👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

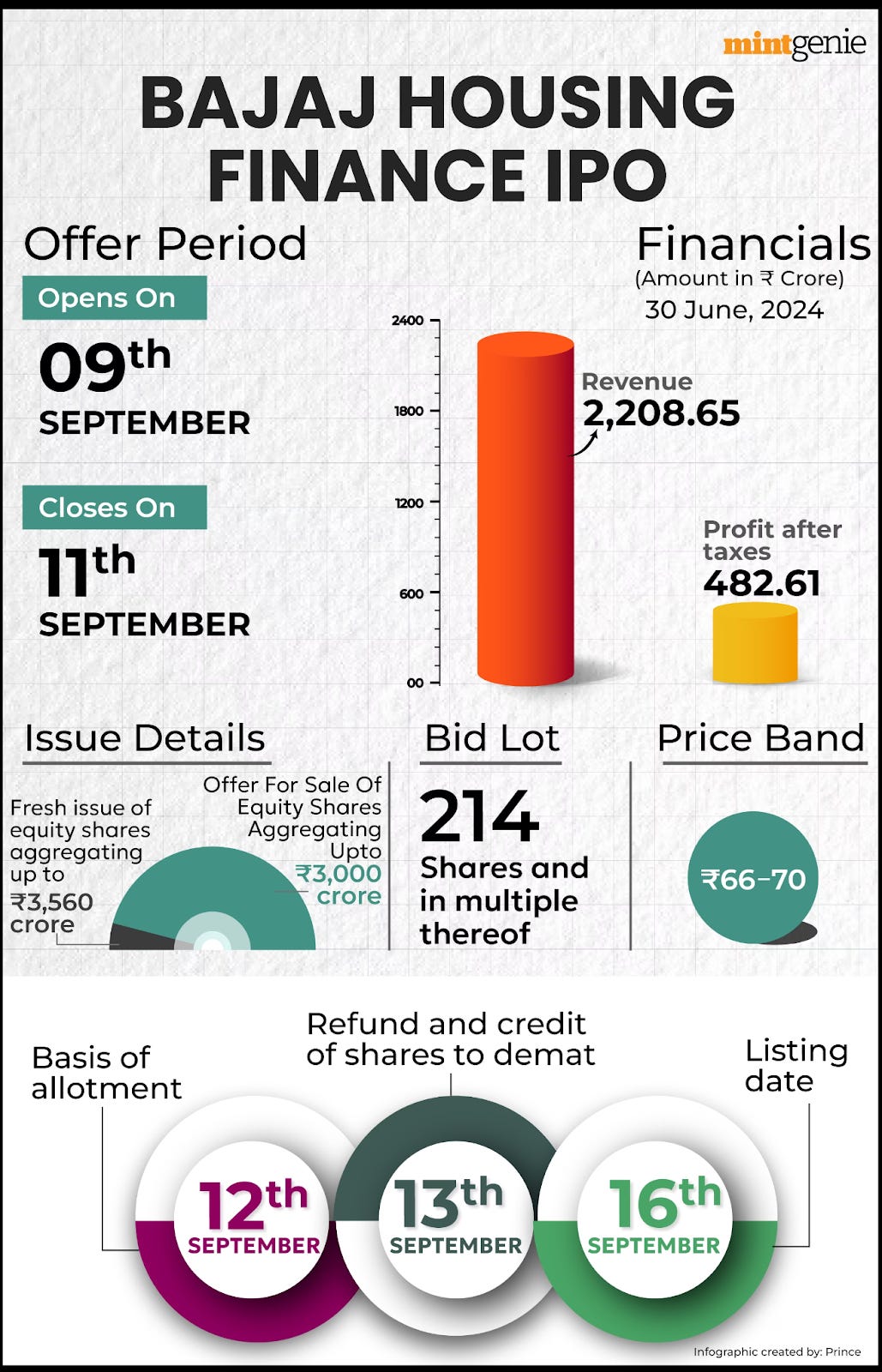

IPO Deep Dive

Bajaj Housing Finance in a nutshell

Bajaj Housing Finance Ltd. (BHFL) is a mortgage lending subsidiary of Bajaj Finance, which had a public offering on September 16th, 2024. While not yet a household name globally, BHFL is a critical player in India's booming mortgage market, with a growing asset base and expansion plans.

