of whom were attracted to the simplicity of its sleek interface and the lack of fees. As one of the first mobile-first brokerages, Robinhood appealed to millennials and Gen Z, groups historically less engaged with traditional investing due to its barriers to entry.

But what really brought Robinhood into the mainstream was its mission-driven marketing. “We’re not just an app,” the founders said, “we’re a movement.”

Market Opportunity

The timing couldn’t have been better for Robinhood. In the aftermath of the 2008 financial crisis, public trust in large financial institutions was at an all-time low. Traditional brokerages still charged fees of $7 to $10 per trade, while younger generations, raised on apps and smartphones, wanted seamless, low-cost access to all services. Robinhood not only capitalized on this but pushed the boundaries further by offering fractional shares and cryptocurrency trading, catering to younger investors looking for more dynamic and diverse portfolios.

The growth in retail investing exploded, especially during the COVID-19 pandemic. In 2020 and 2021, Robinhood experienced a user surge as people stuck at home turned to the stock market. By the time Robinhood went public in 2021, the platform had over 22 million funded accounts, a testament to its meteoric rise.

Product

Robinhood reimagines trading by prioritizing simplicity and accessibility. Designed to make investing feel intuitive, the platform brings financial markets closer to the user—right at their fingertips.

Core Features

Commission-Free Trading

The core proposition is straightforward: trade stocks, ETFs, options, and cryptocurrencies without incurring fees. Robinhood eliminates the traditional barriers, opening up new possibilities for everyday investors.Fractional Shares

Robinhood breaks down the cost of investing by allowing users to buy portions of a share. This flexibility enables investors to access high-priced stocks without the need for large capital commitments.Cryptocurrency Trading

As one of the first mainstream brokerages to embrace crypto, Robinhood lets users seamlessly trade digital assets like Bitcoin and Ethereum alongside traditional securities.Cash Management

With an integrated debit card and interest-earning cash, Robinhood extends its functionality beyond trading, merging aspects of banking with investing.

The platform’s intuitive design and educational content empower new investors to participate in the markets with confidence. Yet, its seamless user experience has sparked debate, with some suggesting that the ease of trading may unintentionally encourage impulsive behaviors.

Each feature—from commission-free trading to crypto access—represents a step towards democratizing finance. The platform doesn’t just offer trading; it transforms how users interact with the financial ecosystem. Partnering with third-party services and adding new asset classes expands its appeal, providing a holistic view of financial management.

Robinhood’s mission to make investing more accessible is supported by its user-friendly design, educational resources, and commitment to lowering barriers. As the platform continues to grow, it aims to deliver more than just a trading experience—Robinhood strives to empower every individual to participate in the financial world.

Business Model

Robinhood may be known for commission-free trades, but it isn’t exactly a charity. In fact, its business model is both innovative and controversial. Here’s how they make money:

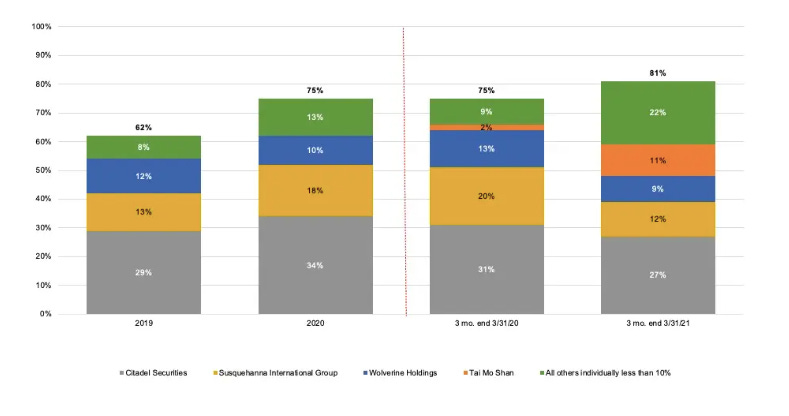

- Payment for Order Flow (PFOF): Robinhood earns revenue by directing orders to market makers who execute the trades, and they are compensated for this “flow.” In 2023, Robinhood made a significant portion of its $1.35 billion revenue from PFOF. This model has sparked debate, with critics arguing that it prioritizes volume over the best price for users.

- Interest on Uninvested Cash: By holding users’ cash, Robinhood collects interest before crediting it back to customers.

- Margin Trading: Users can borrow money to trade on margin, a service Robinhood charges for under its Robinhood Gold premium offering. As of 2023, margin-related revenues were a strong contributor to the company's financials.

- Subscription Services: Robinhood Gold, priced at $5 per month, gives users access to higher buying power, larger instant deposits, and professional research tools.

