👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Saturday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Money Machine Newsletter

Market beating stocks in 5 min.

Picked by elite traders.

Delivered weekly to your inbox pre-market.

Join 8k+ subscribers who have already placed themselves on the path to greater wealth.

Ola Electric: EV future in India

This week I want to dive deep into Ola Electric which had its IPO in August 2024. Let’s get down to it -

Ola Electric (OLET) Stock Overview

Current Price: ₹125.19 (as of market close)

Market Cap: 552.98B INR

52-Week Range: ₹76.00 - ₹157.40

IPO Details:

Ola Electric will allocate proceeds from its IPO towards capital expenditure, debt repayment, and research and development. Below is the breakup of how Ola Electric plans to use the funds raised from the IPO:

Capital expenditure: ₹1,226 crores in capex

Debt Repayment: ₹800 crores

Research & Development: ₹1,600 crores and

Organic Growth and expansion: ₹350 crores

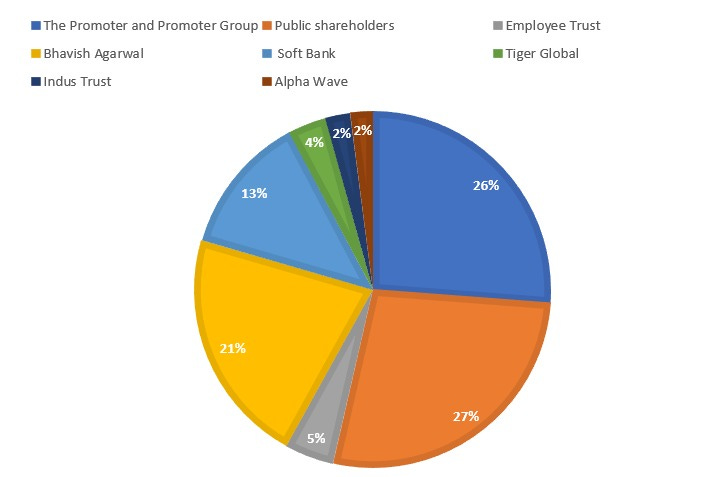

The IPO includes a fresh issue of equity shares worth ₹5,500 crores and an offer for sale of over 95 million equity shares. As a part of the Ola Electric IPO’s offer for sale, Bhavish Aggarwal plans to sell up to 47.4 million shares (3.48% stake). Other key shareholders participating in the sale include Indus Trust, Tiger Global’s Internet Fund III, SoftBank Vision Fund, and Alpha Wave Ventures.

Although the IPO attracted considerable attention, Ola Electric, like many growth-focused companies, continues to navigate the challenges of negative earnings as it invests heavily in expanding its electric vehicle (EV) ecosystem.

Company Overview:

Ola Electric is the best bet for India’s electric vehicle revolution, aiming to transform the transportation landscape by offering affordable and efficient electric two-wheelers. The company's flagship products, including the Ola S1 Pro, Ola S1 Air, and Ola S1 X+, have received significant attention for their sleek design, cutting-edge technology, and competitive pricing. With a strong commitment to sustainability, Ola Electric is playing an important role in reducing the carbon footprint in the transportation sector, making it a key player in India’s push towards greener mobility solutions.

Recent Developments:

Launch of MoveOS 4: Ola Electric recently rolled out MoveOS version 4, introducing several advanced features such as Ola Maps-powered navigation, geofencing, anti-theft alerts, and energy insights. These enhancements aim to provide a superior user experience and strengthen the company's position in the EV market.

Expansion of Production Capabilities: The company is ramping up production at its Futurefactory, the world’s largest two-wheeler manufacturing facility, to meet the growing demand for electric scooters both domestically and internationally.

Investment in Battery Technology: Ola Electric is investing heavily in developing its own cell manufacturing capabilities at the Ola Gigafactory. This initiative is expected to reduce reliance on external suppliers and improve the overall efficiency of their EVs.

Strategic Partnerships: Ola Electric has forged key partnerships with global suppliers and technology firms to enhance its supply chain and accelerate the development of next-generation electric vehicles.

