👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

ServiceTitan in one minute

One-Minute Overview

Founded in 2012, ServiceTitan has revolutionized the residential and commercial trades industries by offering a comprehensive SaaS platform tailored for home and commercial service providers. This platform serves a vast market, including HVAC, plumbing, and electrical contractors, enhancing their operational efficiency, workflow management, and profitability.

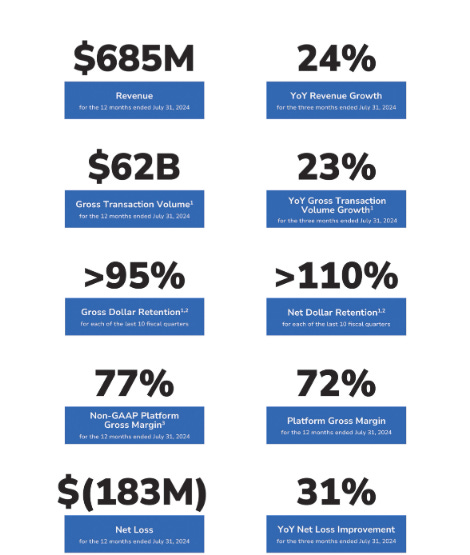

ServiceTitan's impact is substantial, with over 100,000 service professionals utilizing its platform across 13,000 businesses. The company processes more than $62 billion in annual Gross Transaction Volume (GTV). In fiscal year 2023, ServiceTitan reported $614.3 million in revenue, marking a year-over-year growth of 31%, while maintaining an impressive 77% gross margin. As it gears up for an IPO with a target valuation of $12 billion, ServiceTitan is poised to modernize an industry with a $1.5 trillion Total Addressable Market (TAM).

The IPO has piqued investor interest, driven by ServiceTitan's robust operational metrics and the promise of significant growth opportunities. The company's journey to going public is underscored by strategic financial maneuvers and a keen focus on capturing a larger share of its expansive market potential.

History

Unlike the tech darlings born in Silicon Valley dorm rooms, ServiceTitan emerged from the gritty world of plumbing and HVAC. Co-founders Ara Mahdessian and Vahe Kuzoyan, scions of tradespeople, saw an industry drowning in paper and starved for innovation. Their solution? A SaaS platform tailor-made for the blue-collar set.The pitch was simple: ditch the clipboards, embrace the cloud. ServiceTitan promised to turn chaotic service operations into well-oiled machines, complete with automated scheduling, mobile payments, and customer relationship management. For an industry accustomed to carbon paper and landlines, it was nothing short of revolutionary.

ServiceTitan's journey from startup to unicorn reads like a Silicon Valley fairy tale, albeit with more wrenches and ductwork:

2013: Mucker Capital plants a $3 million seed, betting on the founders' unique blend of engineering chops and industry insight.

2018: The company hits $100 million in ARR, its software powering everything from mom-and-pop shops to sprawling franchises.

2021: A staggering $500 million Series G round catapults ServiceTitan to an $8.3 billion valuation, making it the trades industry's first decacorn.

2024: ServiceTitan files for IPO, eyeing fresh capital to fuel product innovation and global expansion.

ServiceTitan's defensibility lies not in patents or network effects, but in its deep understanding of an unsexy yet massive market. By speaking the language of plumbers and electricians, the company has built a loyal customer base that views the software not as a luxury, but as a lifeline.As ServiceTitan prepares to go public, investors will be weighing the company's impressive growth against its path to profitability. With a $1.5 trillion TAM and a growing appetite for trades automation, ServiceTitan's journey from the toolshed to Wall Street may just be beginning.

Market Opportunity

The trades industry, encompassing essential services like HVAC, plumbing, electrical work, landscaping, and pest control, is a cornerstone of the economy. Despite its vastness, this sector remains largely under-digitized, with over 70% of businesses still relying on manual processes or outdated software systems.In North America alone, the trades industry represents a colossal $1.5 trillion market. Of this, ServiceTitan has identified a $650 billion Serviceable Industry Spend (SIS) as its primary focus. The company's Serviceable Market Opportunity (SMO), based on capturing an average of 2% of Gross Transaction Volume (GTV) as revenue, is estimated at $13 billion.

Serviceable Addressable Market (SAM)

ServiceTitan is currently targeting a $650 billion SAM, with plans to broaden this by entering new verticals and expanding internationally. Capturing just 5% of this SAM could position ServiceTitan as a multibillion-dollar revenue enterprise.

Aging Infrastructure:

The aging of U.S. homes tells a story of opportunity. With the median home age rising to 43 years in 2021 (up from 27 in 1991), maintenance and upgrades are no longer optional—they're essential. This need has driven a 4.5% compound annual growth rate (CAGR) in home service spending since 2020. The story extends beyond homes: commercial properties, particularly in HVAC and plumbing, face similar pressures to modernize.

Climate Change:

Extreme weather events are reshaping priorities. Rising temperatures and unpredictable climates have increased the demand for heating, ventilation, and air conditioning services. Meanwhile, the shift to renewable energy—like the adoption of solar panels—presents tradespeople with fresh opportunities and challenges, underscoring the need for supportive technologies.

Digitization of the Trades:

Traditionally fragmented, the trades industry is undergoing a transformation. Private equity consolidation and the professionalization of small-to-medium businesses have accelerated the adoption of digital tools. Seamless, technology-driven customer experiences—like online appointment booking and digital payments—are no longer a luxury; they’re the expectation.

Labor Shortages:

A talent shortage looms. With an aging workforce, the trades industry must rethink productivity. Efficiency isn’t just a goal—it’s a necessity. ServiceTitan’s platform addresses this by helping contractors do more with less, enabling productivity gains that offset labor constraints.

Consumer Expectations:

Transparency. Instant scheduling. Digital payments. Homeowners want streamlined, tech-enabled experiences, and ServiceTitan delivers. In an industry ripe for disruption, this ability to meet consumer expectations positions ServiceTitan as a trusted partner for trades businesses navigating a rapidly changing landscape.