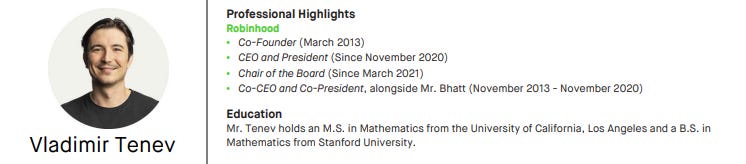

Management Team

Robinhood’s leadership reflects its Silicon Valley roots. Vlad Tenev and Baiju Bhatt, as co-founders, continue to be the public faces of the company. Tenev, serving as CEO, is known for his background in physics and finance, while Bhatt, who stepped down as co-CEO in 2020, remains on the board and plays a key strategic role.

In recent years, Robinhood has added experienced executives to its management team to navigate the complexities of scaling and public scrutiny. Notably, Jason Warnick, the CFO since 2018, played a critical role in guiding Robinhood through its IPO and public market challenges.

Vladimir Tenev (CEO): A co-founder and current CEO, Vlad Tenev has been instrumental in leading Robinhood through its rapid growth and challenges. With a background in physics and finance, he’s known for his strategic vision but faced criticism during the GameStop controversy. His leadership remains crucial as Robinhood navigates regulatory pressures and its post-IPO journey.

Baiju Bhatt (Co-founder, Board Member): Although he stepped down as co-CEO in 2020, Baiju Bhatt continues to play a strategic role at Robinhood as a board member. With expertise in software and engineering, Bhatt is passionate about democratizing finance and remains deeply involved in Robinhood’s long-term vision.

Jason Warnick (CFO): As Robinhood’s Chief Financial Officer, Jason Warnick has been pivotal in guiding the company through its IPO and ensuring financial discipline. With over two decades of experience at Amazon, he is focused on achieving profitability while managing the firm’s financial complexities.

Gretchen Howard (COO): Robinhood’s Chief Operating Officer, Gretchen Howard, joined the company in 2019 after a long tenure at Google and CapitalG. She oversees day-to-day operations, focusing on scaling the business efficiently while improving user experience and regulatory compliance.

Dan Gallagher (Chief Legal Officer): Dan Gallagher, a former SEC commissioner, serves as Robinhood’s Chief Legal Officer. His deep regulatory knowledge helps the company navigate the complex legal landscape, especially as Robinhood faces ongoing scrutiny from regulators.

Investors

Robinhood’s ownership is a mix of institutional investors, public shareholders, and its founders, Vladimir Tenev and Baiju Bhatt, who retain significant control over the company through a dual-class share structure.

Founders' Control

Vladimir Tenev and Baiju Bhatt, the co-founders of Robinhood, hold Class B shares, which come with 10 votes per share, giving them significant influence over the company’s direction despite their relatively smaller economic stake. Combined, Tenev and Bhatt control approximately 65% of the voting power as of 2023. This structure allows them to maintain tight control over key decisions, including board appointments and major company strategies, even as Robinhood continues to grow as a public company.

Institutional Investors

Robinhood has attracted investment from some of the most prestigious venture capital firms and institutional investors in Silicon Valley. Early backers, like Andreessen Horowitz, Index Ventures, and Ribbit Capital, continue to hold substantial stakes in the company. Other key investors include:

Sequoia Capital: One of the most prominent venture capital firms, Sequoia played a vital role in Robinhood's early stages and remains a major shareholder.

DST Global: This investment firm, founded by billionaire Yuri Milner, is also a notable shareholder, having supported Robinhood through several fundraising rounds.

Ribbit Capital: A major player in fintech investments, Ribbit has been deeply involved in Robinhood's journey and holds a significant stake.

Public Shareholders

Since Robinhood went public on July 29, 2021, through its much-anticipated IPO, a portion of its shares are now held by retail and institutional investors via Class A shares. These shares carry 1 vote per share and represent the portion of the company available to public shareholders. At the time of the IPO, Robinhood’s stock price was $38 per share, giving it a market valuation of around $32 billion. However, by late 2023, Robinhood’s stock price had fallen significantly, reducing its market capitalization to approximately $8 billion.

Gamestop Mania

If there’s one episode that crystallizes Robinhood’s divisive role in modern finance, it’s the GameStop saga of January 2021. In a whirlwind battle between retail traders on Reddit’s r/WallStreetBets and powerful hedge funds, the price of GameStop stock skyrocketed over 1,700% in just a matter of weeks. For a brief moment, it felt like the little guys were winning, using Robinhood as their weapon of choice.

But at the height of the chaos, Robinhood made a move that shocked its users: it restricted the buying of GameStop and other volatile stocks, citing liquidity issues and clearinghouse demands. What followed was an explosion of outrage. To many, Robinhood’s decision felt like a betrayal of its core promise—to democratize finance. Critics accused the platform of siding with hedge funds, abandoning the very retail investors it claimed to empower.

The fallout was swift and brutal. Robinhood found itself in the crosshairs of congressional hearings, lawsuits, and a tidal wave of public criticism. Its reputation took a serious hit, and despite efforts to clarify its actions and improve liquidity protocols, the GameStop incident remains a dark chapter in its history, casting a long shadow over its mission.