The IPO will raise approximately INR 4,000 crore (~$480 million), a substantial step to fuel growth. BHFL’s AUM has already reached $11.7 billion as of Q1 FY25, and it’s this momentum that investors are eager to ride. BHFL’s parent, Bajaj Finance, brings credibility and a proven track record to the table, making this offering an exciting one to watch.

For more on BHFL’s rapid rise, market position, and its potential to shake up India’s housing finance landscape, let’s dive into it.

Introduction

Bajaj Housing Finance (BHFL) Stock Overview

Current Price: INR 154.50 (as of market close)

Market Cap: INR 103192 crores

Sector PE: 17.71

BHFL has long prided itself on being more than just another non-banking financial company (NBFC). Since its inception, it has disrupted the Indian financial landscape, with each quarter bringing new offerings that push the boundaries of consumer finance. Whether it's consumer durable loans, SME financing, or mortgage lending, Bajaj Housing Finance does more than provide financial services; it meets aspirations.

The company operates across 4,202 locations, but it isn't just its geographical reach that impresses. Bajaj Housing Finance serves over 88 million customers — a staggering figure, hinting at more than just convenience or necessity. It points to trust.

For Bajaj Housing Finance, success isn't just about its popular products like the Bajaj Finserv App or EMI Card, though these have revolutionized digital finance in India. It's about creating an ecosystem where the customer always feels in control, and where the experience of borrowing is as seamless and frictionless as possible.

What distinguishes BHFL isn’t merely the numbers, though they are impressive. With a significant foothold in both urban and rural India, the company has solidified its role as an essential player in the financial services landscape, constantly expanding its portfolio and market share.

In a world where tech-driven NBFCs are mushrooming, Bajaj Housing Finance stands out not just for its offerings, but for its commitment to evolving the very idea of what it means to be a financial partner in modern India. It's more than numbers; it's a state of trust.

Recent development

It wasn’t simply about offering more loans, though Bajaj Housing Finance has certainly expanded its horizons. In personal loans and SME financing, the company’s reach continues to grow, as does its presence in the digital lending space. But this isn’t just about increasing numbers — it’s about transforming the very nature of borrowing. Through seamless digital channels, Bajaj Housing Finance has redefined what it means to access instant loans and e-commerce financing.

The company's digital transformation goes far deeper than a slick app or a website. Bajaj Finance is engineering a financial ecosystem, one that blends personalized lending with superior credit risk management. Its Bajaj Finserv App, with a staggering 56.79 million net users, isn’t just a tool — it’s a gateway. A portal to instant access, tailored financial products, and an experience built on trust and ease. This digital platform is where Bajaj Housing Finance’s true power lies, engaging customers across every financial product in its ever-expanding suite.

And yet, Bajaj Housing Finance’s ambition doesn’t stop at acquiring new customers. The company has been tapping into the potential of its vast existing base — 55.1 million cross-sell customers as of Q1 FY25. It's a game of depth, not breadth. By offering insurance, payment products, and additional loans, Bajaj Housing Finance is deepening its relationships, increasing revenue per customer, and positioning itself as an essential partner in their financial journey.

Bajaj Housing Finance isn’t just expanding its offerings — it’s reshaping the financial landscape, one customer at a time.

Investor sentiment

Investor sentiment toward Bajaj Housing Finance is anything but tepid. Bulls are drawn to the company’s commanding market position and diverse product portfolio, particularly in consumer and SME lending. For them, Bajaj Housing Finance isn't just another player — it’s a leader, a company that has consistently delivered on growth and innovation. Adding fuel to this optimism is the upcoming Bajaj Housing Finance IPO, which has stirred significant interest. The subsidiary's potential to outperform in India's booming mortgage market is undeniable, with many believing it will further cement Bajaj Finance's dominance.