Product

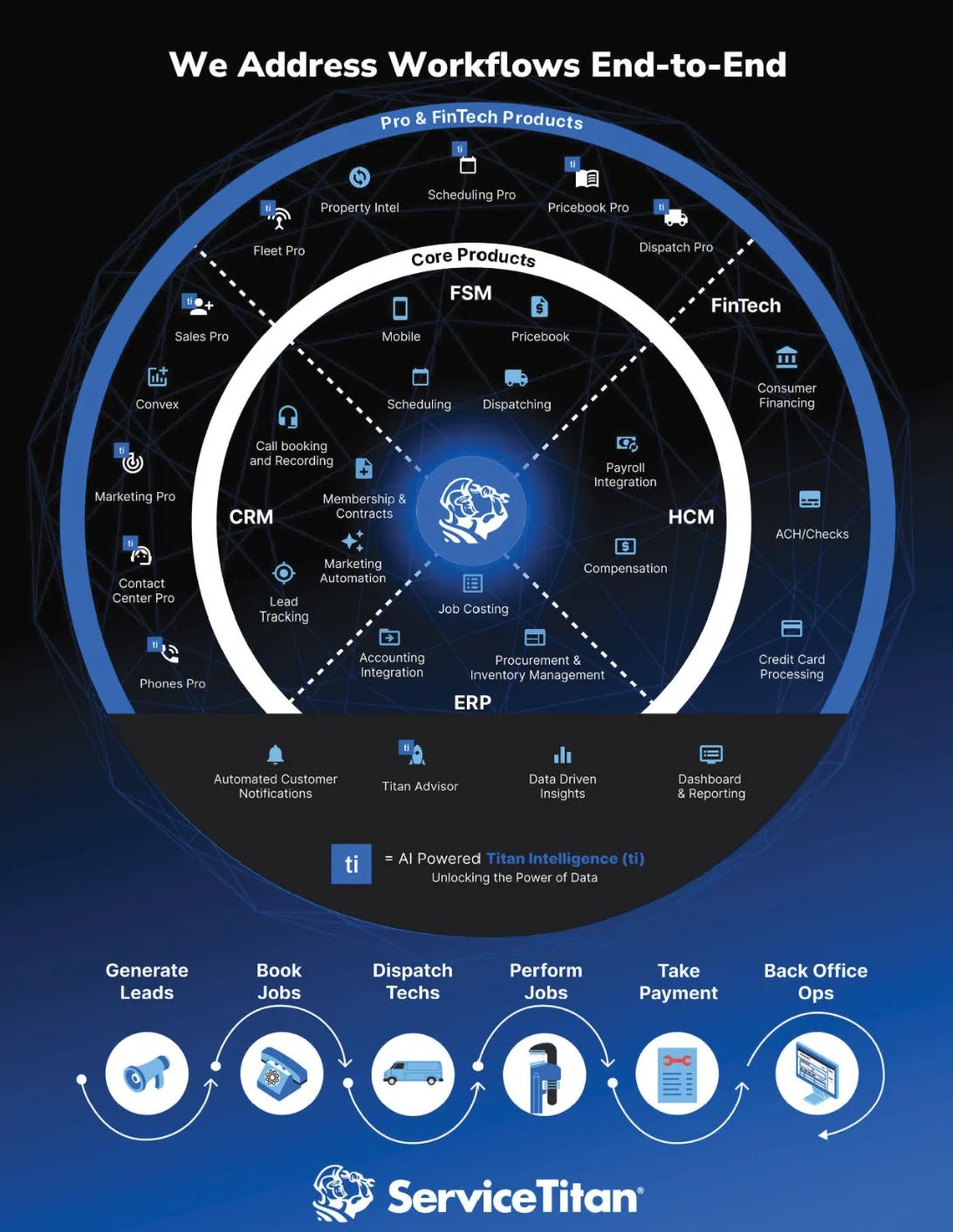

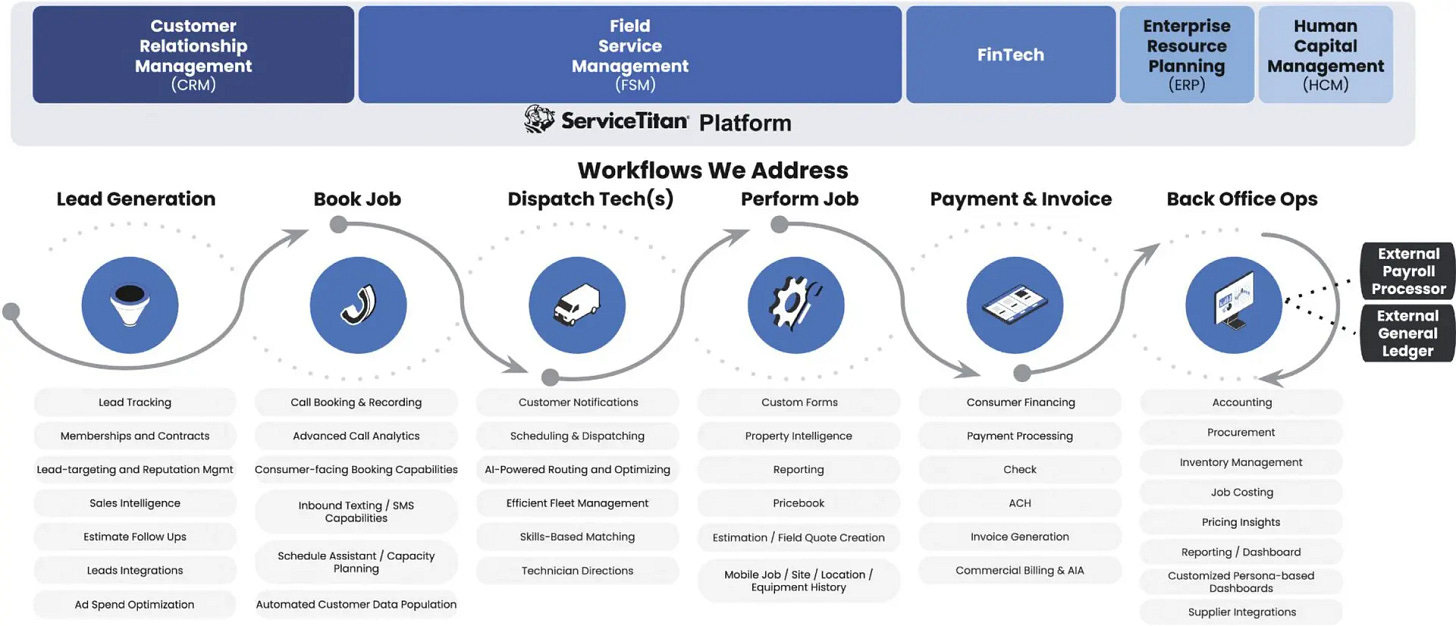

ServiceTitan has positioned itself as the comprehensive solution for the trades industry, offering an end-to-end SaaS platform that addresses critical pain points plaguing contractors. Unlike generic software solutions, ServiceTitan's platform is tailor-made for the unique needs of trades businesses, integrating core functionalities like CRM, FSM, ERP, HCM, and FinTech tools

Core Product: The Foundation of Trades Management

offering delivers everything contractors need to optimize efficiency and scale:

Job Scheduling & Dispatching: AI-driven routing cuts idle time by 20–30%, allowing technicians to handle 2–3 extra jobs daily.

CRM: Automates follow-ups, tracks service history, and highlights upselling opportunities, increasing customer retention by 15%.