Beginnings

In the dynamic world of Indian startups, few stories are as electrifying as that of Ola Electric. What began as a daring spin-off from one of India’s most disruptive companies, Ola Cabs, has now evolved into a trailblazer in the electric vehicle (EV) market. With an audacious vision to redefine transportation, Ola Electric is not just selling vehicles; it’s spearheading a movement toward a greener, more sustainable future.

Founded in 2017 by Bhavish Aggarwal, Ola Electric was initially a subsidiary of Ola Cabs, focused on developing charging infrastructure for electric vehicles. However, Aggarwal's vision quickly expanded beyond merely supporting the EV ecosystem. By 2020, the company pivoted to manufacturing electric two-wheelers, launching the iconic Ola S1 series, which garnered significant attention and marked the company’s entry into the electric vehicle manufacturing space.

Aggarwal’s vision was not merely to build another electric scooter; he aimed to lead a revolution in India’s transportation sector. From its inception, Ola Electric was designed to disrupt the market, leveraging Ola Cabs’ vast infrastructure and customer base while forging a new path in green technology.

Riding the EV Wave

India's electric vehicle market is on the cusp of exponential growth, driven by increasing environmental concerns, government initiatives, and consumer demand for sustainable mobility solutions. This growth is fueled by both supply-side advancements (like improved battery technology and charging infrastructure) and demand-side incentives (such as government subsidies and rising fuel costs).

India has firmly established itself as a global leader in two-wheeler manufacturing, producing approximately 19.5 million units in FY 2023. This represents 15-20% of the world's total two-wheeler output, positioning India as the second-largest producer globally, just behind China. Out of this total production, around 4 million units were exported, while 16-17 million units were sold within the domestic market. On a global scale, India ranks as the second-largest market for two-wheeler sales by volume. In FY 2023, the domestic two-wheeler market in India was valued at approximately ₹1.4-1.6 trillion (US$17-20 billion). The Total Addressable Market (TAM) for two-wheeler exports from India stands between ₹7-8 lakh crore, with regions such as Africa and Southeast Asia offering significant export opportunities. These markets present an opportunity to export around 100 million units globally.

Electric two-wheeler (E2W) penetration in India is projected to rise sharply, increasing from about 5.4% of domestic two-wheeler registrations in Fiscal 2024 to an anticipated 41-56% of the domestic two-wheeler sales volume by Fiscal 2028, according to a Redseer report. Compared to internal combustion engine (ICE) vehicles, electric vehicles (EVs) offer a lower total cost of ownership (TCO). For instance, electric two-wheelers, which are at the forefront of EV adoption in India, have a TCO that is approximately 55% lower than their ICE counterparts over the vehicle’s lifespan. This cost advantage is primarily driven by significantly lower fuel costs (around 1/10th of that for ICE vehicles) and additional savings on maintenance, registration subsidies, and other vehicle-related expenses.

High fuel prices and the resultant TCO have limited two-wheeler penetration in India to roughly 160 units per 1,000 people as of 2022. This is substantially lower than some Southeast Asian countries (with China at 300-350 and Indonesia at 450-470), indicating considerable room for growth in India’s two-wheeler market. The industry is expected to expand at an 11% CAGR over the next five years.

A trend towards premiumization is emerging within the industry, with the market share of entry-level motorcycles declining significantly since FY20. Higher-end motorcycles and scooters are seeing increased sales, as indicated by segment share data.

Several factors are driving demand for personal mobility via two-wheelers: a. The need for cost-effective personal transportation. b. The current state of road transport infrastructure. c. A robust supply chain. d. The growing need for last-mile mobility solutions.

Affordable price segments dominate both the scooter and motorcycle markets, with 86% and 82% of sales volumes respectively coming from vehicles priced below ₹1 lakh.