But not all is smooth sailing. Some investors are approaching with caution, eyes on the horizon for potential storms. Rising non-performing assets (NPAs) in an unpredictable economic landscape, coupled with fierce competition from digital-first fintech players, cast shadows of doubt. And yet, Bajaj Housing Finance stands resilient. Its balance sheet remains strong, boasting a Net NPA of just 0.38% as of Q1 FY25 — a testament to its prudent management and excellent asset quality.

For those playing the long game, Bajaj Housing Finance is still a favoured pick. Its consistent profitability, robust fundamentals, and clear vision for the future make it a cornerstone of any portfolio aimed at long-term growth.

History

Bajaj Finance Limited (BFL) started humbly in 1987, a small finance company nestled within the larger Bajaj Group, focusing primarily on vehicle financing for Bajaj Auto’s two- and three-wheelers. But BFL was never destined to stay small. Over the following decades, it expanded beyond its initial scope, entering personal loans, mortgage lending, and SME financing, signalling the start of its transformation.

The real shift, though, came in the 2000s. Under the visionary leadership of Sanjiv Bajaj and CEO Rajeev Jain, BFL recognized the vast potential in consumer finance and business loans. This wasn’t just an expansion — it was a reinvention. By embracing technology and crafting customer-centric products, they propelled Bajaj Finance into becoming one of India’s largest and fastest-growing non-banking financial companies (NBFCs).

Today, BFL is a financial powerhouse, operating across consumer finance, SME lending, commercial lending, mortgage loans, and wealth management. Its impressive customer base of 88.11 million spans both urban and rural markets, making Bajaj Finance a key player in shaping India’s financial landscape.

Market Opportunity

India's financial market is on the brink of a seismic shift, and Bajaj Housing Finance is primed to lead the charge. In a country where only around 10% of the population has access to formal credit, Bajaj Finance carved out its place by offering affordable, accessible financial solutions. From consumer loans to SME finance, it has reached every corner of the population — from rural borrowers to urban middle-class consumers financing everything from durable goods to education. Their focus on personal loans, mortgage lending, and digital credit has made them a go-to lender for millions of Indians.

The growth story is just beginning, with Bajaj Housing Finance’s digital push playing a crucial role in capturing the tech-savvy millennial market and tapping into India’s expanding internet penetration. Here’s how the market breaks down:

Consumer Financing: India's middle class is ballooning, driving increased demand for consumer durables, electronics, and lifestyle products. Bajaj Finance, a leader in consumer durable loans, has watched demand soar year after year. By 2028, the consumer durable financing market is projected to hit $20 billion, and Bajaj Finance is poised to lead.

Personal Loans: Rising aspirations have opened a vast opportunity in personal loans, particularly for salaried individuals. Bajaj Finance already disbursed $525 million in personal loans in Q1 FY25, growing 58% year-on-year. By 2030, this segment is expected to grow into a $50 billion market, with Bajaj Finance squarely positioned at its forefront.

SME Financing: India’s small and medium enterprises (SME) sector remains critically underpenetrated. Bajaj Finance’s SME lending has surged, recording $4.9 billion in assets under management (AUM) in FY25. With government reforms and increasing digitization, India’s SME lending market could reach $100 billion by 2030, and Bajaj Finance is set to capitalize on this momentum.

Mortgages: Housing finance continues to be a key growth driver. Bajaj Housing Finance Ltd (BHFL) saw a 31% year-on-year growth in AUM, reaching $11.7 billion in FY25. With the government's push for affordable housing, India’s mortgage market is projected to hit $1 trillion by 2027, and Bajaj Finance is ready to take a large slice of that market.

Digital Finance: Bajaj Finance is also a major player in the digital lending space, with over 56.79 million users on its Bajaj Finserv app and 45.6 million EMI cards in circulation. Digital personal loans and e-commerce financing are expected to grow into a $40 billion market by 2028, further cementing Bajaj Finance’s role as a digital finance leader.

