👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Saturday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to Life Self Mastery podcast which gives you a guide on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Astera Labs in 1 Minute

Astera Labs is a high-performance connectivity solutions company focused on enabling AI and machine learning applications. Founded by a team of Silicon Valley veterans, Astera is known for its deep expertise in semiconductors and its innovative approach to data processing. Astera Labs went public in February 2024, marking a significant milestone for the company as it raised $300 million at a $35 per share IPO.

Astera’s strength lies in its cutting-edge product line, which helps power cloud and AI infrastructure. The company is navigating the typical challenges of a high-growth tech firm, including negative earnings as it focuses on expanding its market share and product offerings.

The challenge for Astera Labs will be convincing investors that its long-term value outweighs short-term losses, but in the rapidly growing AI and semiconductor space, there may be no shortage of believers. For a deeper dive into Astera Labs’ product innovations and competitive positioning, keep reading.

Introduction

Astera Labs (ASTL) Stock Overview

Current Price: $38.25 (as of market close)

Market Cap: $3.1 billion

52-Week Range: $31.50 - $45.00

EPS (TTM): -$1.35

IPO Details:

Astera Labs went public in February 2024 with an IPO price of $35 per share, raising $300 million. On the first day, the stock rose 29% to $45.00. Trading as "ASTL," it saw some ups and downs, peaking at $45.00 before settling. Despite the strong IPO, the company faces typical growth challenges, including losses as it focuses on expanding.

Company Overview:

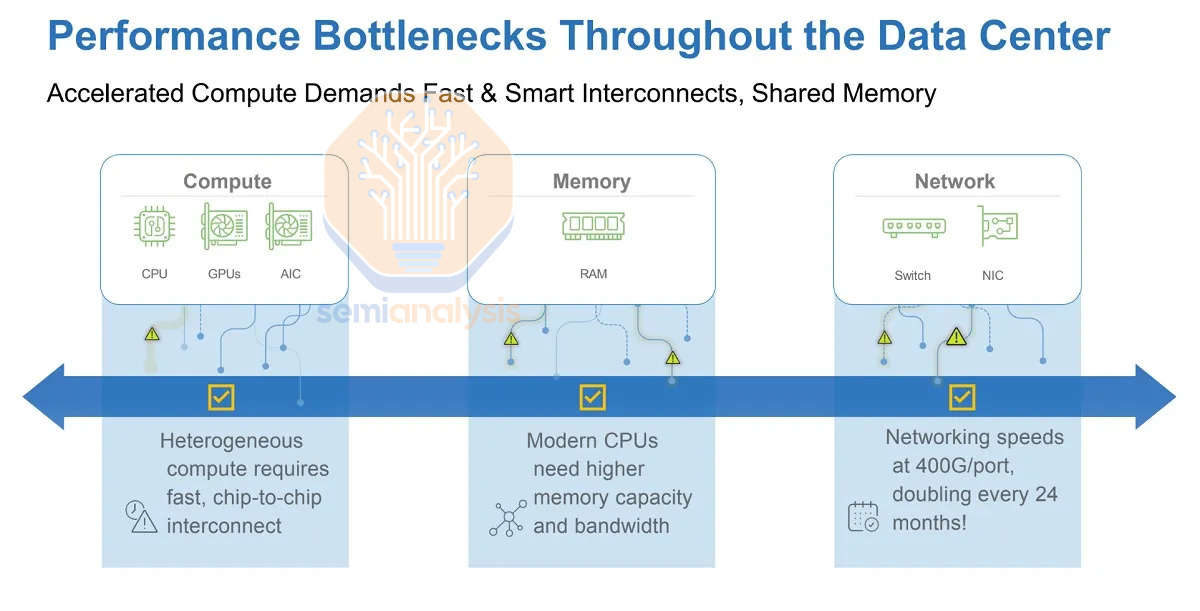

Astera Labs is a leader in semiconductor connectivity solutions designed specifically for cloud and AI infrastructure. The company’s innovative products help hyperscalers, such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, solve critical data, network, and memory bottlenecks, ensuring the efficient functioning of data centers. With its proprietary COSMOS software suite and a portfolio of cutting-edge hardware solutions, Astera Labs plays a crucial role in the evolving landscape of high-performance computing.

