👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

Partners

Money Machine Newsletter - https://moneymachinenewsletter.substack.com/

Market beating stocks in 5 min. Picked by elite traders. Delivered weekly to your inbox pre-market. Join 8k+ subscribers who have already placed themselves on the path to greater wealth.

S1 Deep Dive

Kairos Pharma in one minute

Kairos Pharma is a clinical-stage biotech company focused on oncology, but it’s not just another pharma company. Kairos is driven by a deep commitment to breakthrough science, with a pipeline of cutting-edge cancer therapies designed to harness the power of the immune system. The goal? To redefine how we treat solid tumors and blood cancers by addressing unmet medical needs in the oncology space.

Kairos’ challenge is transforming innovative research into effective treatments—treatments that can genuinely improve patient outcomes. In an industry known for complexity, Kairos is positioning itself as a leader in cancer immunotherapy, pushing the boundaries of what’s possible in cancer research.

To explore Kairos' revolutionary therapies, its impact on cancer treatment, and its mission to reshape the future of oncology, keep reading.

Introduction

Kairos Pharma (KAPA) Stock Overview

Current Price: $1.540

Market Cap: $19.78M

52-Week Range: $1.500 - 4.000

EPS (TTM): -0.19

Kairos Pharma (KAPA) is a fresh entrant in the biotechnology sector, focusing on oncology with a mission to develop groundbreaking immunotherapies that target cancer. Kairos went public in September 2024, raising $6.2 million in its IPO, priced at $4.00 per share. At its peak, the stock hit $4.00, reflecting strong early enthusiasm in a hot biotech market. However, like many companies at this stage, the stock has since leveled off and is now trading around $1.54.

With a market cap of $19.78M and ongoing EPS losses of -0.19, Kairos remains a high-risk, high-reward investment. The company’s current financials reflect the heavy R&D spending typical of clinical-stage biotech firms. As Kairos advances its pipeline of innovative cancer therapies, investors are watching closely for the breakthroughs that could reshape its financial trajectory—and the future of oncology.

Recent Developments:

Clinical Trials Expansion: Kairos has entered a critical phase with the launch of Phase 2 clinical trials for its lead product, KAI-123, aimed at treating advanced non-small cell lung cancer (NSCLC). Early data suggests the therapy is showing promising signs of efficacy, signaling potential for breakthrough results.

Strategic Collaborations: To supercharge its research efforts, Kairos has established pivotal partnerships with top-tier academic and research institutions. These collaborations are designed to accelerate innovation and bring cutting-edge science to the forefront of its therapeutic pipeline.

Regulatory Milestones: In a significant boost to its commercialization efforts, Kairos secured Fast Track Designation from the FDA for one of its key therapies. This designation will help expedite the regulatory process and bring life-saving treatments to market faster.

Advances in Combination Therapies: Kairos is also exploring the integration of its immunotherapy with conventional cancer treatments like chemotherapy and radiotherapy. The aim? To create more robust, multifaceted approaches that improve patient outcomes in the fight against cancer.

Investor Sentiment

Investor sentiment around Kairos Pharma (KAPA) is a mix of cautious optimism. On the bullish side, investors are excited by the company’s innovative focus on oncology, particularly its promising work in immunotherapy and early success in clinical trials. For them, the potential for significant growth is clear, especially if Kairos can navigate regulatory milestones and bring its therapies to market.

However, the bears emphasize the risks inherent in biotech. They point to the high costs associated with clinical trials, the lengthy approval process, and the company’s negative earnings. Skeptics also highlight the fierce competition in the oncology space, where larger, established players dominate.

History

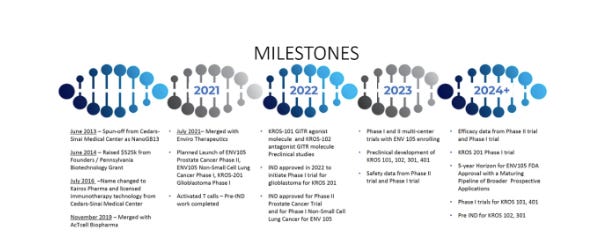

Kairos Pharma was founded with a bold and transformative vision: to overcome the most daunting challenges in cancer treatment by developing therapies that target immune suppression and drug resistance. Originally launched in 2013 under the name NanoGB13, Inc., the company took a significant step forward in 2016 when it rebranded as Kairos Pharma, reflecting its sharpened focus on cutting-edge oncology therapies. The new name embodied the company’s commitment to seizing pivotal moments in the fight against cancer.