With its broad reach across these segments, Bajaj Finance is positioned to capture a substantial portion of India’s $500 billion financial services market by 2030. The company isn't just playing the game — it’s rewriting the rules.

Products

Bajaj Finance has carved out a commanding presence in India’s financial landscape, with a range of products that cater to a diverse and expanding customer base:

Consumer Durable Loans: Bajaj Finance is the undisputed leader in financing consumer electronics, lifestyle products, and digital gadgets. Its zero-cost EMI financing, offered through EMI cards, is available at over 44,200 stores in urban areas and 53,000 stores in rural regions. This extensive reach ensures that no corner of India is left untapped.

Personal Loans: Whether for salaried or self-employed individuals, Bajaj Finance’s personal loans are in high demand. In Q1 FY25, personal loan disbursals skyrocketed by 58% year-on-year, reaching $525 million. The numbers reflect not just growth, but the company’s ability to meet the rising aspirations of millions.

Mortgage Loans: Bajaj Housing Finance Ltd (BHFL), the subsidiary of Bajaj Finance, has been a key driver of its mortgage lending portfolio. Offering home loans, loans against property, and lease rental discounting, BHFL’s home loan AUM stood at $6.87 billion as of June 2024, a robust 24% year-on-year growth. The future of housing finance in India is bright, and Bajaj Finance is leading the way.

Business Loans: Bajaj Finance plays a crucial role in supporting India’s small and medium enterprises (SMEs) with both secured and unsecured loans. Whether it’s medical equipment financing, loans against securities, or working capital finance, the company is a critical lifeline for entrepreneurs. SME lending alone accounts for 11.5% of their AUM, underscoring their importance in fueling India’s economic engine.

EMI Card: Bajaj Finance’s EMI Card has revolutionized consumer financing, allowing users to instantly finance purchases at online and offline retailers. With 45.6 million EMI cards in circulation, this innovative product has become a cornerstone of the company’s success, giving millions of consumers access to hassle-free credit.

Digital Lending: As digital finance gains ground, Bajaj Finance is at the forefront. With over 56.79 million net users on its Bajaj Finserv app, the company has embraced the digital shift, offering personal loans, e-commerce financing, and payments solutions at scale. The app has become an essential tool for millions seeking quick, efficient, and digital-first financial services.

Backed by a vast distribution network spanning 4,202 locations and over 207,000 distribution points, Bajaj Finance’s reach is unparalleled, ensuring that it remains the dominant force in India’s financial sector.

Business Model

Bajaj Finance’s meteoric rise can be attributed to its innovative, data-driven business model, which is the backbone of its success:

Cross-Selling: With a sprawling customer base of 88.11 million, Bajaj Finance has mastered the art of cross-selling. What begins as a simple consumer durable loan quickly evolves into a deeper relationship. Once onboarded, customers are offered personal loans, credit cards, or even insurance products. Bajaj Finance isn’t just selling products—it’s building long-term financial partnerships.

Omnichannel Approach: Bajaj Finance blends the physical and digital worlds seamlessly. Its hub-and-spoke model allows it to operate in both rural and urban landscapes, with a presence in 2,617 rural towns and 1,585 urban locations. This omnichannel approach ensures it reaches every corner of the country, serving a diverse range of customers, from metropolitan cities to remote villages.

Technology Integration: Technology sits at the heart of Bajaj Finance’s operations. By leveraging deep data analytics, the company tailors its products to meet individual customer needs, while streamlining operational efficiency. A significant portion of loan approvals are now completed digitally, demonstrating how Bajaj Finance has embraced tech to enhance the customer experience.

Risk Management: One of the most striking aspects of Bajaj Finance is its ability to manage risk. The company maintains one of the lowest Gross Non-Performing Assets (GNPA) ratios in the industry at just 0.86%. By using advanced data analytics for credit risk assessment, Bajaj Finance ensures its lending practices remain sound, even in volatile markets.