Marketing Pro: Turns data into actionable insights, improving lead tracking and boosting campaign ROI by 25%.

Field Operations: Mobile tools deliver job details and inventory updates in real time, shaving service times by 25%.

Inventory Management: Minimizes waste and ensures efficient material use.

Payroll & Reporting: Processes over $15 billion annually, streamlining finances and increasing ticket sizes by 20%.

ServiceTitan isn’t stopping there. Its Pro suite adds high-value enhancements:

Dynamic Pricing: Adjusts pricing automatically based on market conditions.

AI-Driven Recommendations: "Titan Intelligence" crunches historical data to suggest operational best practices.

Customer Reviews: Simplifies reputation management with integrated review tools.

On the financial front, FinTech Products are reshaping how trades businesses manage cash flow:

Payment Processing: Seamlessly integrates on-site and online payment options with job workflows.

Consumer Financing: Helps contractors close more deals by making services affordable through third-party financing.

What Sets ServiceTitan Apart

ServiceTitan’s strengths go beyond features:

End-to-End Integration: A one-stop solution that covers every aspect of trades management.

Scalability: Tailored for everyone from small shops to enterprises handling $1 billion in gross transaction volume.

AI-Powered Insights: Processes data from 109 million jobs completed in fiscal 2024, offering unparalleled intelligence.

Customization: Delivers tailored solutions across more than 10 trades.

Retention: Boasts a 125% net dollar retention rate, proving its stickiness with customers.

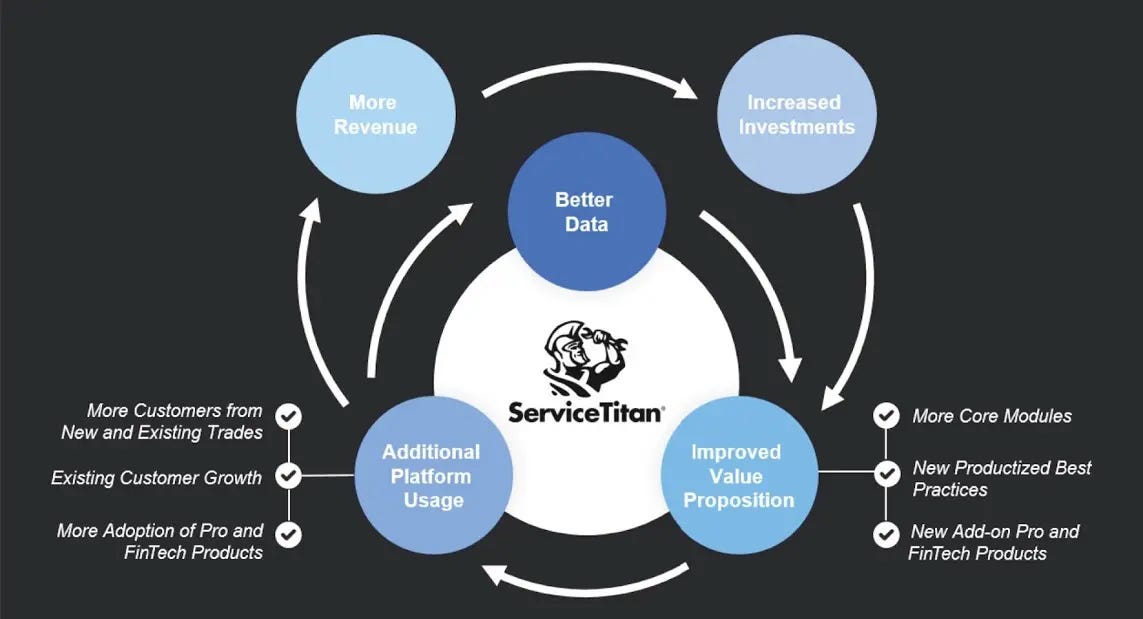

ServiceTitan fills the gaps left by legacy tools, creating deep customer lock-in with its data-driven insights and industry-specific capabilities. Much like Asana’s focus on culture as a moat, ServiceTitan’s moat lies in its ability to integrate, innovate, and deliver results in an industry ripe for digital transformation. By empowering contractors to thrive in a competitive landscape, ServiceTitan isn’t just a trades platform—it’s their operating system.

Business Model

ServiceTitan operates a vertical SaaS business model uniquely crafted for the field service industry, aligning its revenue streams and operational structure with customer success and scalability.