A defining milestone came in 2021, when Kairos made the strategic acquisition of Enviro Therapeutics. This move was pivotal, adding a suite of advanced drug candidates to its pipeline, with a focus on treating hard-to-tackle cancers such as prostate and lung cancer. The acquisition not only bolstered Kairos' existing portfolio but also expanded its reach into areas where traditional treatments often fall short. With these new assets, Kairos reinforced its mission to develop breakthrough therapies for cancers that evade conventional approaches, particularly those that involve drug resistance or immune system suppression.

Kairos’ evolution from NanoGB13 to a full-fledged biotechnology company with a diverse oncology pipeline is a testament to its relentless drive to innovate. As it continues to advance its research, Kairos remains laser-focused on delivering therapies that could change the landscape of cancer treatment and offer new hope to patients worldwide.

Market Opportunity

Cancer remains a leading cause of death globally, with the demand for new and effective treatments driving one of the largest markets in healthcare. By 2030, the global cancer treatment market is expected to surpass $250 billion, reflecting the urgent need for innovative therapies. More specifically, the global immunotherapy market—Kairos Pharma’s area of focus—is projected to reach $126.9 billion by 2026, growing at a remarkable Compound Annual Growth Rate (CAGR) of 20.2%. This exponential growth in immunotherapy is fueled by its potential to revolutionize cancer care by harnessing the body’s own immune system to fight the disease.

Kairos is positioning itself to tap into some of the most high-potential segments of this market by targeting cancers with substantial unmet medical needs. Prostate cancer, for example, represents a multi-billion-dollar opportunity. Kairos’ lead candidate, ENV 105, is designed to address castration-resistant prostate cancer—a condition for which current treatments often fail. If successful, ENV 105 could generate as much as $9 billion in gross sales, significantly impacting the prostate cancer treatment landscape.

Beyond prostate cancer, Kairos is also focusing on the lucrative lung cancer market, particularly in patients with EGFR mutations. Non-small cell lung cancer (NSCLC) driven by these mutations is a major challenge, especially in non-smokers. Kairos’ ENV 105 drug has the potential to complement existing EGFR inhibitors, providing an additional tool in the fight against this deadly cancer. With billions of dollars at stake, the lung cancer segment offers another massive growth opportunity for the company.

By targeting these critical areas, Kairos is not only addressing pressing medical needs but also positioning itself to capture a significant share of the oncology and immunotherapy markets. The company's innovative approach and focus on drug resistance and immune suppression could make it a key player in the future of cancer treatment.

Product

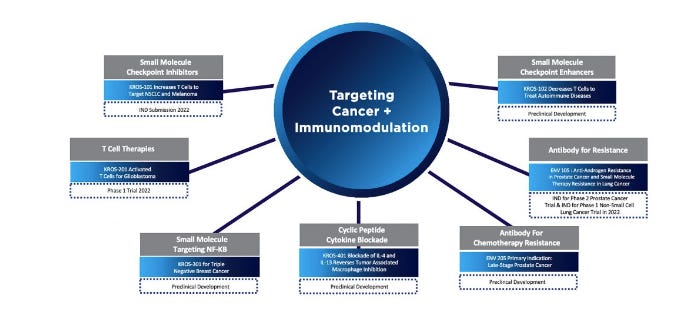

Kairos Pharma boasts an impressive and diverse pipeline of seven key drug candidates, each designed to tackle some of the most challenging cancers and diseases.

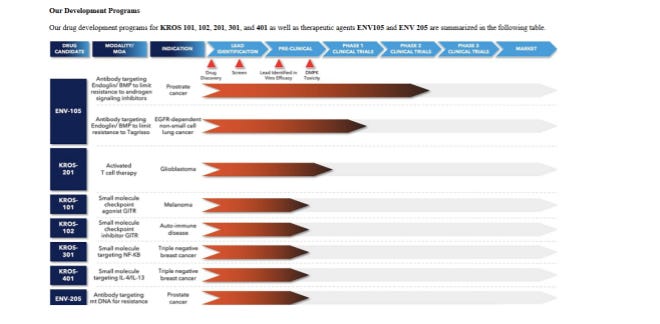

ENV-105: This antibody therapy is at the forefront of Kairos’ oncology efforts, targeting drug resistance in both prostate and lung cancers. ENV-105 focuses on Endoglin/BMP to overcome resistance to treatments like androgen signaling inhibitors and Tagrisso. Currently, ENV-105 is in Phase 2 clinical trials for prostate cancer and Phase 1 trials for EGFR-dependent non-small cell lung cancer, showing promise in limiting treatment resistance.