Though Robinhood has tried to move forward, the GameStop controversy still lingers—a reminder of the fine line the company must walk between innovation and the pressures of the financial system it aims to disrupt.

Competition

Robinhood’s disruptive approach to trading set off a wave of changes across the industry. The competitive dynamics intensified as established players like Charles Schwab, E*TRADE, and Fidelity adapted by eliminating commission fees to match Robinhood’s core appeal. Meanwhile, newer entrants like Webull, SoFi, and M1 Finance have emerged, each bringing a diverse range of services that intersect with Robinhood’s offerings.

Direct Competitors in Trading

Robinhood aligns most closely with trading-centric platforms, where it competes head-on with both legacy brokers and modern fintech companies. While competitors have closed the gap by matching key features—such as commission-free trading and mobile access—Robinhood differentiates itself through continuous expansion in areas like cryptocurrency, fractional shares, and user education. These enhancements are aimed at deepening engagement with young investors who prioritize ease of access and digital-native experiences.

The Broader Fintech Ecosystem

Beyond trading, Robinhood exists within a broader financial ecosystem that includes digital banking, robo-advisors, and investment platforms. However, while the larger players focus on a wide range of financial products, Robinhood zeroes in on democratizing access to markets through simplicity and transparency.

Expanding Reach Through Innovation

Robinhood’s strategy revolves around capturing mindshare among young investors by continually enhancing its platform. Whether through adding new crypto assets, refining educational content, or launching cash management features, the goal is to embed itself more deeply into users’ financial lives.

In an industry shaped by rapid shifts and emerging competitors, Robinhood's emphasis on accessibility, innovation, and education positions it to stand out and resonate with the next generation of investors.

Financial HIghlights

Robinhood's financial trajectory from 2021 to 2023 reveals a mix of challenges and progress. Despite fluctuations in revenue and operating expenses, the company is making strides toward stabilizing its financial position.

2021-2023 Revenue Analysis

Total net revenues saw a decrease from $1.82 billion in 2021 to $1.36 billion in 2022, followed by a recovery to $1.87 billion in 2023. The decline in 2022 was primarily due to reduced transaction-based revenues, which fell from $1.4 billion in 2021 to $814 million in 2022, reflecting lower user engagement and trading activity. However, 2023 showed signs of improvement with increased net interest revenues reaching $929 million, suggesting a shift towards interest-driven income streams.

Expense Breakdown

Operating expenses showed significant variation, decreasing from $3.46 billion in 2021 to $2.37 billion in 2022 and then slightly rising to $2.4 billion in 2023. The reduction in expenses was mainly driven by lower technology and development costs, as well as marketing expenses, which dropped dramatically from $325 million in 2021 to $122 million in 2023. General and administrative expenses, however, remained substantial, reflecting ongoing investments in operational infrastructure.

While Robinhood's net loss narrowed considerably from $3.69 billion in 2021 to $541 million in 2023, profitability remains elusive. The primary drivers behind the losses include high general and administrative expenses and fluctuating revenues from trading activities.

Cash from Operating Activities

The company turned a corner in 2023, generating $1.18 billion in cash from operating activities compared to cash outflows in the previous years. This improvement indicates a stronger focus on cash flow management and operational efficiency.

Investing and Financing Activities

Investing activities showed increased outflows in 2023, amounting to $582 million, signaling ongoing investments in product development or strategic initiatives. In contrast, financing activities flipped to a cash outflow of $610 million in 2023, following a significant inflow of $5.2 billion in 2021, suggesting repayments or share buybacks.

Robinhood’s current focus is on diversifying revenue streams, such as expanding its crypto offerings and launching new financial products. The company faces a shifting landscape, with declining user engagement and competition from established financial institutions that have embraced commission-free trading.

Despite a smaller active user base, Robinhood remains a prominent player in retail trading, particularly among younger investors. With $6.6 billion in assets and improvements in cash flow, the company is positioning itself for a more sustainable growth trajectory.

Closing thoughts

The fact that Robinhood surged to prominence during a time of unprecedented retail investor activity—alongside the rise of cryptocurrencies and meme stocks—tells you much about why it has become a defining player in the fintech space. The market’s hunger for disruptive platforms has never been stronger, especially ones that promise to level the financial playing field.

Despite the regulatory challenges and the lingering stain of the GameStop saga, Robinhood has continued to expand its offerings, from crypto trading to retirement accounts and IPO access. This growth has allowed the company to maintain its position at the forefront of a shifting investment landscape, where retail investors wield increasing influence.

As Robinhood navigates the evolving regulatory environment and works to regain trust, the platform’s mission to democratize finance remains its driving force. With millions of users and an ever-expanding suite of services, Robinhood’s snowball—built on bold innovation and accessibility—continues to gather momentum, positioning it well for the next phase of retail investing.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Charlie Munger on Koreans and their auto industry

SaaS era is over. This is the era of AI world

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.

What do you think about my bi-weekly Newsletter? Love it | Okay-ish | Stop it