Revenue Streams

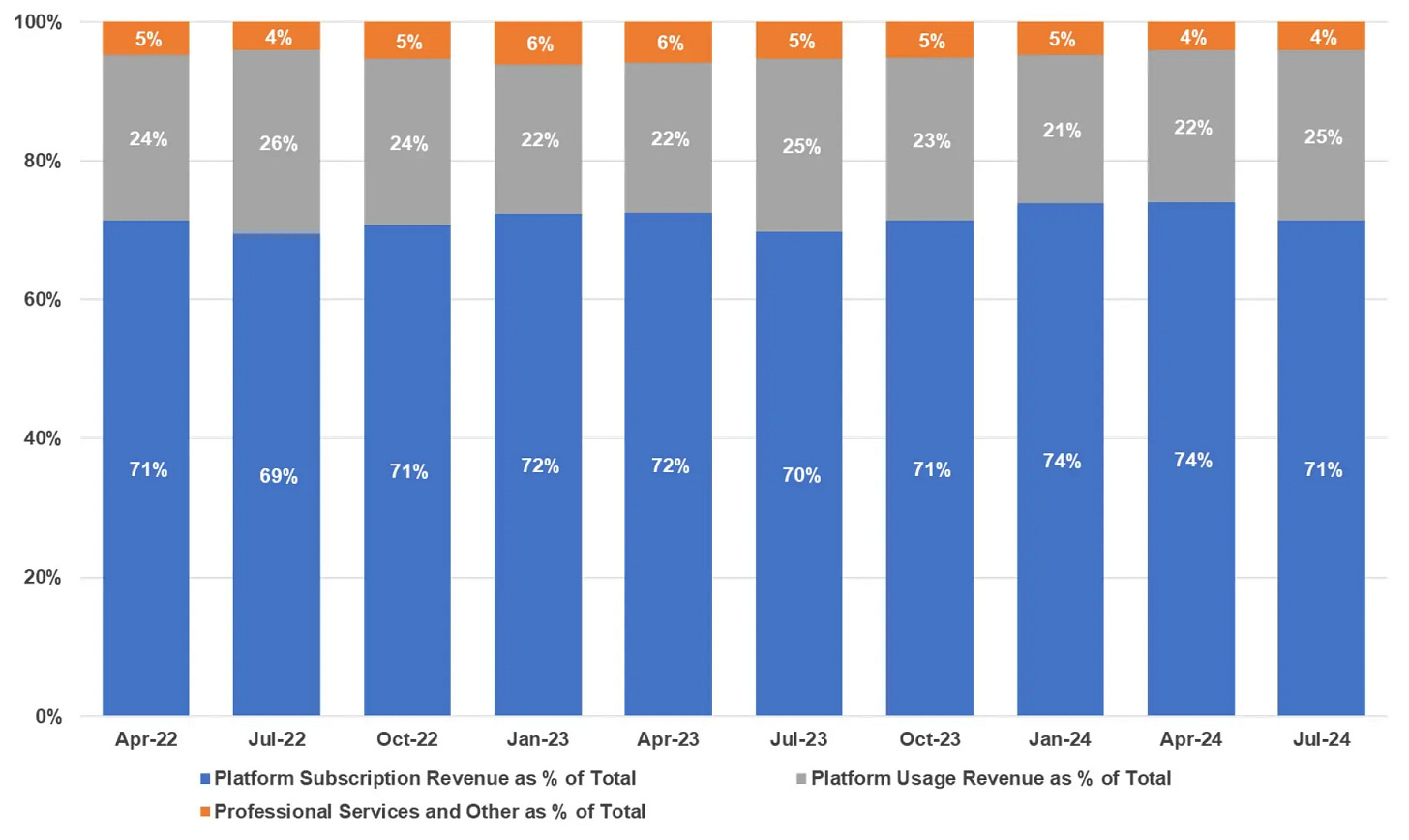

Platform Subscription Revenue: This is the primary income source, derived from subscription fees for ServiceTitan's Core and Pro products. Priced at $398 per month per user and billed annually, subscriptions adjust based on additional features and user numbers. In fiscal 2024, this stream accounted for 71% of the total revenue, underscoring its significance in ServiceTitan's financial framework

Platform Usage Revenue: Generated from transaction-based fees, particularly through payment processing and financing options within its FinTech services. This revenue stream represented 25% of total revenue in 2024, highlighting the platform's growing role in facilitating payments and third-party transactions

Professional Services and Other Revenue: Comprising onboarding, training, and implementation services, this segment accounted for 4% of total revenue. Although a smaller portion, these services are crucial for ensuring long-term customer retention by minimizing churn during the initial adoption phase

ServiceTitan's business model not only provides comprehensive solutions to its customers but also ensures that its growth is closely tied to the success and expansion of its users.

Management Team

ServiceTitan’s leadership is composed of industry experts and seasoned executives, driving the company’s vision to modernize the trades sector with technology.

Ara Mahdessian – Co-Founder & CEO

Ara Mahdessian, with a background in engineering, co-founded ServiceTitan to address the operational challenges he witnessed growing up in a family of tradespeople. As CEO, Ara drives the strategic vision, focusing on innovation and scaling the business.Vahe Kuzoyan – Co-Founder & President

Vahe Kuzoyan, also an engineer, co-founded ServiceTitan and now leads product development and operations. He ensures the company’s offerings align with the evolving needs of customers.Jeffrey Imm – Chief Revenue Officer

Jeffrey Imm, with a rich background in sales from Salesforce, leads ServiceTitan’s global sales and marketing efforts.

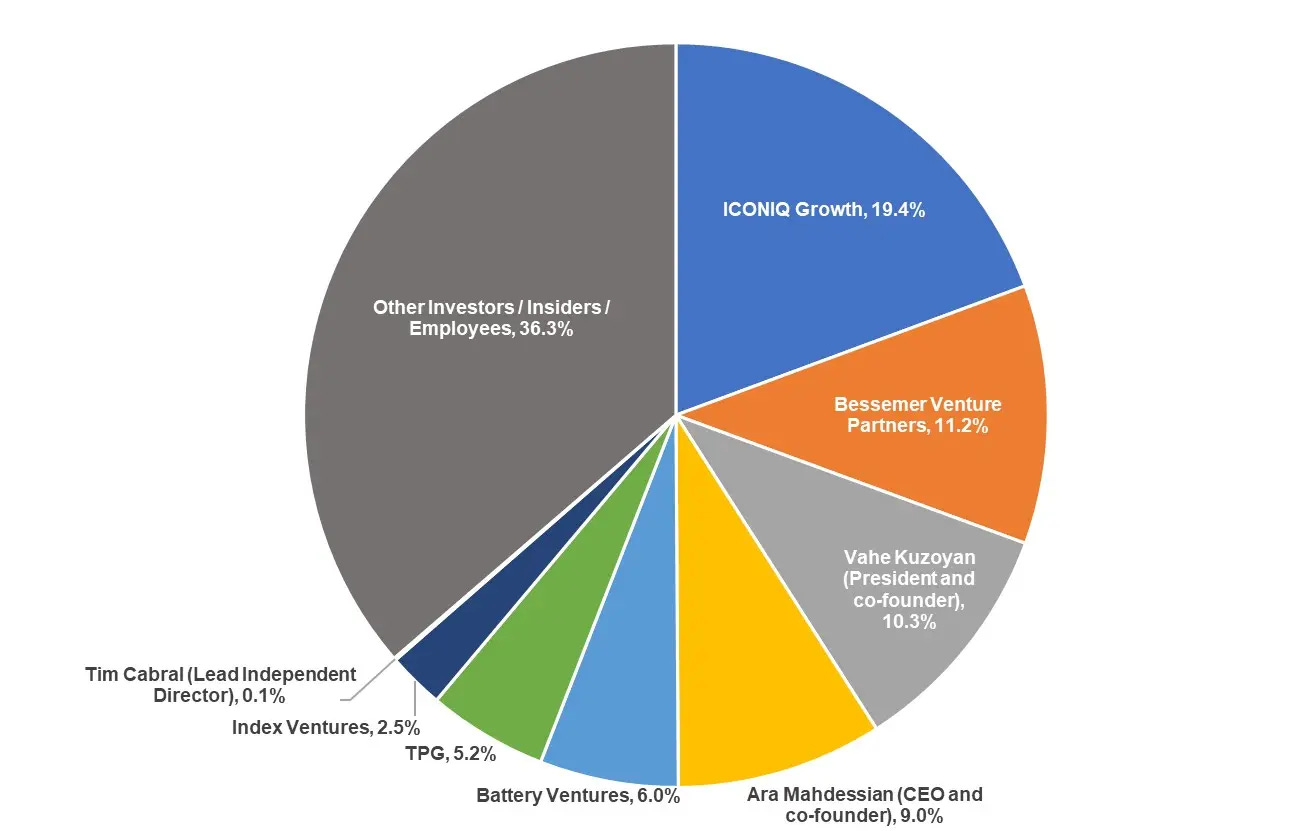

Ownership Breakdown

As of the latest funding rounds, ServiceTitan's cap table includes prominent venture capital firms, institutional investors, and the company’s co-founders:

Institutional Investors:

ICONIQ: 19.4%

Bessemer Venture Partners: 11.2%

Battery Ventures: 6.0%

TPG: 5.2%

Index Ventures: 2.5%

Other investors include Dragoneer, Thoma Bravo, Coatue, Tiger Global, Sequoia, T. Rowe Price, Durable Capital, and Mucker Capital.Founders:

Vahe Kuzoyan (President and Co-Founder): 10.3%

Ara Mahdessian (CEO and Co-Founder): 9.0%

ServiceTitan’s Investment History

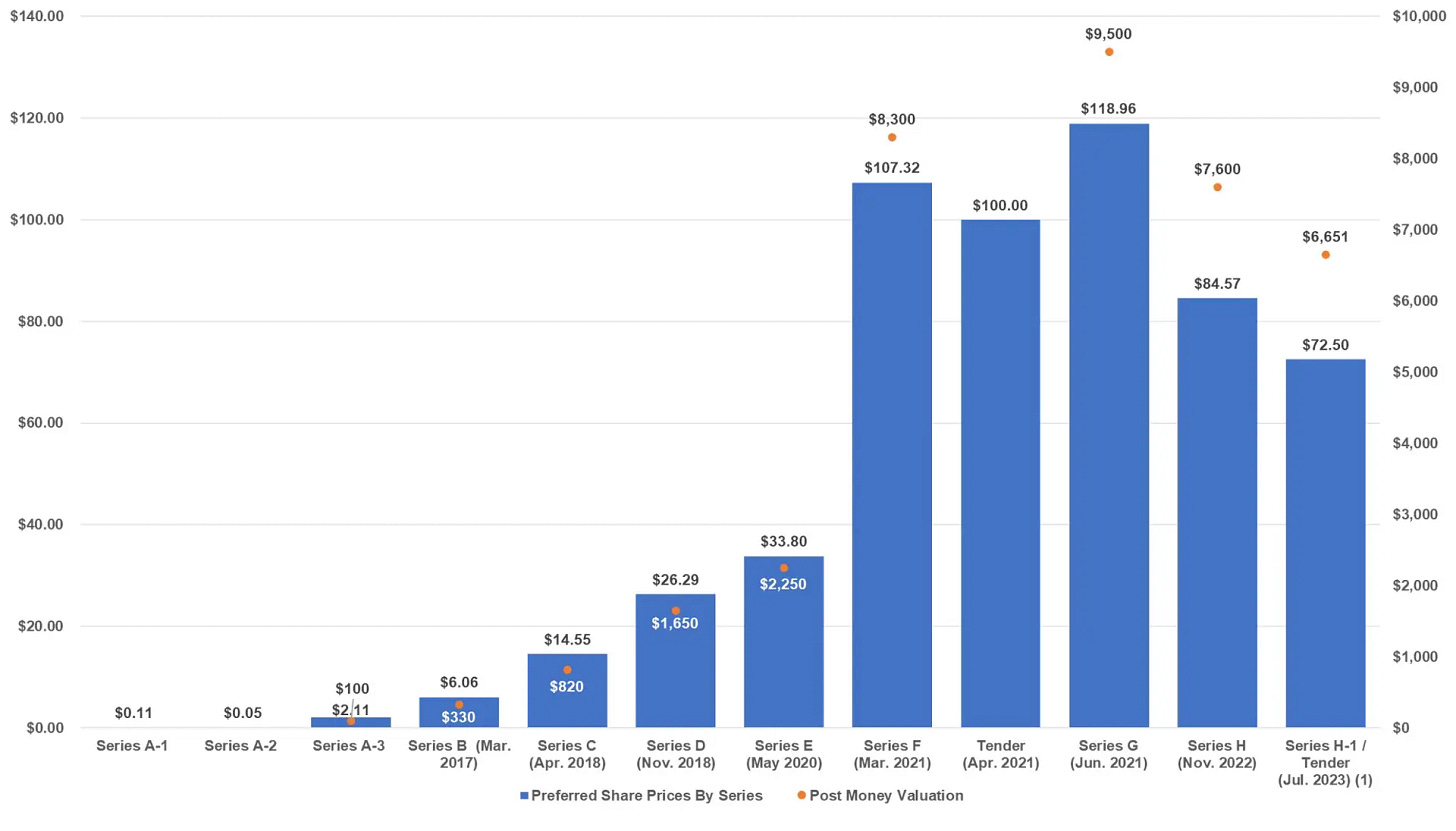

Seed Round (2012)

Amount Raised: $1.5 million

Valuation: Not publicly disclosed

Series A (2015)

Amount Raised: $18 million

Valuation: Estimated at $50 million (early stage)

Investors: Bessemer Venture Partners

Series B (2017)

Amount Raised: $33 million

Valuation: $200 million

Investors: ICONIQ Capital, Bessemer Venture Partners

Series C (2018)

Amount Raised: $62 million

Valuation: $500 million

Investors: ICONIQ Capital, Bessemer Venture Partners

Series D (2020)

Amount Raised: $125 million

Valuation: $1.65 billion

Investors: Tiger Global Management, ICONIQ Capital, Bessemer Venture Partners

Series E (2021)

Amount Raised: $200 million

Valuation: $3.5 billion

Investors: ICONIQ Capital, Battery Ventures, TPG, Sequoia Capital, Dragoneer

Series F (2021)

Amount Raised: $500 million

Valuation: $6.75 billion

Investors: Tiger Global Management, Sequoia Capital, Battery Ventures

Series G (2021)

Amount Raised: $200 million

Valuation: $8.3 billion

Investors: Dragoneer, ICONIQ Capital

Series H (2022)

Amount Raised: $200 million

Valuation: $10 billion

Investors: ICONIQ Capital, Battery Ventures, TPG, Bessemer Venture Partners, Sequoia Capital

Competition

In the bustling field service industry, ServiceTitan stands out by offering a comprehensive, vertical-specific platform that gives it a distinct edge over both horizontal platforms and niche players.

Key Competitors

Horizontal Platforms:

Salesforce: While Salesforce provides robust CRM tools, it lacks the specialized features that trades businesses require.

QuickBooks: Primarily an accounting solution, QuickBooks does not offer comprehensive tools like job scheduling, dispatching, and customer management that are integral to ServiceTitan's offering.

Niche Players:

Jobber: Focuses on field service management but does not match ServiceTitan’s AI capabilities and deep integrations.

Housecall Pro: Offers basic business management tools but lacks the end-to-end solutions and data-driven insights provided by ServiceTitan.

ServiceTitan’s Competitive Advantage

End-to-End Platform: ServiceTitan uniquely integrates CRM, FSM, ERP, HCM, and FinTech into a seamless solution tailored for trades businesses.