KROS-201: A cutting-edge T cell-based immunotherapy, KROS-201 is developed to target glioblastoma stem cells, an aggressive form of brain cancer. After securing FDA approval for its Investigational New Drug (IND) application, KROS-201 is now preparing for Phase 1 clinical trials. The goal is to improve outcomes in this difficult-to-treat cancer by attacking its root cause—cancer stem cells.

KROS-101: This small molecule checkpoint agonist targets GITR and is designed to combat melanoma. Building on strong pre-clinical efficacy data, KROS-101 is advancing toward Phase 1 clinical trials, aiming to offer a new treatment option for melanoma patients.

KROS-102: Also targeting GITR, but for autoimmune diseases, KROS-102 is a small molecule checkpoint inhibitor designed to regulate immune responses. Still in pre-clinical development, early studies have shown promising results in models of autoimmune conditions, positioning KROS-102 as a potential breakthrough in autoimmune therapy.

KROS-301: Focused on triple-negative breast cancer, KROS-301 is a small molecule therapy that targets NF-KB, a protein complex that drives cancer cell proliferation. The drug is currently in pre-clinical development and progressing toward early-phase clinical trials, with the potential to address an unmet need in aggressive breast cancer treatments.

KROS-401: This therapy takes aim at the IL-4/IL-13 signaling pathways, crucial in the growth of aggressive tumors. KROS-401 is also being developed to treat triple-negative breast cancer and is currently undergoing pre-clinical testing, showing potential for future clinical use.

ENV-205: An antibody therapy targeting mitochondrial DNA, ENV-205 focuses on drug resistance mechanisms in prostate cancer. In pre-clinical stages, ENV-205 has demonstrated significant potential to combat treatment-resistant prostate cancer.

Among these, two therapies stand out for their promise in reversing immune suppression and drug resistance:

KROS-201 offers hope to glioblastoma patients by targeting the stem cells at the heart of this deadly brain cancer.

ENV-105 represents a multi-billion dollar opportunity in prostate cancer, with potential treatment costs of $5,000 per month, giving patients new hope where other treatments have failed.

These therapies reflect Kairos’ dedication to delivering breakthrough treatments for patients facing the most difficult cancers and diseases.

Business Model

Kairos Pharma has adopted a hybrid business model designed to ensure both short-term viability and long-term success. The company has strategically diversified its revenue streams into two main pillars, enabling it to drive innovation while maintaining financial flexibility.

Internal R&D and Drug Development: At the core of Kairos’ strategy is its robust internal research and development efforts. The company is advancing a pipeline of proprietary drug candidates through the clinical trial process, with the ultimate goal of bringing these breakthrough therapies to market. By focusing on high-potential therapies, particularly in immuno-oncology, Kairos aims to commercialize treatments that can address critical unmet needs in cancer care, such as drug resistance and immune suppression. Once these therapies receive regulatory approval, they are expected to generate substantial revenue, creating a self-sustaining loop of innovation and commercialization.

Licensing and Partnerships: In parallel with its internal R&D, Kairos is leveraging strategic partnerships with renowned academic institutions like Cedars-Sinai and major pharmaceutical companies. These collaborations not only provide Kairos with access to cutting-edge research but also serve as an additional revenue stream. By licensing its drug technologies to partners, Kairos generates income that helps fund ongoing clinical trials while minimizing financial risk. For instance, the company entered into a lucrative licensing agreement with Tracon Pharmaceuticals, which includes milestone payments of $1.1 million and a 3% royalty on net sales. These agreements offer Kairos an avenue to capitalize on its intellectual property without bearing the full burden of drug commercialization, while also expanding the reach of its therapies through larger industry players.

This dual approach of internal development and external collaboration allows Kairos to fund its ambitious R&D agenda, sustain its clinical operations, and build long-term commercial value. By diversifying its income streams and strategically partnering with larger entities, Kairos is positioning itself to navigate the costly and high-risk nature of drug development while maintaining a clear path to profitability.