With an AUM of $42.67 billion as of June 2024, Bajaj Finance’s formula for growth—cross-selling, technological innovation, and robust risk management—has created a model of sustainable success, positioning the company as a leader in India’s financial sector.

Management Team

Bajaj Finance’s remarkable transformation can be traced back to its visionary leadership. The key figures behind the company’s success have not only shaped its strategy but also driven its evolution into a financial powerhouse:

Sanjiv Bajaj, Chairman: As the Chairman of both Bajaj Finserv and Bajaj Finance, Sanjiv Bajaj has been the guiding force behind the company’s growth. A Harvard Business School graduate, his leadership was instrumental in steering Bajaj Finance through its digital transformation.

Rajeev Jain, Managing Director & CEO: A towering figure in India’s financial services sector, Rajeev Jain joined Bajaj Finance in 2007 and has since been the architect of its incredible growth. Known for his strategic brilliance, Rajeev has spearheaded expansion across consumer lending, SME loans, and digital finance. Under his stewardship, Bajaj Finance’s AUM skyrocketed from $1 billion to $42 billion, a testament to his foresight and execution.

Sandeep Jain, CFO: With over 25 years of experience in finance and taxation, Sandeep Jain has been pivotal in shaping Bajaj Finance’s financial strategy.

Deepak Reddy, Chief Risk Officer: The man behind Bajaj Finance’s exemplary risk management, Deepak Reddy is a seasoned expert in credit risk. Under his watchful eye, the company has maintained a remarkably low GNPA ratio of 0.86%, ensuring that growth is coupled with stability.

Rakesh Bhatt, COO: Overseeing the day-to-day operations, Rakesh Bhatt plays a crucial role in executing Bajaj Finance’s omnichannel strategy. His efforts ensure smooth coordination between business units, allowing the company to seamlessly integrate its physical and digital services.

Investment structure

Bajaj Finance’s transformation from a small vehicle finance company to one of India’s leading non-banking financial companies (NBFCs) is a story of well-timed investments that fueled its rise:

IPO in 1994: Bajaj Finance made its public debut, raising INR 28 crore (~$7 million). This initial capital provided the foundation for its early foray into consumer financing, marking the beginning of its upward trajectory.

Preferential Allotment in 2009: In the aftermath of the global financial crisis, Bajaj Finserv, its parent company, injected INR 150 crore (~$35 million) to fuel growth in personal loans and SME financing. This move positioned Bajaj Finance to capitalize on emerging opportunities in the Indian credit market.

QIP in 2012: Bajaj Finance raised INR 1,400 crore (~$250 million) from institutional investors. This infusion allowed the company to expand into rural financing and digital lending, diversifying its portfolio and reaching new customer segments.

QIP in 2017: With an eye on aggressive expansion, Bajaj Finance raised INR 4,500 crore (~$700 million), enabling it to accelerate growth in consumer, mortgage, and digital finance. This investment solidified its position as a financial powerhouse, ready to compete with fintechs and traditional banks alike.

Rights Issue in 2020: As the world grappled with the COVID-19 pandemic, Bajaj Finance raised INR 8,500 crore (~$1.13 billion) to strengthen its balance sheet and ensure liquidity in uncertain times. This strategic move helped the company weather the storm while maintaining its growth trajectory.

Bajaj Housing Finance IPO: Looking ahead, Bajaj Housing Finance plans to raise INR 4,000 crore (~$480 million) to further expand its booming mortgage business, which already boasts an AUM of $11.7 billion. This IPO is set to bolster Bajaj Finance’s already impressive portfolio.

Today, Bajaj Finance remains firmly under the control of its parent company, Bajaj Finserv, which holds 51.34% of the company as of June 2024. This majority stake ensures that Bajaj Finance continues to benefit from the strategic support and long-term vision of the Bajaj Group.

Here’s a breakdown of key stakeholders driving Bajaj Finance’s continued ascent into the future.