Vertical-Specific Features: Designed specifically for the trades sector, offering tools that cater directly to industry needs.

AI-Powered Insights: With Titan Intelligence, ServiceTitan offers predictive analytics and automated scheduling that competitors do not match.

Scalability: Capable of supporting businesses of all sizes, from small operations to large enterprises, unlike competitors who often focus on smaller businesses.

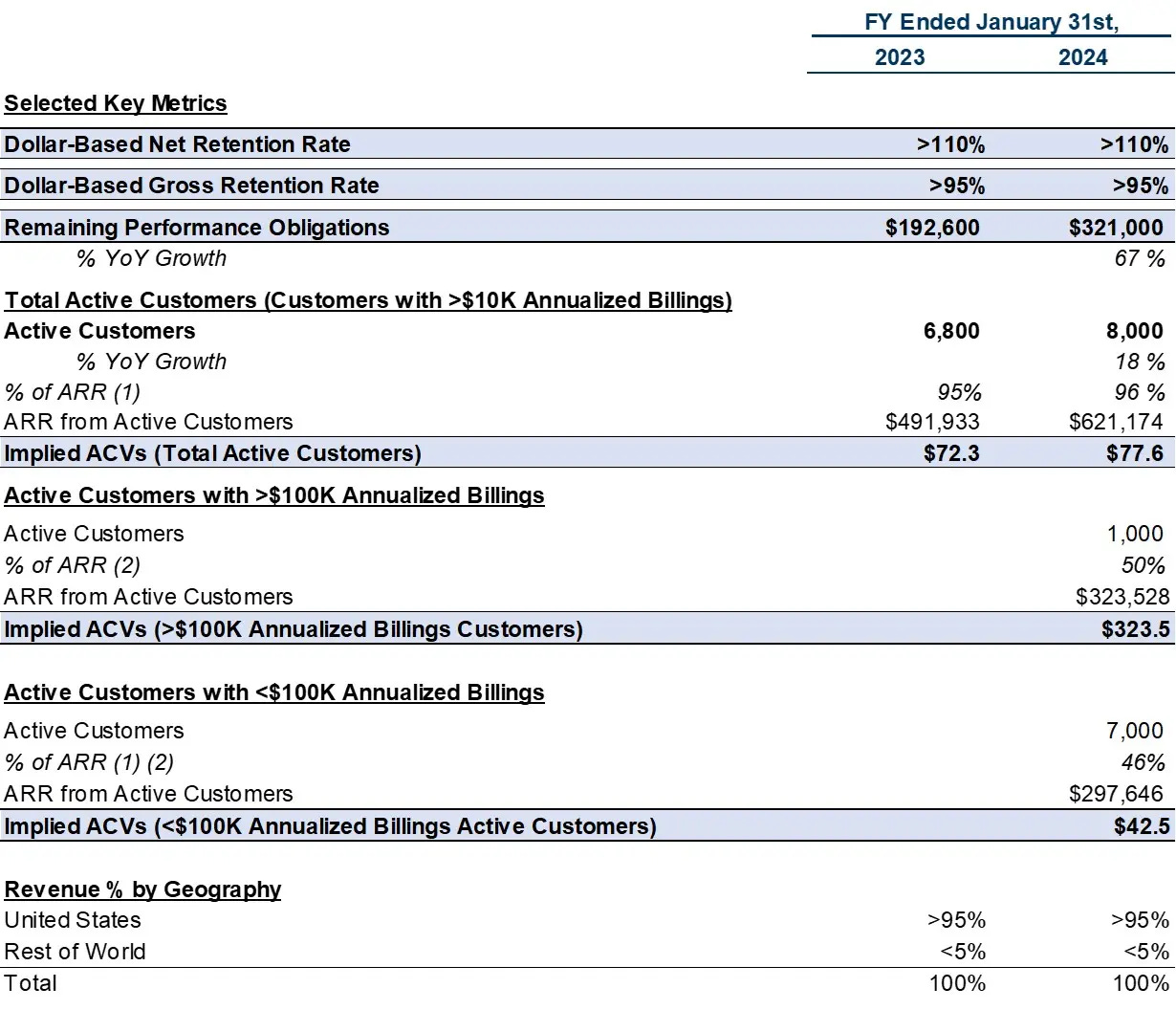

Strong Retention Rates: Boasts a 95% gross dollar retention rate and 110% net dollar retention, demonstrating its ability to keep customers satisfied and growing.

ServiceTitan’s strategic focus on providing a comprehensive suite of features tailored specifically for the trades industry positions it as a leader in the market. Its commitment to innovation and customer success continues to drive its competitive edge.