In the long run, this model ensures that Kairos can continue innovating in oncology while remaining financially sustainable, even as it tackles the challenges of bringing life-saving cancer therapies to market.

Management Team

Kairos Pharma is guided by a highly experienced leadership team with deep expertise in oncology and drug development:

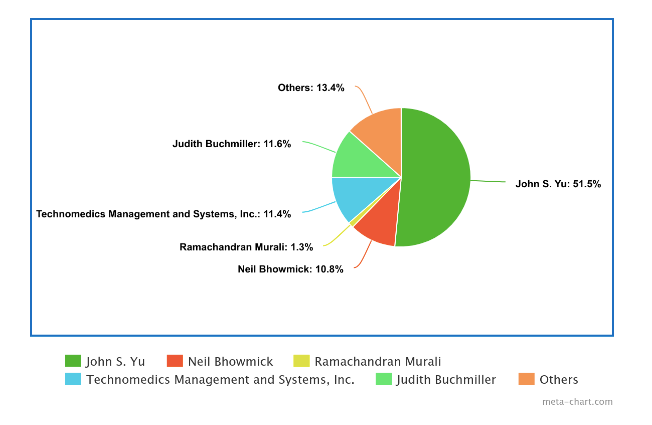

Dr. John S. Yu, CEO and Chairman: A renowned neurosurgeon and oncology specialist at Cedars-Sinai, Dr. Yu co-founded Kairos Pharma and has dedicated his career to pioneering cancer immunotherapies. He holds multiple patents in the field and has been involved in 17 clinical trials. Dr. Yu is also the co-inventor of GITR and activated T-cell technology, solidifying his reputation as a leader in cancer research and treatment innovation.

Dr. Neil Bhowmick, Chief Scientific Officer: With over two decades of experience in biochemistry and cancer research, Dr. Bhowmick steers Kairos’ scientific strategy. He has authored more than 110 peer-reviewed publications, contributing significant knowledge to the field of oncology. His leadership ensures that Kairos remains at the forefront of scientific advancements in cancer treatment.

Doug Samuelson, Chief Financial Officer: A seasoned financial executive, Doug Samuelson is responsible for managing Kairos Pharma’s financial operations. His expertise in corporate finance is crucial to supporting the company’s growth and ensuring its long-term financial stability as it navigates the high costs of clinical trials and drug development.

Dr. Ramachandran Murali, VP of Research & Development: With decades of experience in the pharmaceutical industry, Dr. Murali oversees the research and development arm of Kairos. His leadership ensures the continuous progression of the company’s innovative drug pipeline, guiding the development of breakthrough therapies from early research to clinical trials.

Together, this accomplished management team is driving Kairos Pharma’s mission to develop life-changing cancer treatments and lead the way in oncology innovation.

Investors

Over the years, Kairos Pharma has strategically raised capital through convertible note offerings and partnerships to support its growth and R&D efforts. Here's a detailed breakdown:

2021 Convertible Note Offering:

Raised: $350,000

Investor: Individual investor via convertible note

Valuation: The note converted into common stock at $4.17 per share

Details: The note accrued 10% interest and included a warrant to purchase 90,000 shares at $4.17 per share. In 2022, the note converted into 92,000 shares of Kairos’ common stock.

2022 Convertible Note Offerings (June and September):

Raised: $675,000 total ($450,000 in June and $225,000 in September)

Investors: Accredited investors

Valuation: Convertible into common stock at 60% of the IPO price

Details: These notes accrue 6% interest and automatically convert into common stock upon the IPO. Boustead Securities, LLC acted as the placement agent, receiving compensation in cash and warrants.

Enviro-Kairos Merger (2021):

Raised: $500,000 in connection with the merger

Investor: Tracon Pharmaceuticals

Valuation: Tracon gained a 1.41% equity stake (420,000 restricted shares) in Kairos post-merger

Details: In addition to equity, Enviro (now part of Kairos) agreed to pay Tracon $1.1 million in cash and 3% royalties on net sales.

Pre-IPO Private Placements (2022):

Raised: $675,000 through a convertible note offering

Valuation: The notes convert at 60% of the IPO price

Details: After deducting expenses, net proceeds totaled $564,000. The notes accrue 6% interest and will convert into common stock upon the IPO.

Through these strategic capital raises, including convertible notes and the Enviro merger, Kairos Pharma has successfully secured funding while maintaining flexibility in ownership conversion. This approach has helped the company raise necessary capital ahead of its IPO, positioning it for long-term growth.