Recent Developments:

Expansion of Product Line:

Astera Labs recently introduced new connectivity solutions, including the Leo CXL Memory Connectivity Controllers, which enhance memory capacity and bandwidth in AI and data-intensive environments. These innovations are aimed at maintaining the company’s competitive edge and increasing its penetration in the cloud and AI infrastructure market.Strategic Partnerships and Collaborations:

The company continues to strengthen its relationships with key industry players like Intel, NVIDIA, AMD, and other data center equipment manufacturers to ensure seamless interoperability. These partnerships are designed to enhance product compatibility and accelerate the adoption of its solutions by hyperscalers and Original Equipment Manufacturers (OEMs).Advances in Software-Defined Connectivity:

Astera Labs has expanded the capabilities of its COSMOS software suite, which now includes advanced analytics and fleet management features. These enhancements offer significant value to customers, allowing them to optimize and manage their connectivity infrastructure more effectively, leading to higher recurring revenues from software licensing.Focus on Global Market Expansion:

To capture a larger share of the global connectivity market, Astera Labs has increased its footprint by expanding its sales and distribution networks across North America, Europe, and Asia. The company plans to further leverage its strategic relationships to enter emerging markets.

Investor Sentiment:

Investors are divided on ASTL’s potential. Optimists see strong growth drivers, including the rapid expansion of cloud computing and AI, Astera Labs' innovative product lineup, and its deep partnerships with industry leaders. They highlight the company's focus on connectivity solutions that are essential for the next generation of data centers and AI infrastructure. Meanwhile, skeptics point to the company's ongoing financial losses and negative EPS, expressing concerns about the competitive landscape in the semiconductor industry and the pressure to achieve profitability amid high R&D expenditures and market volatility.

Growth ahead

Exploring the growth trajectory of Astera Labs, the semiconductor disruptor redefining cloud and AI infrastructure through purpose-built connectivity solutions.

“We’re in the early innings of a computing revolution,” says Jitendra Mohan, co-founder, and CEO of Astera Labs. Indeed, for a company that’s been around for just six years, Astera Labs has already carved out an enviable niche in the semiconductor industry. Backed by top-tier investors and partnerships with some of the largest cloud providers, Astera Labs is setting its sights on becoming the connective tissue for next-generation cloud and AI infrastructure.

Astera Lab’s history

Founded in October 2017 by Jitendra Mohan, Casey Morrison, and Sanjay Gajendra, Astera Labs was born from a desire to address the data and connectivity challenges faced by hyperscalers like AWS, Google Cloud, and Microsoft Azure. The company began operations in Santa Clara, California, with a focus on developing high-speed, low-latency connectivity solutions that enable AI and cloud infrastructure to operate at maximum efficiency.

In 2020, Astera Labs launched its first major product, the Aries PCIe®/CXL™ Smart DSP Retimer, which was quickly adopted by leading cloud providers for its ability to maintain signal integrity across longer distances without sacrificing speed. Within just four years, Astera Labs had achieved over 300 design wins and shipped millions of units, placing it firmly on the map as a critical supplier to the world’s largest data centers.

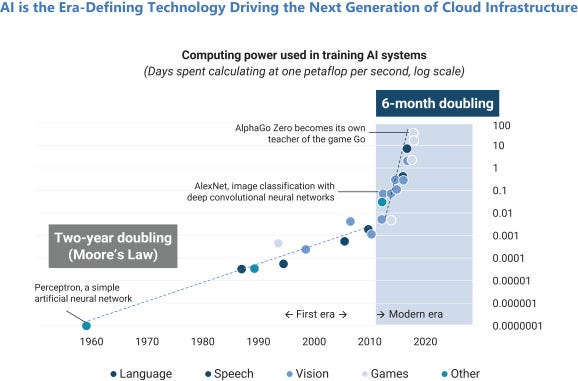

Market Opportunity: A $27.4 Billion Bet on AI and the Cloud

Astera Labs sits at the crossroads of two massive, rapidly expanding markets: cloud computing and artificial intelligence (AI). The global shift toward accelerated computing—using specialized processors like GPUs and TPUs for specific workloads—has created a new demand for advanced connectivity solutions that can handle the intense data loads these systems generate.