Financials

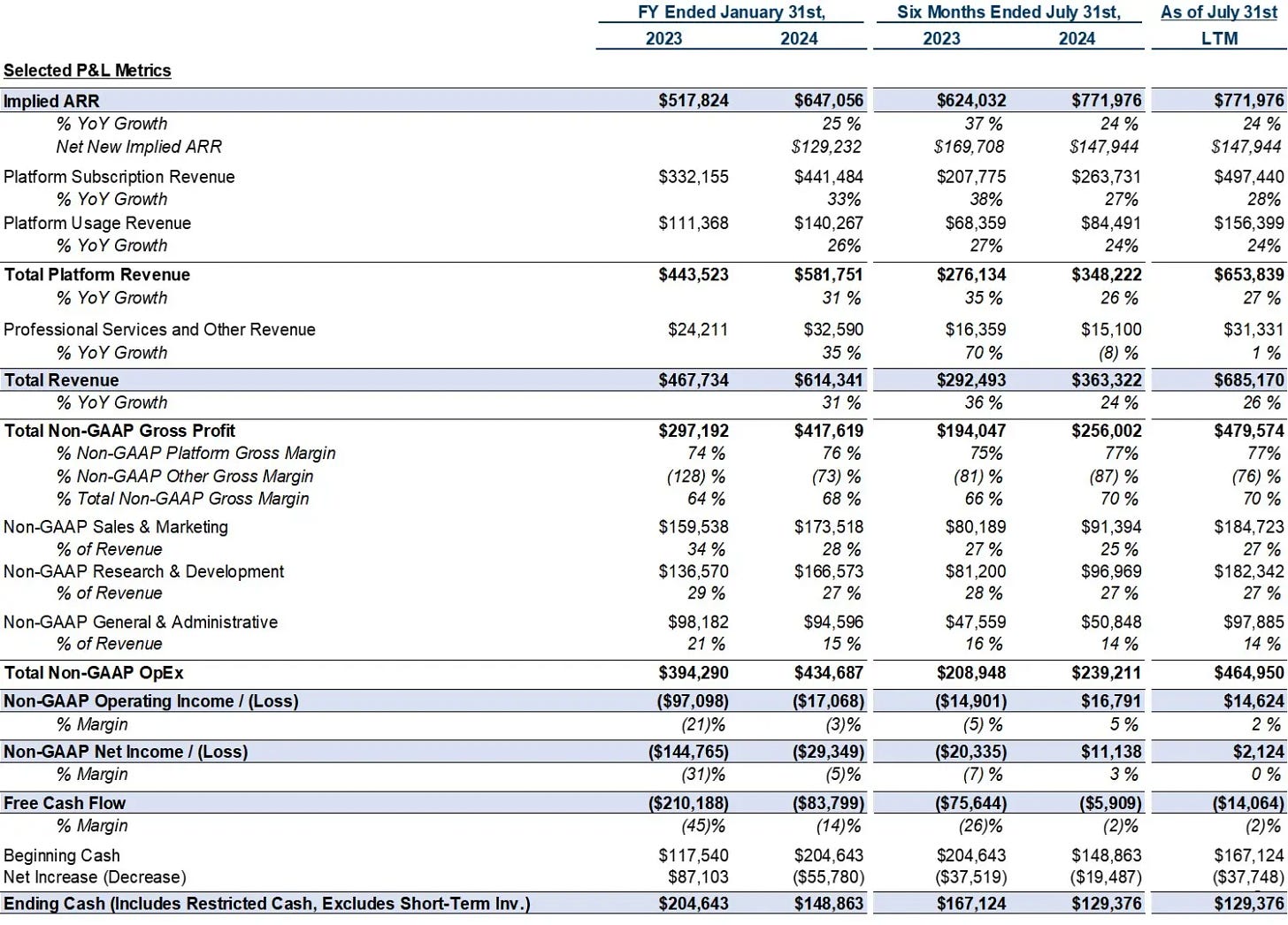

ServiceTitan has established itself as a dominant player in the trades industry, boasting $772 million in implied ARR with a robust 24% year-over-year growth

The company's strong customer retention metrics—95% gross dollar retention and 110% net dollar retention over the past 10 quarters—underscore its product stickiness and value propositions

Revenue Streams

The company's revenue mix reflects its multi-pronged approach:

Platform subscription revenue: 71%

Platform usage (payment processing): 25%

Professional services: 4%

This blend of subscription-based and usage-based revenue provides both stability and growth potential

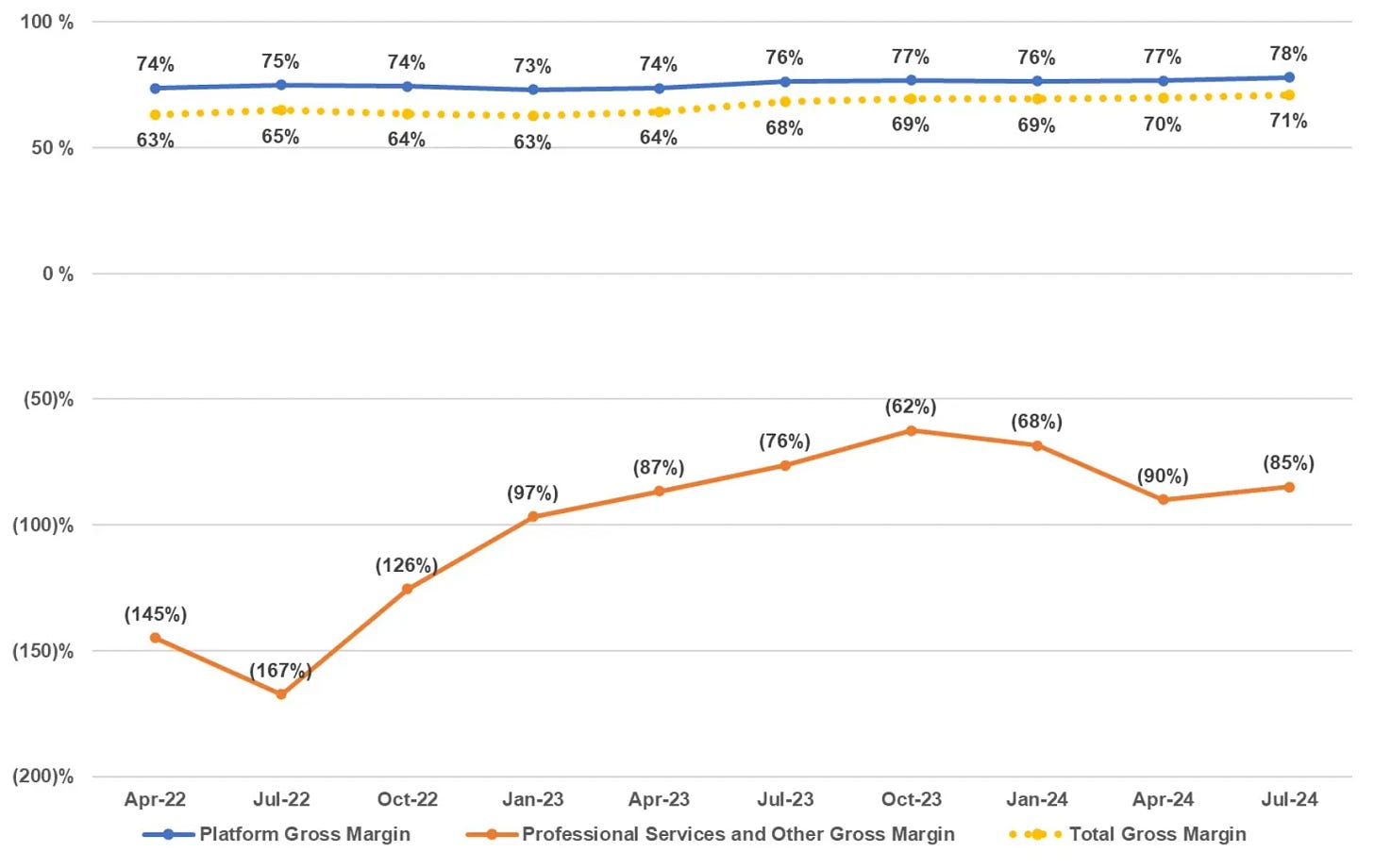

Profitability and Margins

While ServiceTitan's 70% LTM gross margin falls short of the public SaaS median of 78%, the company has shown consistent improvement in platform gross margins

This trajectory suggests potential for future margin expansion as the business scales.