Government policies are also playing a crucial role in supporting the EV two-wheeler segment:

Production-Linked Incentive (PLI) Schemes: Launched in 2020, the PLI scheme aims to enhance domestic manufacturing, reduce import dependency, boost exports, and create jobs. These incentives are tied to incremental sales of domestically manufactured new-age technology products.

Automobile and Auto Components Sector: With a budget of ₹25,900 crore, this PLI scheme offers financial incentives of up to 18% (linked to sales) to promote domestic manufacturing of Advanced Automotive Technology (AAT) products, requiring a minimum of 50% domestic value addition. The scheme will be applicable from FY 2024 for a total of five consecutive financial years.

Advanced Chemistry Cell (ACC) Battery Scheme: Launched with a budget of ₹18,100 crore, this scheme aims to establish ACC Battery Storage manufacturing facilities in India, targeting a total production capacity of 50 GWh over five years.

India Semiconductor Mission 2021: With a budget of ₹76,000 crore, this mission includes various schemes such as semiconductor fabrication, display fabrication, compound semiconductor and semiconductor assembly, testing, marking and packaging, and design-linked incentives.

Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME): Phase I of this subsidy, with a budget of ₹900 crore, was implemented between FY15 and FY19. Phase II, launched between FY20 and FY24, has a budget of ₹10,000 crore.

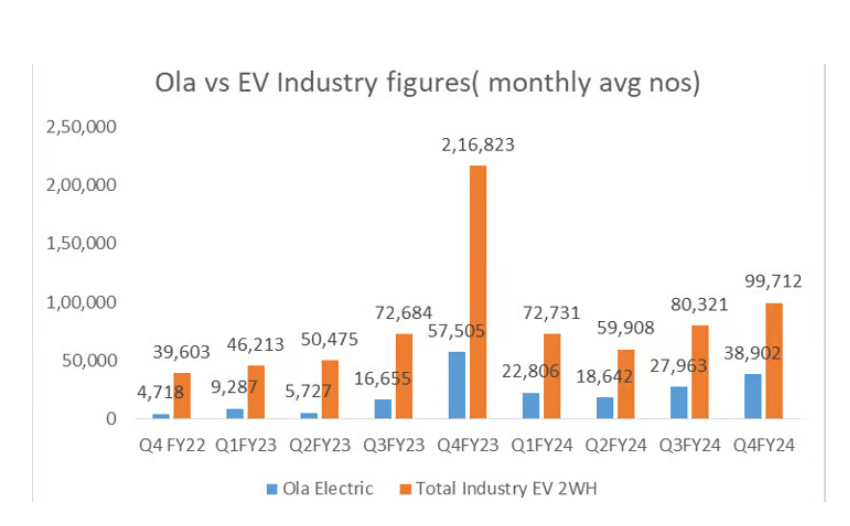

However, recent data has shown that maintaining market share in such a fast-growing sector is challenging. Ola Electric's market share dropped by over 30% in the last two months alone suggesting intense competition and the need for continued innovation and customer engagement.

Products

At the heart of Ola Electric’s success lies its flagship products – the Ola S1 and Ola S1 Pro. These scooters are not just vehicles; they’re a statement. Designed for the urban commuter, these electric two-wheelers combine sleek aesthetics with cutting-edge technology. The Ola S1 series boasts features like AI-powered navigation, keyless entry, cruise control, and top speeds of up to 115 km/h.

The Ola S1 comes with a 2.98 kWh battery, offering a range of 121 km on a single charge, while the S1 Pro has a 3.97 kWh battery with a range of 181 km. The scooters are equipped with 7-inch touchscreen displays, multi-mode riding, and the capability to receive over-the-air updates, ensuring that customers always have the latest features at their disposal.

These products are the result of significant investment in R&D. Ola Electric is committed to innovating not just in vehicle design but also in battery technology. The company has developed its own proprietary Hyperdrive Electric Motor and Battery Management System, which provides greater efficiency and longevity compared to its competitors.

Ola provides a standard warranty covering three years or 40,000 kilometers (whichever comes first) for the battery and electric scooter components, along with an extended warranty of eight years or 80,000 kilometers (whichever is sooner) specifically for the battery packs.