By 2027, the total addressable market (TAM) for Astera Labs’ products is projected to grow from $17.2 billion to $27.4 billion. This expansion is fueled by a 40% annual increase in enterprise spending on AI-driven infrastructure, as companies seek to harness the full power of AI models, such as OpenAI’s GPT-4 and beyond.

In 2023 alone, hyperscalers like AWS and Azure spent over $70 billion on their data center infrastructures, a figure expected to grow at a double-digit rate annually through 2025. Astera Labs’ unique product lineup is designed to capture a growing share of this spend by addressing the connectivity bottlenecks that limit the efficiency and scalability of AI and cloud deployments.

Product Overview

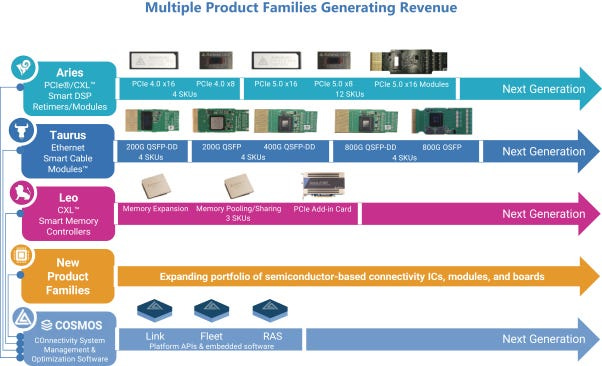

Astera Labs offers a suite of solutions that address critical challenges in high-performance computing environments:

Aries PCIe®/CXL™ Smart DSP Retimers: Engineered to recover and retransmit high-speed signals with zero latency, these chips are designed for AI and data-intensive workloads. They have already been deployed across all major hyperscalers and system OEMs, helping them manage and optimize data flow between AI accelerators, CPUs, and GPUs.

Taurus Ethernet Smart Cable Modules™: Designed to improve network bandwidth within data centers, Taurus modules extend Ethernet signaling reach over copper media at data rates exceeding 400 Gbps. This solution enables cost-effective, rack-level connectivity, which is essential for the efficient functioning of cloud and AI infrastructure.

Leo CXL Memory Connectivity Controllers: These controllers are built to address memory bandwidth and capacity challenges, enabling scalable memory expansion and pooling across servers. This functionality is crucial for AI models that require vast amounts of memory to operate effectively, such as large-scale language models and deep neural networks.

Astera Labs' products have been integrated into systems running in over 50 data centers globally, shipping millions of units across more than 15 countries. In 2023, the company recorded revenue of $115.8 million, a 45% increase from $79.9 million in 2022, reflecting the surging demand for its specialized solutions.

Business Model

Astera Labs operates on a unique model that blends direct sales to hyperscalers and OEMs with a robust distribution network. Approximately 70% of its revenue in 2023 came from direct engagements with leading hyperscalers, while the remaining 30% was generated through distributors who provide logistics and order fulfillment services.

Astera Labs' business model is built on three pillars: direct customer engagement, strategic partnerships, and software-driven differentiation, driving substantial growth and positioning it as a leader in cloud and AI connectivity solutions.