Competition

The oncology space is fiercely competitive, dominated by industry giants such as Gilead Sciences and Amgen, both of whom are heavily invested in the development of immuno-oncology therapies. However, despite the presence of these established players, Kairos Pharma is carving out a distinct position with its innovative and targeted approach.

What sets Kairos apart is its laser focus on overcoming two of the most challenging aspects of cancer treatment: drug resistance and immune evasion. Unlike many competitors that focus on broad-spectrum therapies, Kairos targets cancer stem cells—the root cause of many aggressive and treatment-resistant cancers. By specifically addressing the mechanisms that allow cancer cells to evade the immune system and resist conventional therapies, Kairos is working to reverse immune suppression and prevent tumor recurrence.

This precision-based strategy gives Kairos a significant competitive advantage, particularly in niche markets such as prostate cancer and glioblastoma, where current treatment options are limited. For example, Kairos' lead candidates, such as ENV-105 and KROS-201, are designed to address these highly resistant forms of cancer, offering patients hope where other therapies may have failed. By focusing on targeting cancer stem cells and enhancing the body’s immune response, Kairos is positioning itself as a leader in the next generation of oncology treatments.

In a market where innovation is critical, Kairos’ differentiated approach not only provides a significant edge over larger, more generalized competitors but also offers the potential for breakthrough success in areas with high unmet medical needs. This unique focus on precision oncology could ultimately make Kairos a formidable player in the immuno-oncology field.

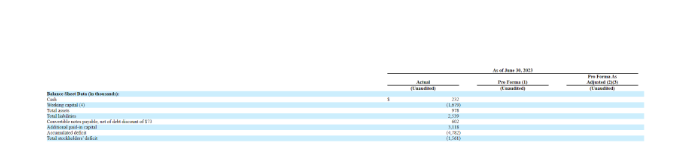

Financials

Kairos Pharma has maintained a lean financial structure while advancing its R&D efforts, showing discipline in its expenditure as it works toward commercialization. While the company's revenue generation is still in its early stages, its financial performance reflects strategic investment decisions aimed at long-term growth.

Let’s break down the key financial trends and strategic drivers for Kairos:

Lean Operating Structure with Focused R&D

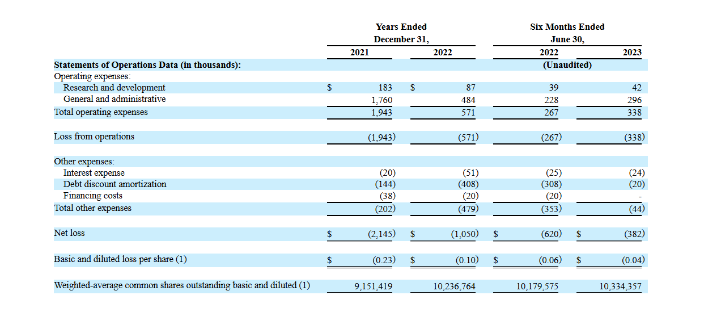

Kairos has managed to operate with a streamlined financial profile. For example, R&D expenses in 2021 were $183,000, but by 2022, these expenses dropped to $87,000, showing a concerted effort to optimize resources. In the first half of 2023, R&D spending amounted to $42,000, signaling the company’s cautious approach to spending while advancing key therapies like ENV-105 and KROS-201. This controlled R&D spending is reflective of Kairos’ focus on advancing its highest potential therapies while keeping operating costs low.

Meanwhile, general and administrative (G&A) expenses have followed a similar trajectory. In 2021, G&A costs were $1.76 million, dropping significantly to $484,000 in 2022, and remaining relatively lean in the first half of 2023 at $296,000. These numbers highlight the company's ability to manage overhead efficiently as it navigates the costly clinical trial process.