In January 2024, Ola Electric introduced MoveOS version 4, which brought a range of new features, including Ola Maps-powered navigation, call filtering, ‘find my scooter’ functionality, geofencing, time fencing, anti-theft alerts, fall detection, hill hold, auto turn-off indicators, ride journaling, and energy insights. Ola’s EV scooters are interconnected through their telematics systems, allowing for continuous updates and improvements to product features and performance.

A significant 87% of the components in the three EV scooter models—the Ola S1 Pro, Ola S1 Air, and Ola S1 X+—are shared across these models. For instance, all three use the same battery pack. The platform’s modular and adaptable design helps reduce costs and accelerates the product development process, enabling Ola to bring new products to market more quickly. Additionally, most of the components are procured from Indian suppliers.

Ola’s commitment to sustainability is further demonstrated by its investment in its FutureFactory—a massive manufacturing facility in Tamil Nadu that is not only capable of producing 10 million scooters annually but is also powered entirely by renewable energy. This factory, which spans over 2000 acres, is expected to be the largest two-wheeler factory in the world, and it epitomizes Ola Electric’s vision of scaling sustainably.

Business Model

Ola Electric’s Direct-to-Consumer (D2C) model has been a game-changer, comprising 870 experience centres and 431 service centres (of which 429 service centres are located within experience centres). By selling directly through its online platform, the company has bypassed traditional dealership networks, allowing for better margins and a more controlled customer experience. This model also aligns with the modern consumer’s preference for online shopping and direct engagement with brands.

The D2C model has enabled Ola Electric to maintain a competitive price point for its scooters. For instance, the Ola S1 is priced at around ₹99,999, while the S1 Pro is available at ₹1,39,999. These competitive prices, combined with the company’s flexible financing options and attractive leasing plans, have made electric scooters accessible to a broader audience.

Additionally, Ola Electric’s emphasis on vertical integration ensures that it retains control over critical components of its value chain. The company manufactures its own battery packs, designs its software in-house, and even develops its own charging infrastructure. This approach not only reduces dependency on external suppliers but also allows Ola to innovate rapidly and respond to market changes with agility.

The company’s Hypercharger Network—a nationwide grid of fast-charging stations—is another key component of its business model. Ola plans to deploy over 100,000 charging points across 400 cities, providing a robust infrastructure that addresses one of the biggest barriers to EV adoption: range anxiety.

Ola’s R&D and technology platform is built around several interconnected technologies: (a) their in-house developed operating system, MoveOS, (b) electronics, (c) motor and drivetrain systems, (d) cells and battery packs, and (e) manufacturing technology. The company employs 959 people in R&D, with a total workforce of 7,369, including 4,011 on-roll employees. The employee attrition rate stands at 44%.

Currently, Ola sources its cells from external suppliers. However, the company is developing its own cell manufacturing capacity at the Ola Gigafactory, aiming to become self-sufficient in cell production. Ola has secured 88 registered patents and has 217 patent applications pending in India.

Management team

At the helm of Ola Electric is Bhavish Aggarwal, the visionary founder and CEO whose leadership has been instrumental in shaping the company’s trajectory. Aggarwal, who co-founded Ola Cabs in 2010, has a background in computer science and a deep understanding of the tech and mobility sectors. His ambition is to not only lead India’s EV revolution but also to create a global electric vehicle brand.

Aggarwal is supported by a seasoned leadership team:

Varun Dubey, Chief Marketing Officer (CMO): Dubey brings over 15 years of experience in marketing and branding, having previously worked with companies like HT Media and Star TV. At Ola Electric, he is responsible for driving brand strategy and consumer engagement, crucial for positioning Ola as a market leader in a competitive space.

Arun Sirdeshmukh, Chief Executive Officer (CEO) - Ola Cars: Sirdeshmukh has extensive experience in retail and e-commerce, having held senior positions at companies like Amazon India and Reliance Retail. He oversees Ola’s automotive retail business, ensuring that the company’s vehicles reach consumers efficiently and that post-sales service meets high standards.