Direct Sales to Hyperscalers and OEMs:

About 70% of Astera Labs' revenue comes from direct sales to major hyperscalers like AWS, Google Cloud, and Microsoft Azure, and OEMs such as Dell and HPE. These direct engagements secure large contracts, often over $10 million each, contributing to the company's 300+ design wins and reinforcing its role as a key player in the industry.Distribution Networks:

The remaining 30% of revenue comes from a network of distributors like Arrow Electronics and Avnet, which help the company expand globally and reach smaller customers. This strategy taps into additional revenue streams worth tens of millions annually, ensuring a steady growth pipeline alongside direct sales.COSMOS Software Suite:

The COSMOS software differentiates Astera Labs by contributing 20% of total revenue through licensing fees and value-added services. It enables customers to optimize connectivity, saving up to 30% in operational costs and reducing downtime by 40%. Recurring software revenues, growing at 35% annually, provide a steady income stream and deepen customer relationships.Strategic Partnerships:

Collaborations with Intel, NVIDIA, AMD, and other leaders ensure Astera Labs’ products integrate seamlessly within cloud environments. The Cloud Scale Interoperability Lab cuts system integration costs by 15-20% and helps maintain an 85% customer renewal rate.Recurring Revenue from Licensing and Support:

Licensing fees for COSMOS software and ongoing support contribute about 25% of total revenue, providing stability and growth. Typical software agreements range from $100,000 to $500,000 per year, reflecting strong demand for monitoring and optimization capabilities.Agile Product Development:

The software-defined IC architecture allows Astera Labs to reduce its product development cycle by 40%, ensuring faster time-to-market and maintaining a 90% customer satisfaction rate with its tailored solutions.

A key differentiator is Astera Labs’ proprietary COSMOS software suite, which enhances its hardware offerings by allowing customers to manage, monitor, and optimize their connectivity infrastructure in real-time. This software-driven approach has helped Astera Labs secure long-term contracts and preferred supplier status with major players in the cloud ecosystem, giving it a critical edge over competitors.

Management Team

The company’s rapid rise is no accident. Led by Jitendra Mohan (CEO), Casey Morrison (Chief Product Officer), and Sanjay Gajendra (Chief Business Officer), Astera Labs has a team with over 50 years of combined experience in semiconductor technology and connectivity solutions.

The leadership at Astera Labs brings together a rare mix of experience, vision, and technical know-how:

Jitendra Mohan, CEO and Co-Founder, is a connectivity veteran with a track record of building successful semiconductor businesses.

Casey Morrison, Chief Product Officer, combines engineering expertise with a keen eye for product development and market trends.

Sanjay Gajendra, Chief Business Officer, is the bridge between the company's innovative engineering efforts and its go-to-market strategy, ensuring that Astera Labs is always aligned with customer needs.

This trifecta has positioned Astera Labs to move with speed and precision, capturing market opportunities and forging critical partnerships with industry giants.

This seasoned leadership has guided the company through multiple funding rounds, securing a total of $150 million in venture capital from high-profile investors, including Intel Capital, Google Ventures, and Lightspeed Venture Partners.

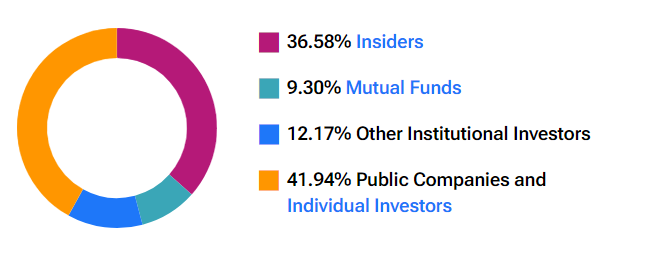

Investors and Ownership

Major investors, including venture firms like Intel Capital and Lightspeed, have retained significant stakes in the company, reflecting their confidence in its long-term prospects.

Funding Journey: Fueling Innovation and Expansion

2017: Seed Round – Raised $6 million from private angel investors and early-stage venture capital firms to kickstart its product development and build the core team.

2019: Series A – Secured $35 million led by Intel Capital, with participation from Costanoa Ventures and Avigdor Willenz. This funding accelerated the development of the Aries PCIe®/CXL™ Smart DSP Retimer.

2020: Series B – Raised $50 million in a round led by Google Ventures (GV) and Intel Capital, with participation from Hewlett Packard Enterprise (HPE) and other returning investors. The round valued the company at an estimated $500 million post-money.