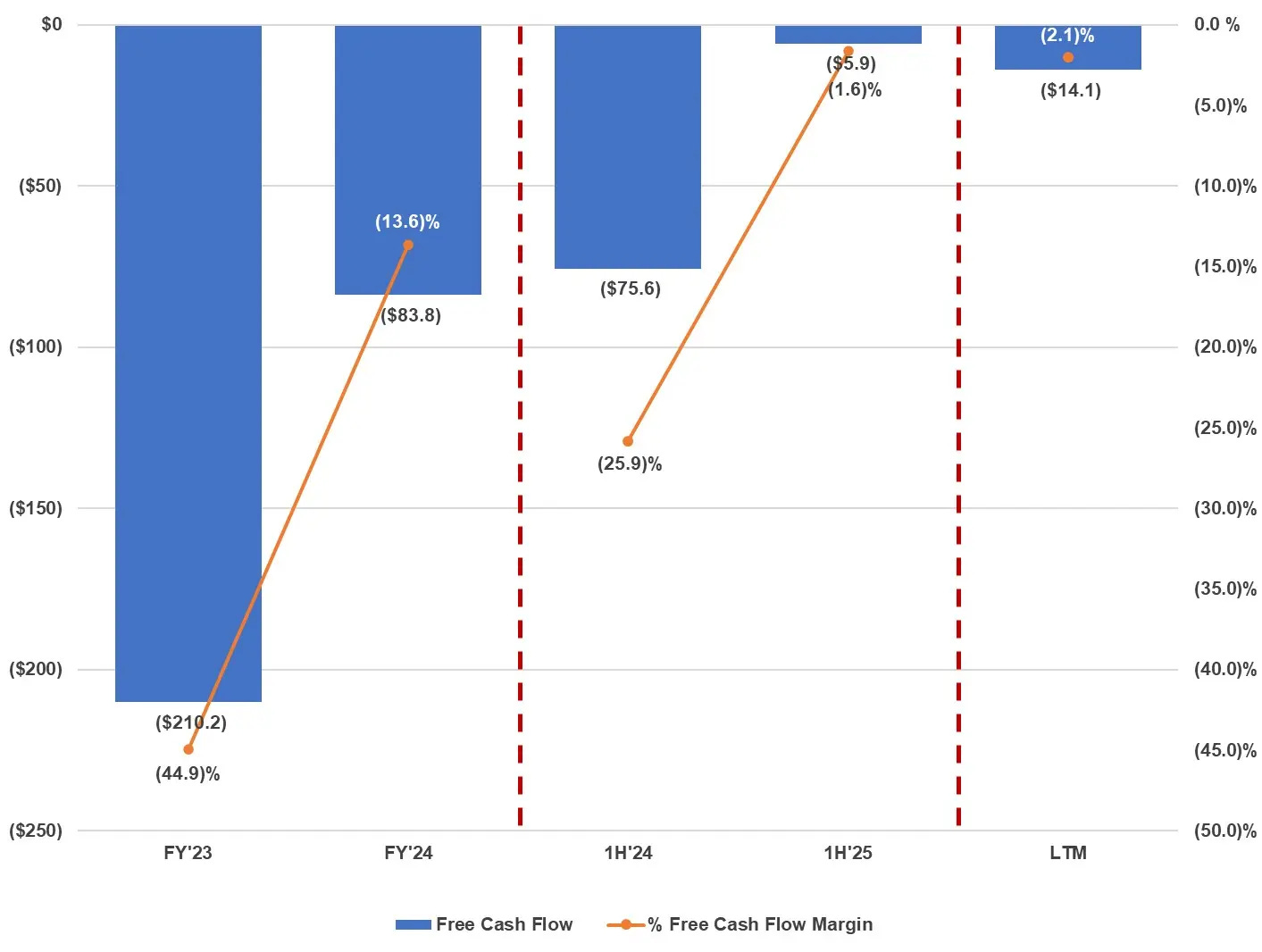

Cash Flow Dynamics

Despite strong top-line growth, ServiceTitan's free cash flow margins remain negative at -2%, lagging behind the SaaS median of 15%

This cash flow profile reflects the company's investment in growth and the nature of its customer contracts, which don't typically involve upfront payments for long-term commitments.

Customer Economics

ServiceTitan's customer base is growing in both size and value:

18% year-over-year growth in active customers (>$10K annual spend)

Average customer spend of $78K per year

Over 50% of billings from customers with >$100K annualized payments

Transaction Volume and Take Rate

The platform processed $55.7 billion in Gross Transaction Volume (GTV) in fiscal 2024, with a current take rate of 1-1.2%. ServiceTitan aims to double this take rate to 2% as it expands its product suite and captures a larger share of customer spend.

Seasonal Patterns

ServiceTitan's revenue exhibits seasonal spikes, particularly in Q2, driven by increased demand for services like air conditioning. While subscription revenue provides a steady base, usage revenue fluctuates with seasonal demand, adding an element of predictable variability to the company's financial profile.

Closing thoughts

ServiceTitan's journey from a startup to a leader in the trades industry exemplifies its ability to innovate and adapt in a largely under-digitized market. The company’s strategic focus on integrating CRM, FSM, ERP, HCM, and FinTech tools into a seamless platform has set it apart from both horizontal platforms and niche players. ServiceTitan’s AI-driven insights and vertical-specific features have not only enhanced operational efficiency for its users but also fostered strong customer retention rates, with 95% gross dollar retention and 110% net dollar retention over the past ten quarters.

As ServiceTitan prepares for its IPO with a target valuation of $12 billion, it stands poised to capture an even larger share of the $1.5 trillion Total Addressable Market (TAM) in North America. The company's growth is driven by key factors such as aging infrastructure, climate change, digitization of trades, labor shortages, and evolving consumer expectations. Despite challenges like negative free cash flow margins, ServiceTitan's robust revenue growth and strategic market positioning underscore its potential to continue leading the trades industry into a digital future.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

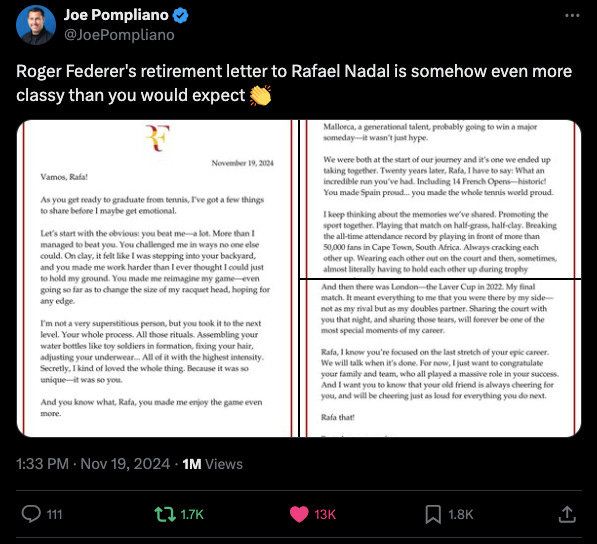

Not easy to do!

Rafael Nadal retired and got a classy retirement letter from Roger Federer

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.

What do you think about my bi-weekly Newsletter? Love it | Okay-ish | Stop it