Naveen Gupta, Chief Financial Officer (CFO): Gupta has a strong background in finance, with previous stints at Citibank and HSBC. He is responsible for managing Ola Electric’s financial strategy, including fundraising, cost management, and financial planning, all of which are critical as the company scales its operations and prepares for an IPO.

Jose Pinheiro, Head of Manufacturing: With decades of experience in the automotive industry, including leadership roles at General Motors and Volkswagen, Pinheiro oversees Ola’s manufacturing operations, including the FutureFactory. His expertise ensures that Ola’s production processes are efficient, scalable, and capable of meeting growing demand.

This leadership team, with its diverse experience across technology, finance, manufacturing, and marketing, is well-equipped to guide Ola Electric through the next phase of its growth journey.

Investors and Ownership Structure

Ola Electric’s growth trajectory has been fueled by the confidence of some of the world’s most prominent investors.

List of all funding rounds of Ola Electric:

Stakeholder Chart:

Competition

Ola Electric operates in a fiercely competitive environment. The Indian electric two-wheeler market is home to several established players, each vying for a share of the rapidly growing market.

Key competitors include:

Ather Energy: Known for its focus on technology and performance, Ather has carved out a niche in the premium electric scooter segment. The company’s flagship product, the Ather 450X, is a direct competitor to the Ola S1 Pro, with similar features and pricing.

Hero Electric: As one of the oldest players in the Indian EV market, Hero Electric has a strong distribution network and a wide range of affordable electric scooters. The company’s focus on affordability and widespread availability makes it a formidable competitor.

Bajaj Auto: A legacy automaker with a strong brand presence, Bajaj has entered the electric two-wheeler market with the Chetak electric scooter. Bajaj’s extensive dealership network and established brand loyalty provide it with a competitive edge.

Despite these challenges, Ola Electric’s aggressive pricing, innovative features, and strong brand recognition position it well to compete. However, maintaining leadership will require continuous innovation, strategic maneuvering, and a focus on customer experience.

Financial performance

Ola Electric’s financial journey has been as dynamic as its operational one. The company has demonstrated impressive revenue growth, driven by strong market demand for its scooters. Yet, like many rapidly scaling startups, it is grappling with profitability.

Total revenue from operations 5010cr in FY24 . (90% up yoy )

Gross margins 16.5%

EBITDA margins -20.6% vs -40% LY.

EBITDA loss 1030cr vs 1100cr LY.

PAT loss of 1580cr vs 1470cr LY.

Ola Electric has experienced remarkable financial growth over the past year, with total revenue skyrocketing by 510% to ₹2,782 crore in FY23, up from ₹456 crore in FY22, encompassing both operational revenue and other income.

The company’s EBITDA margin showed significant improvement, narrowing from -157% in FY22 to -43% in FY23.

However, despite this progress, Ola Electric's net loss almost doubled to ₹1,472 crore in FY23, compared to ₹784.1 crore the previous year, largely due to a substantial increase in expenses.

The EBITDA loss for FY23 stood at ₹1,318 crore, with total expenditures climbing to ₹3,383 crore, up from ₹1,240 crore in FY22.

Net cash flow from operations (-630) cr in FY24, that in FY22 and FY23 are -1510cr and -890cr respectively.

Concluding thoughts:

Ola Electric is the market leader with significant sales volumes and a growing market share and its increase from 35% in FY 24 to 38% in FY 24-25 suggests solid market dominance. While TVS remains a strong competitor but with a declining market share.

Despite impressive revenue growth and improving EBITDA margins, Ola Electric continues to face challenges in achieving profitability

The company's innovative products, direct-to-consumer model, and vertical integration strategy have positioned it as a leader in the EV space.

Investor sentiment remains mixed, with bulls excited about Ola's potential to dominate the market and bears cautious due to ongoing financial losses. Ola Electric’s success will likely depend on its ability to balance growth with profitability, navigate competitive pressures, and capitalize on the expanding EV market in India and beyond.