2022: Series C – Garnered $105 million at an estimated $1.2 billion post-money valuation, led by Fidelity Management & Research Company, Atreides Management, and Valor Equity Partners, with existing backers like Intel Capital and Google Ventures also joining in. The funds were aimed at scaling operations and expanding the product lineup.

2023: Series D – Raised $150 million at a $2 billion post-money valuation from investors such as BlackRock, Fidelity, Google Ventures, Intel Capital, and Atreides Management. This round was intended to support product innovation, market expansion, and IPO preparation.

2024: IPO – Raised approximately $300 million with a valuation of $3 billion, marking its entry into the public market and fueling its ambition to lead the next generation of cloud and AI infrastructure.

As of the IPO, insiders and early investors still hold over 60% of the outstanding shares, signaling a strong belief in the company’s future growth trajectory.

Competition

The high-performance connectivity market in which Astera Labs operates is fiercely competitive, with several key players vying for dominance. The company’s focus on enabling AI, machine learning, and cloud infrastructure puts it in direct competition with both established semiconductor companies and newer players looking to disrupt the space. Let’s break down the competition into three main groups: specialized connectivity providers, semiconductor giants, and broader tech infrastructure companies.

Specialized Connectivity Providers

Astera Labs’ primary competition comes from companies that focus on specialized connectivity solutions for AI, cloud, and data processing applications. Firms like Marvell Technology and Broadcom are significant rivals in this space. These companies have robust product portfolios tailored to address the needs of high-speed data transfer, similar to Astera’s offerings. Astera Labs differentiates itself with innovative PCIe and CXL solutions designed to optimize cloud and AI workloads, but its rivals are also expanding into these areas, creating a competitive race to build the most efficient and scalable connectivity solutions.

Semiconductor Giants

Astera Labs is also competing against well-established semiconductor giants like Intel and Nvidia, which have significantly more resources at their disposal. While Intel is a leader in chipsets and server components, Nvidia is advancing rapidly in AI-related hardware with its dominance in GPU technology, which plays a critical role in machine learning and AI infrastructure. These companies have integrated solutions that encompass both the processing units and the connectivity interfaces, making it challenging for smaller firms like Astera to gain market share. Astera Labs’ key advantage lies in its ability to focus narrowly on connectivity innovations without the overhead of managing a broad portfolio of semiconductor technologies.

Broader Tech Infrastructure Companies

In addition to competition from hardware-centric firms, Astera Labs faces challenges from broader tech infrastructure companies, such as Cisco and Arista Networks. These firms focus on building network infrastructure that supports data centers and cloud computing environments. While their primary business revolves around networking equipment, they are increasingly encroaching into the connectivity space, offering solutions that could overlap with Astera Labs’ high-performance connectivity products.

Astera Labs must navigate these competitive pressures by staying nimble and continuing to innovate, particularly as AI and cloud technologies grow. It will also need to focus on strategic partnerships with key players in AI and data center infrastructure to strengthen its market position and expand its customer base.

As the industry evolves, Astera Labs’ success will depend on its ability to outpace rivals in delivering highly specialized, efficient connectivity solutions while also managing the pressures of competing against larger, more established firms.