Tight Loss Control

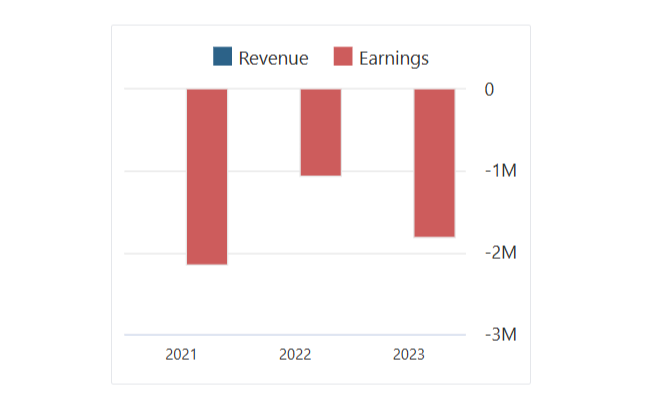

Despite the inherent costs associated with drug development, Kairos has demonstrated an ability to control losses. In 2021, the company reported a net loss of $2.1 million, followed by a much-reduced loss of $1.05 million in 2022. For the first half of 2023, the net loss stood at $382,000, reflecting a steady narrowing of losses as Kairos inches closer to its IPO and commercialization.

This ability to minimize losses, even as the company advances clinical trials and prepares for commercialization, suggests that Kairos is strategically positioning itself to make the most of its limited capital while focusing on its core assets.

Funding Through IPO and Convertible Notes

Kairos’ growth has been fueled by a combination of convertible note offerings and its 2024 IPO, which raised $6.2 million. This capital injection is critical for advancing its clinical trials, expanding its R&D efforts, and preparing for the commercialization of its therapies. Kairos' funding strategy has allowed it to maintain flexibility in ownership conversion, while milestone payments from partnerships (like the $1.1 million deal with Tracon Pharmaceuticals) have supplemented its operational capital.

Strategic Focus on Drug Resistance and Immune Evasion

Kairos distinguishes itself from competitors in the oncology space through its targeted focus on drug resistance and immune evasion. With therapies like ENV-105 (targeting prostate and lung cancers) and KROS-201 (focused on glioblastoma), the company is addressing critical unmet needs in cancer treatment. This niche focus, particularly in areas like castration-resistant prostate cancer and glioblastoma, positions Kairos to capitalize on multi-billion dollar market opportunities.

Challenges Ahead: Operating Losses and Competition

While Kairos has been disciplined in controlling costs, the company still faces significant financial challenges. The biotech sector is notoriously capital-intensive, and Kairos’ negative EPS of -0.04 (for the first half of 2023) underscores the financial burden of clinical trials and ongoing R&D. The company will need to secure additional funding or partnerships to maintain its momentum, especially as competition in the oncology space from larger, well-capitalized firms like Amgen and Gilead Sciences continues to intensify

Shareholder Dilution and Long-Term Value

Like many early-stage biotech firms, Kairos has utilized share-based compensation to conserve cash. This strategy has been crucial in retaining talent while keeping cash burn low. However, the potential for shareholder dilution could become a concern as the company scales and seeks additional funding. Moving forward, Kairos will need to carefully balance its use of equity to incentivize employees with the interests of its shareholders.

Kairos Pharma’s current financials show a company operating with discipline, advancing its clinical pipeline while keeping losses and overhead in check. The company’s IPO funding and strategic partnerships provide a solid foundation for further R&D and commercialization. However, as it enters the next phase of growth, Kairos will need to navigate the high costs of drug development, mounting competition, and the pressures of shareholder expectations.

Despite these challenges, the company’s unique focus on addressing drug resistance and immune evasion in niche oncology markets could provide a significant competitive advantage, potentially positioning Kairos as a key player in the next generation of cancer therapies.

Closing thoughts

The timing of Kairos Pharma's IPO is strategic, aligning with heightened interest in the biotechnology sector, particularly in oncology and immunotherapy. The company's decision to go public follows a wave of excitement in the market for cutting-edge cancer treatments, driven by the urgent need for innovative solutions to combat drug-resistant and immune-evasive cancers.

As larger players like Amgen and Gilead dominate headlines with their own advancements, Kairos' entry into the public market offers a timely opportunity to capture investor attention and position itself as a key player in niche oncology treatments. The funds raised through the IPO provide a critical boost for advancing clinical trials and accelerating the commercialization of its therapies, all while fostering credibility within the industry.

Like the growing momentum seen in other early-stage biotechs, Kairos has methodically built its pipeline and operational efficiency over the years. Now, the company is poised to capitalize on a window of opportunity in an increasingly competitive and high-stakes market, where its focus on precision oncology could set it apart as a rising star in the fight against cancer.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Underrated truth!

Reason is that a second product can have a different ICP and sales cycle

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.

What do you think about my bi-weekly Newsletter? Love it | Okay-ish | Stop it