Competition

Bajaj Finance operates in a fiercely competitive market, going head-to-head with both NBFCs and traditional banks. The key players challenging its dominance include:

HDFC Ltd: A major force in housing finance, HDFC competes directly with Bajaj Finance in consumer lending and mortgage finance, leveraging its established reputation in the sector.

Tata Capital: As another leading NBFC, Tata Capital offers a similar suite of financial products, vying for market share in personal loans, SME financing, and more.

ICICI Bank and SBI: These banking giants present formidable competition in retail lending, personal loans, and mortgages, drawing on their vast customer bases and deep financial resources.

Yet, despite the competition, Bajaj Finance continues to stand apart. Its focus on innovation, digital transformation, and cross-selling has allowed it to maintain its leadership position in the financial services space. What truly sets Bajaj Finance apart is its commitment to reaching underserved sectors and regions. By concentrating on rural and semi-urban markets, the company has carved out a significant competitive edge, tapping into areas where many others have yet to gain a foothold.

Financials

Bajaj Finance has consistently demonstrated robust financial growth, solidifying its leadership in the non-banking financial sector. Here’s a closer look at its key financials over recent years:

AUM Growth: Bajaj Finance’s Assets Under Management (AUM) surged from $29.8 billion in FY23 to $42.67 billion in FY25, marking a strong 31% year-on-year increase in the latest quarter. This impressive growth has been driven by strategic expansion in core areas such as mortgages, SME lending, and consumer finance. Notably, the mortgage portfolio alone grew 32% YoY to reach $13.21 billion by Q1 FY25.

Net Interest Income (NII): Despite market challenges, Bajaj Finance has steadily increased its net interest income, which jumped 25% YoY to $1,008 million in Q1 FY25. This growth reflects the company’s ability to optimize its lending operations and maintain strong margins in a competitive landscape.

Profit After Tax (PAT): Bajaj Finance’s profitability continues to climb, with PAT growing by 14% YoY to $471 million in Q1 FY25. The company’s disciplined approach to risk management, combined with a focus on high-margin segments, has helped sustain this upward trajectory.

Return on Equity (ROE): In FY25, Bajaj Finance delivered an ROE of 19.86%, underscoring its efficiency in generating profits from shareholder equity. This strong return reflects the company’s financial discipline and ability to deliver value to investors.

Operational Resilience: Over the past three years, Bajaj Finance has weathered market volatility with resilience. Even during the pandemic, the company maintained low net non-performing assets (NPAs), which stood at just 0.38% in Q1 FY25. This reflects its prudent lending practices and strong risk management framework.

With a customer base of over 88.11 million and 10.97 million new loans booked in Q1 FY25, Bajaj Finance continues to expand its reach. Its competitive cost of funds, currently at 7.94%, further strengthens its position for future growth. As Bajaj Finance looks ahead, it’s clear that its financial strength, strategic foresight, and operational discipline will continue to drive its success in India’s dynamic financial market.

Closing thoughts

The timing of Bajaj Housing Finance’s IPO could not be more strategic. With India’s mortgage market on a fast upward trajectory and housing demand continuing to soar, Bajaj Housing Finance is primed to capitalize on the growing appetite for affordable housing. The fact that Bajaj Finance has chosen to spin off its mortgage subsidiary during this boom tells you almost everything you need to know about why this move is happening now.

The public market's enthusiasm for high-growth financial services companies, particularly those with a strong digital and rural reach, has never been stronger. A government-led push for affordable housing combined with India’s increasing middle-class demand has created a perfect storm for investors looking to tap into the future of homeownership.

By going public at this moment, Bajaj Housing Finance positions itself not only to capture market share but also to generate significant buzz. The IPO represents a timely opportunity for the company to cement its leadership in India’s mortgage space and align its growth trajectory with an unprecedented market opportunity. Like the "snowball" effect described by Sanjiv Bajaj, this is the culmination of years of calculated expansion, now picking up momentum at precisely the right time to take advantage of a high-demand market.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Know what you want and then pay the price for it

Love this frame of reference

Here’s how I can help

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.

What do you think about my bi-weekly Newsletter? Love it | Okay-ish | Stop it