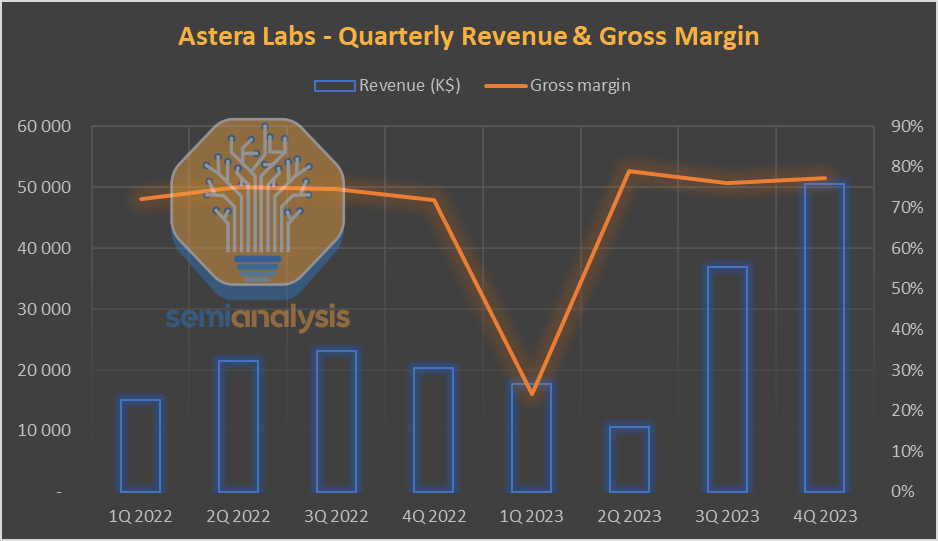

Financials highlights

Astera Labs is experiencing significant momentum in its revenue growth, showcasing its strong market presence and demand for its high-performance connectivity solutions. In 2023, the company reported a total revenue of $115.8M, marking a 45% year-over-year increase from $79.9M in 2022. This impressive growth is largely driven by the rising adoption of Astera’s cutting-edge product line, which supports AI, cloud, and machine learning applications across various industries.

Product sales are the dominant driver of this revenue surge, accounting for $111.9M in 2023, up from $78.2M the previous year. This indicates a growing customer base and increased product demand as companies invest more in advanced connectivity solutions. In contrast, engineering services—while contributing a smaller portion of the overall revenue—saw a notable rise from $1.6M in 2022 to $3.9M in 2023, reflecting Astera Labs' ability to expand its value-add services alongside its product offerings.

Geographically, Taiwan continues to be the company's largest and most lucrative market, generating $72.2M in revenue for 2023, a substantial increase from $61.0M in 2022. This growth highlights the company’s deep ties to the semiconductor and electronics manufacturing sectors, where Taiwan plays a critical role. The United States emerged as the second-largest market, with revenue jumping from $4.8M in 2022 to $30.7M in 2023, signifying Astera’s growing footprint in the U.S. market, particularly in sectors focused on AI and cloud infrastructure. Other regions, including the Netherlands and smaller markets, contributed $8.0M in total, showing that the company is steadily gaining traction across multiple global markets.

This diversified revenue base, both in terms of product mix and geographic reach, positions Astera Labs well for continued growth. However, the company's future success will depend on its ability to scale efficiently, expand into new markets, and continue driving innovation within its product portfolio.

The company, however, faces mounting expenses. In 2023, Astera spent $118.9M on operating costs, primarily on research and development (R&D) at $73.4M and sales and marketing at $24.9M. This heavy investment reflects the company's focus on innovation and market expansion, though it has resulted in a net loss of $58.3M in 2023.

Despite the losses, Astera’s strong gross margin of 68.2% in 2023 highlights the company’s ability to generate profit from its core business once it scales. However, like many high-growth tech companies, Astera's significant stock-based compensation expense and negative earnings will be key factors to monitor as it matures in the public market.

Closing thoughts

The timing of Astera Labs’ IPO aligns with a growing demand for companies advancing AI, machine learning, and semiconductor technology. Its decision to go public in February 2024, amid significant market enthusiasm for tech infrastructure, reflects a strategic move to capitalize on investor appetite for high-growth, cutting-edge innovation.

With the surge in AI-driven applications and the increasing reliance on advanced connectivity solutions, Astera Labs positions itself as a key player in shaping the future of cloud and AI infrastructure. Despite short-term losses, the company's public debut offers a chance to seize mindshare and secure a solid footing in an increasingly competitive market.

Much like other high-tech firms, Astera Labs’ patience in building out its product portfolio has paid off, entering the public market at a moment when AI and cloud computing investments are at an all-time high. This IPO provides an ideal opportunity to fuel its expansion and reinforce its position in a fast-evolving industry.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

You need to go fast to achieve what you want!

Walking 10k steps a day has made a world of difference for me

Here’s how I can help

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you next week.